We are about 3 weeks away from Easter. It is the time for egg hunting, Easter bunny, and family gatherings. Celebrate this special occasion of hope and fun with these 7 affordable Easter-themed Kitchen and Dining ideas…

1. BUNNY PLATES (SET OF 4)

Crate & Barrel, S$19.95. Buy it here.

Image Credits: www.crateandbarrel.com

Crate & Barrel is full of beautiful festive items for Easter. Kicking it off with a set of four assorted colored plates with lovely bunnies pattern that will truly make dining delicious. These plates are 100% porcelain with dimensions of 8″ diameter and 0.75″ height. What’s more? It is dishwasher, oven, and microwave safe.

2. PHOEBE EGG CUP

Crate & Barrel, S$3.95. Buy it here.

Image Credits: www.crateandbarrel.com

This egg cup designed by Olivia Barry can be a center piece to show off your decorative easter egg or you may fill the table with a couple of this sculptural blue glass egg cup. It is made with 100% pressed soda lime glass and is dishwasher safe.

3. WILTON HOP AND TWEET EASTER BUNNY EGG AND TREAT STAND

Bake It Yourself, S$10.50. Buy it here.

Image Credits: www.b-i-y.com

This two-tiered treat stand serves as an entertaining piece to showcase your plain or painted Easter eggs along with sweets or cupcakes. It can hold about 16 cupcakes and a dozen of mini treats that the kids would really want. It is easy to assemble with a manual included.

4. CERAMIC MINI BUNNIES

Crate & Barrel, S$9.95 each. Buy it here.

The ceramic mini bunnies come in the smooth shade of yellow and blue. What an adorable display to bring an extra Easter flare to your simple table! To clean, just wipe it off with damp cloth.

Image Credits: www.crateandbarrel.com

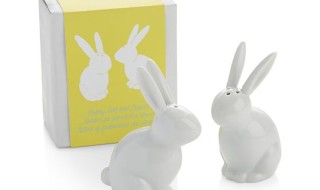

5. BUNNY SALT AND PEPPER SHAKERS (SET OF 2)

Crate & Barrel, S$9.95. Buy it here.

Image Credits: www.crateandbarrel.com

Designed by Olivia Barry, the 100% porcelain salt and pepper shakers are both charming and elegant pieces. As it comes with a designed box, you may either place it on your kitchen or give it as a gift for your family and friends. Simply hand wash this set to clean.

6. SUNFLOWER BAKING MOULD

Lemon Zest, S$12. Buy it here.

Image Credits: www.lemonzestlife.com/sg

Located at Holland Village, Lemon Zest has a wide array of stylish kitchen products that they constantly update. This sunflower baking mould goes well with Easter bunny cookies or egg treats. It comes in assorted colors at an affordable price.

7. WILTON TEXTURED COMFORT GRIP BUNNY WITH MINI COOKIE CUTTER

Bake It Yourself, S$6.90. Buy it here.

Image Credits: www.b-i-y.com

The textured cushion grip makes the bunny cutter safe and easy to handle. It also comes with a bunny tail or flower cookie cutter. Since it has a stainless steel cutter, it makes it possible to cut other treats such as brownies and sandwiches. Best of all? The cute set is rust-resistant so it would last long.