Want a brand new Dyson Supersonic™ hair dryer or an Apple iPad? From the month of May 2024, SingSaver will be offering new cardmembers who sign up for a credit card with a free Apple iPad 9th Gen 10.2 64GB WiFi (worth S$508.30), Dyson Supersonic™ hair dryer (worth S$699), and other attractive gifts upon meeting the requirements.

There will be no limit to the number of sets to be given away, so every eligible applicant who applies can each receive a set!

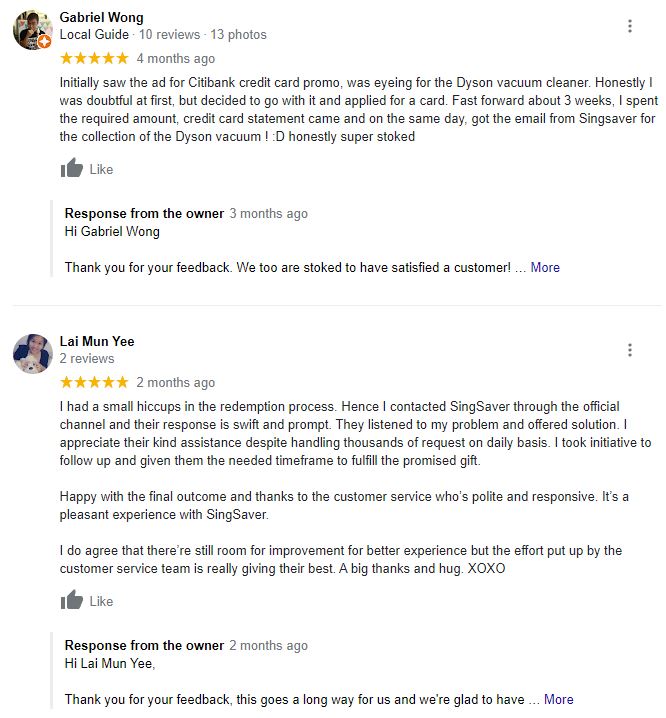

For those who are unfamiliar with SingSaver, you can check out their reviews on Google:

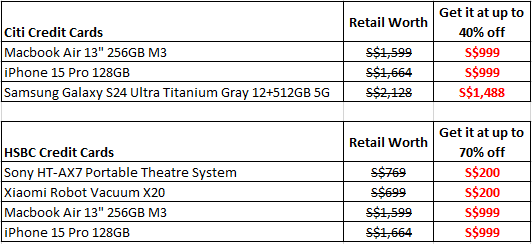

Choose from any of the products below:

Citi PremierMiles Card

Earn your miles faster with one of the best cards for your travel needs. The Citi PremierMiles Card lets you redeem from the widest range of airlines, where 1 Citi Mile = 1 Mile, with KrisFlyer, Asia Miles, Qantas, Qatar, Flying Blue, and more. With no caps on miles earned, redeem your miles for flights, hotels and merchandises.

- Earn 1.2 miles for every S$1 spent on all your eligible purchases with your Card

- Earn 2 miles for every S$1 equivalent in foreign currency spent overseas on eligible purchases

- Complimentary access to over 1,300 airport VIP lounges twice per calendar year with Personalised Priority Pass membership card. Priority Pass membership is on application basis and reserved for Principal cardholders only.

Welcome gift: Receive a Dyson Supersonic (worth S$699) or Apple iPad 9th Gen (worth S$508.30) or S$350 eCapitaVoucher or S$300 Cash

Requirements: Activate and spend a minimum S$500 within 30 days of card approval

Citi Cash Back Card

Keep this card in your wallet. The Citi Cash Back Card is one of the best cash back card in the market, offering a whopping 8% cash back on your Groceries and Petrol, and 6% on dining, daily, worldwide. Subject to cash back cap of S$80 across all retail spend per statement month with a min. spend of S$800 per statement month.

Imagine this: every $800 spends get you $80 cash back in a month. That works out to be almost a thousand dollar of cash savings in a year!

Welcome gift: Receive a Dyson Supersonic (worth S$699) or Apple iPad 9th Gen 10.2 Wifi 64GB (worth S$508.30) or Dyson V8 Slim Fluffy (worth S$509) or S$400 eCapitaVoucher or S$300 cash via PayNow

Requirements: Activate and spend a minimum S$500 within 30 days of card approval

Citi Rewards Card

The Citi Rewards Card is a must-have card for those who always shop online using credit cards. Imagine earning 10X Rewards^ (4 Miles) for every S$1 spent online each time you shop. For example, you can earn 4 miles per dollar on shopping transactions, online food delivery, online groceries, ride-hailing platforms with the Citi Rewards Credit Card. Often paired with the amaze card, you’ll be able to earn 4 miles per dollar on both local and overseas spend, up to S$1,000 per statement month. If you are looking for a versatile card, look no further than the Citi Rewards Card!

- Enjoy 10X Rewards^ (4 Miles) on online and retail purchases at Lazada, Qoo10, TANGS and more.

- Earn 10X Rewards* (4 Miles) on rides with Grab, ComfortDelGro, Gojek and more

- Earn 10X Rewards^ (4 Miles) on online food delivery

- Earn 10X Rewards^ (4 Miles) on online groceries

Earn 1X Reward on all other spend.

Welcome gift: Receive a Dyson Supersonic (worth S$699) or Apple iPad 9th Gen 10.2 Wifi 64GB (worth S$508.30) or Dyson V8 Slim Fluffy (worth S$509) or S$400 eCapitaVoucher or S$300 cash via PayNow

Requirements: Activate and spend a minimum S$500 within 30 days of card approval

Citi Cash Back+ Mastercard®

Not to be confused with the Cash Back Card, the Citi Cash Back+ Mastercard® is a new product launched by Citibank this year which offers a competitive 1.6% cashback on all spend categories with no cap and no minimum spend. In other words, you can accumulate as much cashback as you want each time you swipe you card. It does not expires and you can redeem it instantly on-the-go with Citi Pay with Points or for cash rebate via SMS.

Welcome gift: Receive a Dyson Supersonic (worth S$699) or Apple iPad 9th Gen 10.2 Wifi 64GB (worth S$508.30) or Dyson V8 Slim Fluffy (worth S$509) or S$400 eCapitaVoucher or S$300 cash via PayNow

Requirements: Activate and spend a minimum S$500 within 30 days of card approval

Standard Chartered Simply Cash Credit Card

Elevate your financial journey with the Standard Chartered Simply Cash Credit Card, a gateway to a world of exciting possibilities and unbeatable rewards. Imagine earning a generous 1.5% cashback on all your expenditures, transforming your everyday transactions into a treasure trove of savings. But the benefits don’t stop there – this card is designed to revolutionize the way you manage your finances. Whether it’s settling your IRAS dues, investing in education, securing insurance coverage, or managing rental payments, the Simply Cash Credit Card showers you with not just cashback, but also reward points and even bonus interest.

Welcome gift: Receive a Sony HT-AX7 (worth S$769) or Dyson SSHD (worth S$699) or Apple iPad 9th Gen 10.2 Wifi 64GB (worth S$508.30) or S$330

Requirements: Activate and spend a minimum S$500 within 30 days of card approval

Standard Chartered Smart Credit Card

The Standard Chartered Smart Credit Card allows you to earn 6% cashback in the form of reward points on selected merchants with no min. spend required. You can also enjoy S$0 fees on annual fee and cash withdrawal with 3-month interest-free instalments with 100% cashback on service fees. Now that is the smarter way to spend and you can say goodbye to fees!

Welcome gift: Receive a Dyson AM07 (worth S$459) or Hinomi H1 Classic V3 Ergonomic Office Chair (worth S$419) or Apple Airpods (3rd Gen) With Magsafe Charging Case (worth S$274) or S$250 and get up to S$40 e-capitaland voucher

Requirements: Activate and spend a minimum S$500 within 30 days of card approval

Standard Chartered Rewards+ Credit Card

Up your rewards game with the Standard Chartered Rewards+ Credit Card, your passport to exceptional benefits. Earn up to 10x rewards points on foreign currency for overseas retail, dining, and travel adventures, and enjoy up to 5x rewards points on dining transactions in SGD, adding a new dimension to your dining experiences. Plus, the perks kick in from the get-go with S$200 cashback upon spending S$388 within 30 days of card approval, setting the stage for a rewarding journey. Terms and conditions apply, so seize the opportunity to unlock a world of enhanced rewards and privileges.

Welcome gift: Receive a Dyson AM07 (worth S$459) or Hinomi H1 Classic V3 Ergonomic Office Chair (worth S$419) or Apple Airpods (3rd Gen) With Magsafe Charging Case (worth S$274) or S$250 and get up to S$40 e-capitaland voucher

Requirements: Activate and spend a minimum S$500 within 30 days of card approval

Standard Chartered Journey Credit Card (Fee Waiver)

Experience the extraordinary with the Standard Chartered Journey Credit Card, where every purchase becomes a gateway to your dream vacation. Earn 3 miles per S$1 for selected bonus categories, 2 miles per S$1 for overseas spending, and 1.2 miles per S$1 for local expenses, accelerating your rewards like never before. Revel in exclusive travel benefits, from 3 miles per $1 on online transactions to non-expiring rewards points that kick in from your very first dollar spent. Indulge in 2 complimentary Priority Pass lounge visits annually and travel with peace of mind through up to S$500,000 in coverage. Embrace a world of travel and rewards beyond the ordinary – your journey starts here.

Welcome gift: Receive a SONY SRS-XB100 (worth S$90) or Apple AirTag (worth S$45.40) or S$50 and get up to S$40 e-capitaland voucher

Requirements: Activate and spend a minimum S$500 within 30 days of card approval

HSBC TravelOne Credit Card

The HSBC TravelOne Credit Card opens up a world of elevated travel with its incredible features. This card stands out as the first HSBC credit card to offer instant redemptions with a wide array of airline and hotel partners, all accessible through your mobile app, providing unprecedented convenience. Additionally, you can earn up to 2.4 miles (6X Reward points) for every dollar spent, accelerating your journey towards your travel dreams. The card further enhances your travel experience with complimentary travel insurance coverage, including protection against COVID-19, airport lounge visits, and more. Moreover, its flexibility shines through with the option to split purchases across various tenors to suit your individual needs through HSBC Instalment Plans, ensuring that your travel experiences are tailored to your preferences.

Welcome gift: Receive a Dyson AM07 (worth S$459) or Xiaomi Robot Vacuum S10 (worth S$349) or S$250 eCapitaVoucher or 15K Max Miles (worth a free flight to Tokyo, Japan)

Requirements: Activate and spend min. S$500 plus pay an annual fee of S$196.20 by end of the following calendar month from the card account opening date

HSBC Visa Platinum

HSBC Visa Platinum Credit Card is a high cashback rewards credit card, with no annual fees – ideal for families as you can get 5% cash rebate on categories like dining, groceries and fuel. Important to note would be the minimum spending requirement of S$600 per calendar quarter to qualify for rebates and the S$250 rebate cap per calendar quarter.

Welcome gift: Receive a Dyson AM07 (worth S$459) or Xiaomi Robot Vacuum S10 (worth S$349) or S$250 eCapitaVoucher or 15K Max Miles (worth a free flight to Tokyo, Japan)

Requirements: Activate and spend min. S$500 for 30-day periods following card approval

HSBC Revolution Credit Card

HSBC Revolution Card is a rewards credit card ideal for savvy online shoppers. It allows you to earn up to 10X Points on online purchases or the usage of contactless payment like Visa PayWave and Apple Pay. Alternatively you can choose miles as your reward, with 4 miles for every dollar spent ($1 = 4 miles). Benefits of the HSBC Revolution card include no annual fees, travel insurance, no required minimum spend and more.

Welcome gift: Receive a Dyson AM07 (worth S$459) or Xiaomi Robot Vacuum S10 (worth S$349) or S$250 eCapitaVoucher or 15K Max Miles (worth a free flight to Tokyo, Japan)

Requirements: Activate and spend min. S$500 for 30-day periods following card approval

HSBC Advance Credit Card

The HSBC Advance Credit Card is a cashback credit card designed to help you save as you spend with up to 3.5% cashback without minimum spend. Spending less than S$2,000 monthly gets you 1.5% cashback while spending more than S$2,000 will get you 2.5% cashback. The maximum cashback you can earn per month is capped at S$70.

The extra 1% cashback can be earned when the HSBC Advance Cardholder also has an HSBC Everyday Global Account that fulfills S$2,000 of monthly deposit AND charges 5 qualifying Credit Card transactions.

Welcome gift: Receive a Dyson AM07 (worth S$459) or Xiaomi Robot Vacuum S10 (worth S$349) or S$250 eCapitaVoucher or 15K Max Miles (worth a free flight to Tokyo, Japan)

Requirements: Activate and spend min. S$500 for 30-day periods following card approval

The Maybank Family & Friends Card offers the ultimate freedom of choice, tailored just #ForYou. With this card, you have the flexibility to pick and choose cashback categories that align perfectly with your lifestyle, all while relishing an impressive 8% cashback rate – one of the most competitive in town! This versatile card allows you to earn 8% cashback not only in your local area but globally as well, encompassing your five preferred cashback categories from a diverse list of ten options. These categories span the spectrum, from Groceries and Dining & Food Delivery to Transport, Data Communication & Online TV Streaming, Retail & Pets, Online Fashion, Entertainment, Pharmacy, Sports & Sports Apparels, and Beauty & Wellness, making it an ideal choice for those who value personalization and rewards tailored to their individual preferences.

Welcome gift: Receive S$200 cashback or Apple AirPods (3rd generation) with Lightning Charging Case (worth S$263.80) or a Samsonite ENOW Spinner 69/25 Luggage (worth S$570) Promotion Period: 8 May, 5pm – 4 June 2024

Requirements: –

Maybank Horizon Visa Signature Card

The Maybank Horizon Visa Signature Card is the ultimate companion for those with a passion for travel and dining. With this card, your dreams of exploring far-flung destinations become a reality as it offers up to 3.2 Air Miles on dining, transportation, and more, making it one of the top choices for air miles and dining enthusiasts. The rewards are remarkably straightforward – you can earn up to 3.2 air miles (equivalent to 8X TREATS Points) or 2 air miles (5X TREATS Points) with a minimum monthly spending of just $300 on your Maybank Horizon Visa Signature Card. With these exceptional benefits, you’ll find yourself jetting off to your dream destinations faster than ever before, while savoring delectable dining experiences along the way.

Welcome gift: Receive 10,000 KrisFlyer Miles (in form of 25,000 TREATS Points) or S$200 cashback or Apple AirPods (3rd generation) with Lightning Charging Case (worth S$263.80) or a Samsonite ENOW Spinner 69/25 Luggage (worth S$570)

Requirements: –

Unlock the full potential of your spending with the DBS yuu Visa Card. Enjoy an unparalleled 5% cash rebate on your purchases, with absolutely no minimum spend and no cap to limit your rewards. Whether it’s your daily coffee or a big-ticket item, every swipe earns you more. Take your cash rebates even further! When your qualified spending reaches S$600 within a calendar month, you unlock an additional 13% bonus cash rebate. It’s your spending, supercharged! With the DBS yuu Card, earning rewards is effortless. Accumulate yuu Points quickly at over 1,000 partner locations islandwide.

Welcome gift: Receive S$388 cashback when you apply for the DBS yuu card with promo code 388CASH

Requirements: Make a min. spend of S$800 within 30 days of card approval to be eligible for reward

American Express® True Cashback Card

This is the card you want to hold if you prefer a no-frill-no-fuss reward on your spending. The American Express® True Cashback Card lets you earn an absolute 1.5% cashback on any spend, without caps. This means that you can earn cashback on every eligible dollar spent without worrying if you have met the requirements or if you have maxed out the cashback earning limit. Sign up now and take advantage of their Welcome Bonus of 3% cashback to double your cashback earning potential for the first 6 months, capped at your first $5,000 spend. Register your card for an additional 1% cashback at selected pet stores and foreign currency spends.

To summarize your earning potential:

- 1.5% base cashback for any spend with no cap;

- +1.5% cashback (total 3% Welcome Bonus) for the first 6 months, capped at the first $5,000 spend;

- +1% cashback at selected pet stores and foreign currency spends when you register your card with AMEX

When you use your card for everyday purchases, you won’t believe how quickly your cashback can add up. With no spend caps imposed, earning cashback is so much simpler than you think.

Welcome gift: Receive S$100 Cash via PayNow

Requirements: Apply and make a min. spend of S$500 spend within 1 month of Card approval

Here’s how to redeem your rewards:

- Scroll through the list above and find a specific product that matches your need

- Click on Apply Now and fill in your email address (SingSaver will be sending the redemption instructions here. Check SPAM folder if you don’t receive any emails)

- Complete the application form from the bank and remember to take a screenshot so you can take note of the application reference number

- Once your card is approved, check your email inbox for the reward redemption instructions from SingSaver (Check junk/spam inbox too)

- Sign up for an account on SingSaver’s website to access the redemption form

- Fill up the form with the application reference number and you are good to go!

For redemption follow-ups and enquiries, drop an email to [email protected]

This promotion is not affiliated, associated, authorized, endorsed by, or in any way officially connected with Dyson, Apple, Nintendo, or any of its subsidiaries or its affiliates. The names Dyson, Apple, Nintendo as well as related names are registered trademarks of their respective owners.

Apply Now

Apply Now