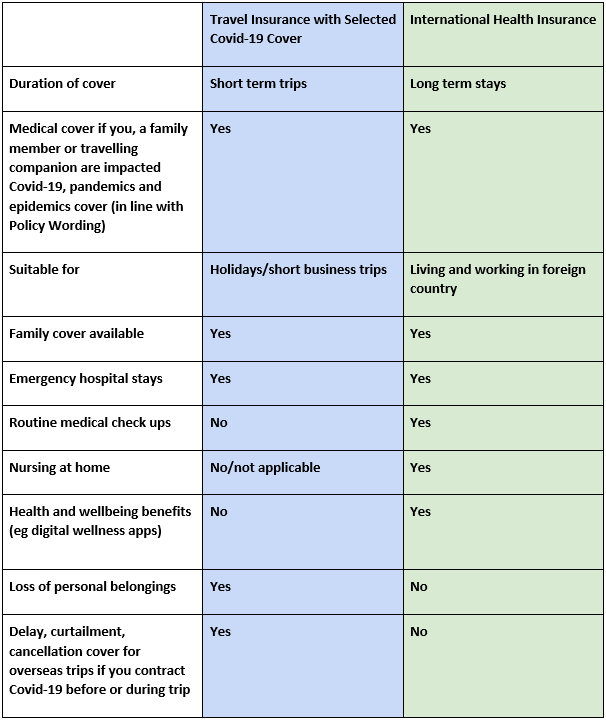

Are you unsure about the difference between travel insurance with selected Covid-19 cover and international health insurance? Here we look at the key differences between the two types of cover.

In short, travel insurance with Covid-19 cover is designed for holidaymakers and those on short business trips to cover things like emergency medical treatment (including covered events related to Covid-19), cancellations and personal belongings. International health insurance provides multi-country cover and is designed for those living and working overseas who need cover for in-patient medical check-ups, medical emergencies and ongoing treatment of chronic conditions.

Below is a general comparison of travel Insurance with selected Covid-19 cover and international health insurance. Exact coverage will depend on the chosen policy.

What about lockdowns and other kinds of general travel disruption?

It’s important to remember that travel insurance doesn’t cover you for everything*. For instance, it does not generally cover against lockdowns, border closures and other kinds of general travel disruption.

*It’s important to remember that travel insurance doesn’t cover everything. Your policy will be subject to the terms, conditions, exclusions, and benefits limits of the policy wording

Travel insurance (with selected Covid-19 cover*) – in more detail

Travel insurance with selected Covid-19 cover is travel insurance that covers you for things like trip cancellations / trip interruptions / trip delay , loss/theft of personal belongings and emergency medical treatment, and includes selected coverage for Covid-19, pandemics and epidemics before or during your trip (in line with the Policy Wording of your chosen policy).

For example:

- If you or a travelling companion/family member are diagnosed with Covid-19 before your trip and need to cancel, you can make a claim for things like travel and accommodation costs.

- If you or a travelling companion/family member are diagnosed with Covid-19 during your trip, you can make a claim for things like medical care and quarantine costs.

In terms of medical coverage, travel insurance is intended to provide short-term emergency medical treatment within your specified area or period of cover. The aim of this is to get you well enough to return home. Travel insurance rarely covers long term medical treatment.

Selected Covid-19 coverage* with Allianz Travel

Travel insurance from Allianz Travel Singapore includes selected Covid-19 coverage*, plus cover for epidemics and pandemics in general (when diagnosed with a disease). The Medical and Dental cover limit is S$1,000,000 (Comprehensive Bronze and Silver) and unlimited for Comprehensive Platinum.

Travel insurance in general is designed to cover you for trips of limited duration. It is intended for holidaymakers and short term trips abroad, and also offers protection against other travel related issues.

For example, Allianz Travel insurance benefits include:

- Selected Covid-19, pandemic and epidemic cover*

- Medical/dental cover of up to $1,000,000

- 24/7 Medical Assistance

- Cancellation, Delay, Curtailment

- Loss/theft/damage of valuables

- Rental Excess cover (Silver & Platinum Plans only)

If further treatment is required, you will be expected to return to your home country. Cover ceases once you are back in your country of residence.

*It’s important to remember that travel insurance doesn’t cover everything. Your policy will be subject to the terms, conditions, exclusions, and benefits limits of the policy wording. For more information please click on the Allianz Travel Policy Wording

Get exclusive 40% off for MoneyDigest readers.

Use promo code: moneydigest40 until 28 March 2022

International health insurance – in more detail

International health insurance is designed for individuals and families living and working overseas for prolonged periods. It is designed to cover things like in-patient care, out-patient GP visits, emergency treatment, specialist consultations, maternity and dental. International health insurance is multi-country and provides members with flexibility in terms of choice of doctor and treatment facility, and with the ability to receive treatment anywhere within their region of cover.

For individuals or families who are unfamiliar with a country’s health system and/or language, international health insurance can make it easier and simpler to obtain medical care. Depending on which country you are moving to, it may also save you significant sums of money compared to ad hoc care if you are not entitled to local free or subsidised medical care.

International health insurance plans vary, but often include:

- Hospital stay

- Routine check-ups

- Cover for pre-existing conditions

- Cover for chronic conditions

- Choice of medical providers

Some international health insurers make it possible to build a plan that suits specific needs. For example, Allianz offers a standard Core plan to which modules can be added, including:

- Out-patient treatment

- Maternity care

- Dental care

- Repatriation

If you choose international health insurance from Allianz, benefits include:

- A range of treatments, inclusive of specialist fees and diagnostic tests, plus generous cover for alternative treatments and physiotherapy

- Health and wellbeing benefits, including digital health apps

- Cover for emergency treatment overseas, medical evacuation and nursing-at-home

- Choice of supplemental cover including Maternity, Dental and Repatriation Plans

- A growing network of over 900,000 quality medical providers

- Cover for Covid-19, pandemics and epidemics

Get 10% off until 28 February 2022