LEGO Unveils Pokémon Sets Featuring Pikachu, Eevee, Charizard, Blastoise and Venusaur

Ask us questions, discover the latest offers & more on Telegram.

Calling all Pokémon Trainers and LEGO builders — your fandom journey just got epically upgraded! The LEGO Group and The Pokémon Company International have teamed up to unveil the very first LEGO® Pokémon™ sets, finally bringing some of the most iconic creatures from the Pokémon world into beautiful brick form. With pre-orders open now and official launch day set for 27 February 2026, Trainers everywhere can soon catch, build, and display their favourites like never before!

Build Legendary Pokémon – Five Fan Favourites Come to Life!

This inaugural collection includes not just one, but three breathtaking LEGO Pokémon builds, featuring five beloved Pokémon from the Kanto region:

- Pikachu

- Eevee

- Charizard

- Blastoise

- Venusaur

Each set is crafted with stunning attention to detail, capturing the spirit and character of these cherished allies—from Pikachu’s electrifying pose to the dynamic trio of starter evolutions.

Featured Sets You’ll Want to Catch!

72152 LEGO® Pokémon™ Pikachu and Poké Ball (2050 pieces)

US$199.99

Jump into action with a brick-built Pikachu emerging from its Poké Ball! This standout set includes a striking display base with bolt-style lightning effects and a creative nod to Pikachu’s Pokédex number “25.” Whether posed for battle or on display, it’s sure to spark joy for fans and collectors alike.

72151 LEGO® Pokémon™ Eevee (587 pieces)

US$59.99

Eevee’s charm comes to life in this expressive build! With movable head, tail, and limbs, you can pose your favourite evolution-potential Pokémon in playful or heroic stances—perfect for any shelf or desk build.

72153 LEGO® Pokémon™ Venusaur, Charizard and Blastoise (6838 pieces)

US$649.99

The crown jewel of the collection! This massive, museum-worthy display features three of the original Kanto starter evolutions—each rendered in detailed brick form with posable joints and themed environmental elements. It’s a breathtaking centrepiece for any serious Trainer or LEGO fan.

Singapore Availability: What You Need to Know

According to online reports, the LEGO Pokémon sets will not be available for purchase at LEGO Singapore stores, including official LEGO Certified Stores and LEGO.com (Singapore).

That said, all hope is definitely not lost.

How Singapore Fans Can Still Buy LEGO Pokémon Sets

- Local collectors can access the LEGO (US) site or PokemonCenter (US) via incognito mode on their web browser.

- Use freight forwarder services to obtain an USA address and ship your purchase here.

Some of the popular options used by Singapore shoppers include:

- comGateway

- ezbuy

- vPost

These services provide you with an overseas shipping address and forward your purchase back to Singapore — a familiar route for collectors who regularly buy region-exclusive LEGO sets, Pokémon merchandise, or limited-edition drops.

⚠️ Do factor in shipping fees, GST, and potential weight-based charges, especially for larger sets.

Spend Your CDC Vouchers At Giant & Get $6 Back — Here’s How

Ask us questions, discover the latest offers & more on Telegram.

If you’re planning to use your CDC Vouchers or SG60 Vouchers this January, here’s a small but satisfying win to stack on top of your grocery run.

For one week only, Giant is giving shoppers a $6 Return Voucher when you spend a minimum of $60 using CDC Vouchers or SG60 Vouchers — essentially putting $6 back in your pocket for your next visit.

How The $6 Return Voucher Works

It’s as straightforward as it gets:

-

Spend $60 or more in a single receipt

-

Pay using CDC Vouchers or SG60 Vouchers

-

Receive a $6 Return Voucher on the spot

No complicated mechanics, no registration required — just shop, spend, and collect.

When & Where

-

Promotion period: 3 – 9 January 2026 (1 week only)

-

While vouchers last

-

Available at cashier and self-checkout counters

When Can You Use The $6 Voucher?

-

Redeemable from the day after issuance

-

Valid until 18 January 2026

-

No minimum spend required when using the return voucher

Yes, that means even a small top-up grocery run can enjoy the full $6 off.

Good News for Every Singaporean Household — $300 CDC Vouchers Available from Jan 2!

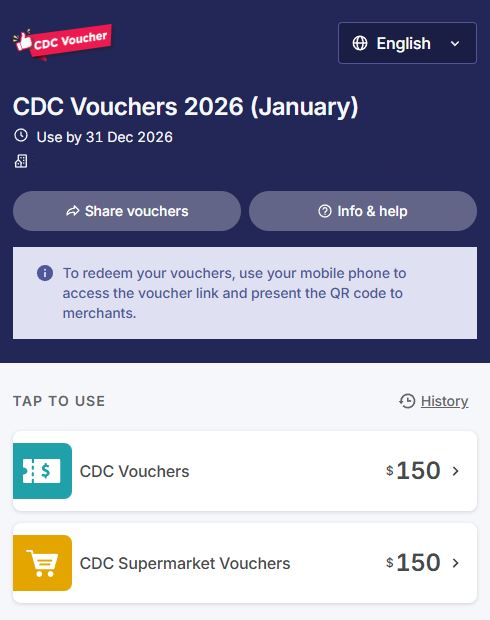

Starting 2 January 2026, every Singaporean household can claim S$300 worth of Community Development Council (CDC) vouchers — the latest support designed to help you with everyday expenses and support heartland businesses across the island.

These vouchers are part of the Government’s ongoing effort to cushion rising costs of living and give families and individuals a hand where it matters most. They follow on from the S$500 CDC vouchers disbursed in May 2025, bringing the total support for this financial year to S$800 per household.

How It Works

It’s simple and convenient — claim your vouchers online via go.gov.sg/cdcv using your Singpass, and they’ll be ready to use digitally. There’s no need to download any separate app — making it easy even for first-time users.

Once claimed, the S$300 CDC vouchers are valid until 31 December 2026, so you have plenty of time to spend them on essentials.

Where You Can Spend

Make every dollar count — the vouchers can be used at:

-

$150 CDC Vouchers 2026 (January) to spend at participating heartland merchants and hawkers — enjoy your favourite laksa, nasi lemak, kopi and more.

-

$150 CDC Vouchers 2026 (January) to spend at participating supermarkets — ease grocery costs for your household.

With daily costs like meals and groceries taking up a big chunk of monthly spending, this latest tranche of CDC vouchers offers practical relief that goes straight where you need it — in your trolley, on your hawker tray, and around your neighbourhood. It’s support that’s easy to use and feels immediate.

Why International Schools Choose Play-Based Learning

Explore why international schools value play-based learning to support confidence, creativity, and balanced development in early education.

Why International Schools Choose Play-Based Learning in Early Childhood Education

International schools seek approaches that respect childhood curiosity while building academic readiness through meaningful experiences. Play-based learning meets that aim through thoughtful classroom practices that feel natural rather than forced. Educators value this model because it supports emotional confidence, social balance, and steady intellectual progress.

Early childhood education gains depth through guided play that links imagination with purposeful learning experiences. This approach supports curiosity, emotional growth, and cognitive development through meaningful daily interactions. This article explores reasons international institutions favour this model.

Cognitive Growth Through Purposeful Exploration

Play-based frameworks allow mental growth through curiosity-driven exploration rather than rigid instruction. Learners engage concepts through tactile materials, imaginative scenarios, and collaborative challenges within guided spaces. Such environments encourage reasoning, memory development, and flexible thought patterns through meaningful experiences. Educators observe strong problem-solving capacity because children test ideas freely without fear of error.

Language skills advance through dialogue, storytelling, and role-play within shared activities. Mathematical awareness emerges naturally during construction tasks, sorting games, and spatial puzzles. This approach respects developmental pace while promoting intellectual confidence across varied abilities. International schools appreciate this balance because it supports diverse learners within multicultural classrooms.

Social Confidence and Emotional Balance

Healthy peer interaction stands at the centre of play-based classrooms within international settings. Children practice cooperation through shared goals, imaginative narratives, and group problem solving. Emotional literacy grows as learners express feelings during pretend play or collaborative tasks. Teachers guide conflict resolution gently, allowing empathy and patience to develop authentically.

Such experiences strengthen self-regulation without pressure or comparison among peers. Social confidence increases because participation feels inviting rather than evaluative. International communities value this harmony due to varied cultural expectations around expression. Emotional balance supports smoother transitions into later academic stages.

Cultural Inclusion Through Flexible Play Structures

International schools serve families from many regions, languages, and traditions. Play-based learning adapts easily to cultural diversity through open-ended materials and shared storytelling. Children introduce personal experiences into play narratives, enriching classroom perspective. This adaptability creates respectful dialogue among peers from varied backgrounds.

Early childhood education in Singapore highlights cultural sensitivity through inclusive play themes. Educators observe strong identity development because children feel represented within daily activities. Flexible structures allow celebration of traditions without formal lessons. International institutions favour this inclusivity because it nurtures global awareness naturally.

Educator Roles Within Guided Discovery

Teachers act as facilitators rather than lecturers within play-based environments. Observation guides lesson design, ensuring support aligns with individual developmental readiness. Educators pose thoughtful questions that extend thinking without interrupting exploration flow. This guidance encourages independence while maintaining academic intention.

Professional expertise shapes environments that invite inquiry through purposeful material selection. Assessment occurs through observation, documentation, and reflective dialogue rather than formal testing. Such practices respect childhood rhythm while providing meaningful insight. International schools trust this role because it balances freedom with responsibility.

Learning Spaces That Invite Curiosity

Classroom design plays a crucial role in play-centred programs. Spaces feature accessible materials, calm colour palettes, and flexible layouts. Children explore areas independently, supporting autonomy and decision confidence. Learning zones reflect varied interests such as art, construction, reading, and dramatic expression.

Clear pathways promote safe movement while maintaining focus and engagement throughout the day. Thoughtful arrangement supports collaboration without overcrowding or unnecessary distraction. Such environments encourage sustained attention, creativity, and respectful shared use of space.

Thoughtful Material Selection

Resource choices influence engagement quality within play-based classrooms. Materials remain open-ended, durable, and culturally neutral to support varied narratives. Natural elements such as wood, fabric, and recycled objects inspire imagination. Educators rotate items based on observed interest and developmental readiness.

This practice prevents overstimulation while sustaining curiosity. Learners develop respect for shared resources through guided care routines. Such environments promote responsibility without strict rules. International schools appreciate this balance because it supports mindful habits.

Assessment Without Pressure

Evaluation within play-based models relies on observation rather than formal examination. Educators document progress through notes, photographs, and reflective summaries. This approach captures authentic growth across social, cognitive, and emotional domains. Children remain unaware of the assessment, preserving joy and confidence.

Families receive detailed insight into development through narrative reports. Such communication builds trust and transparency between school and home. International communities value this clarity across language differences. Pressure-free evaluation supports long-term motivation.

Preparation for Lifelong Learning

Play-based foundations prepare learners for future academic demands through confidence and curiosity. Children develop resilience through trial, adaptation, and creative problem-solving. Motivation remains intrinsic because discovery feels rewarding rather than compulsory. These qualities support adaptability across varied educational systems worldwide.

International schools seek graduates who think critically and collaborate respectfully. Play-based beginnings nurture these attributes naturally. Learners transition smoothly into structured learning with strong self-belief. This preparation aligns with global education goals.

International schools continue to select play-based models because they honour childhood while building capable, confident learners. This approach aligns emotional well-being, cultural respect, and intellectual growth through thoughtful practice. Play-based learning in early childhood education helps establish strong foundations for curiosity and lifelong learning. This foundation encourages adaptable thinking and strong social awareness, qualities valued across diverse educational communities worldwide.

eight Telecom offering 1-for-1 top-ups (can do online!) from now till 16 Dec 25

Ask us questions, discover the latest offers & more on Telegram.

If you’ve been waiting for the right moment to switch mobile plans or top up your balance, this is it. eight is bringing back its 88 Deals this holiday season, and the offers are exactly as shiok as they sound — big value, no nonsense, and seriously limited-time.

Running from 14 to 16 December only, these deals are available at 400 island-wide retailers and online, so you don’t even need to queue long-long to enjoy the perks.

Switch to eight & Get 88 Days FREE

Thinking of porting over? eight is making the switch extra rewarding.

Switch to eight and enjoy 88 days FREE on all mobile plans. (equivalent to 3 months!)

That’s nearly three months of savings, just for making the move. No complicated hoops — just switch, activate, and enjoy.

1-For-1 Top Up: Load $88, Get $88 FREE (Up to 8 times!)

This is where the deal gets even more interesting.

During the promo period, users can enjoy 1-for-1 top ups up to 8 times. That means every time you load $88, you’ll receive another $88 FREE — up to eight separate top-ups.

In simple terms?

If you max it out, you’re effectively getting up to $704 worth of value from this promotion alone.

No complicated mechanics, no lucky draw — just straight-up bonus value credited to your account.

Click here to read the FAQs.

Skip the Queue, Grab the Deals

Whether you’re switching plans or topping up, these 88 Deals are designed to be fast, fuss-free, and worth your time. With availability both in-store and online, there’s really no excuse to miss out.

📍 Available at 400 island-wide retailers

🌐 Online via Main Balance > Top up

📅 Only from 14 to 16 December

Don’t blink — once the 3 days are up, these deals are gone.

T&Cs apply.