To kick start the year 2024, Webull, a leading online brokerage platform, is rewarding its customers with attractive offers. This time round, Webull is rewarding both their new and existing users with stackable rewards from now till 31 January 2024. While most of us may be familiar with their generous Welcome Rewards, Webull is taking it further to another level by throwing in other attractive offers.

Stackable Rewards

First, register an account with Webull via this link. Then, download the Webull app on Apple Store, Google Play or the Webull Desktop. Once you are done, you can refer to the table below and stack the rewards and get as much as you can.

Offer A – Pick The Lowest Hanging Fruit First

For those who are new, you can start off by signing up an account with them via this link and fund any amount from as little as $0.01. You will receive 5 free shares worth between US$3 – US$500 each randomly. That also means you are guaranteed to receive a minimum of 5 x US$3 worth of fractional shares or US$15 by simply signing up without doing any trading. If you are super risk adverse, you can stop at this step.

Offer B – Get Up to USD3,000

Let’s say you are a little bit more risk tolerant, you can choose to take it up a notch further and earn even more rewards with Moneybull. What is Moneybull if you may ask? Well, to put it simply, it is a wealth management tool for the lazy investor. It is designed for margin accounts to earn a yield on idle cash while maintaining liquidity and low risk. These low-risk cash funds are effectively mutual funds. As of time of writing, Moneybull USD and SGD has a 7-day annualized yield of 5.4162%* and 3.8208%* respectively.

*T&Cs apply. Figures shown are based on 7-Day Yield (P.A.) of the USD Cash Fund and SGD Cash Fund in Moneybull as of 11 Jan 2024. Principal is not guaranteed. Returns are not guaranteed and not an indication of future performance. All investments involve risks and are not suitable for every investor. This advertisement has not been reviewed by the Monetary Authority of Singapore.

The yield is on top of the offers given by the Moneybull promotion so you are actually earning both the interest yield plus the rewards. While money market funds are considered relatively safe and low risk, however, like all investment, there may be negative return on certain days. Carefully consider the investment objectives, risks, charges, and expenses before investing.

You can start small and subscribe US$500+ on Moneybull and get a minimum of US$75 worth of fractional shares up to this step.

Offer C – Highest Transfer In Rewards

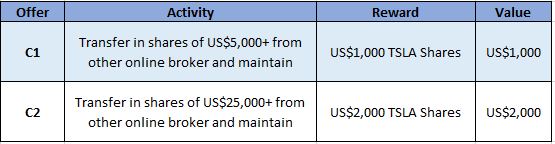

Webull is offering the highest transfer-in rewards*, and we definitely want to give you a heads-up! From now till 31 January 24, Webull is giving both new and existing customers up to USD2,000 worth of Tesla Shares for free when you make an initial transfer of your stocks from another broker.

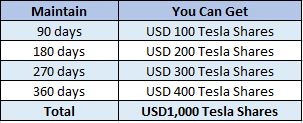

For seasoned investors who have positions with other brokers, this offer is worth considering as you can receive the highest transfer-in rewards*. For example, if you have positions under TD Ameritrade Singapore (who no longer serve non-Accredited Investors) or with other online brokers, you can transfer in US$5,000+ of US Stocks over and receive US$1,000 worth of TSLA Shares from Webull as a reward. You will then need to maintain it for a holding period of between 90 days to 360 days to receive the rewards.

You will then need to maintain it for a holding period of between 90 days to 360 days to receive the rewards.

If you transfer US$25,000+ from another broker, you will receive double the rewards with the same holding period.

*T&Cs apply. For details, please refer to Webull’s Website at https://www.webull.com.sg/. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Here are the steps provided by Webull on how to initiate a transfer in.

- Please download the Share Transfer-In form, complete it, and email it to [email protected].

- Subsequently, please contact your respective broker and provide them with the following details to initiate a transfer-out request. (You can Google “How to transfer out shares from [name of broker]”)

*Please note that only Stocks and Exchange-Traded Funds (ETFs) listed on US Exchanges are supported for Share Transfer-In.

Note that there will may be fees involved from transferring out from another broker. Webull is aware of this and will subsidise the fee up to US$150. Simply submit the proof of payment and Webull will reimburse it!

That’s about it! We hope you can stack as many rewards like we did! We recommend that you try and obtain [Offer A, B1, B2 & C1] and get at least US$1,155 in reward* as they do not require a large sum of money and do not require you to undertake too much risk.

Is Webull Safe?

Webull is regulated by the Monetary Authority of Singapore (MAS) and holds a Capital Markets Services (CMS) Licence under the Securities and Futures Act 2001. As such, Webull must comply with the “Customer’s Moneys” regulations; Webull is only allowed to utilise these monies as per the customers’ instructions, for example, settling your trades, or to defray costs that was agreed or as stated, for example, taxation and brokerage fees, if any.

Under the same regulation, the trust account must be opened with specified financial institutions, for example, a bank licensed by the MAS under the Banking Act 1970. Webull has appointed DBS Bank Limited as the custodian of their customers’ monies, a licensed bank under the Banking Act. The bank is not allowed to exercise any right of set-off against the moneys in this trust account for any debt owed by Webull. Monies belonging to customers must be kept in this trust account for safekeeping, separate from all other monies belonging to Webull or for other purposes.

With the above safeguards in place, your money placed in Webull is safe.

*Terms and conditions apply. Principal is not guaranteed. Returns are not guaranteed and not an indication of future performance. All investments involve risks and are not suitable for every investor. This advertisement has not been reviewed by the Monetary Authority of Singapore.