Many are afraid or shy to ask for more money and better working conditions.

You may be afraid of the negative reactions you are expecting to get such as dismay, shock, embarrassment or being fired from the job.

But, whatever the reason may be, you are letting your long-term opportunities to be flushed away.

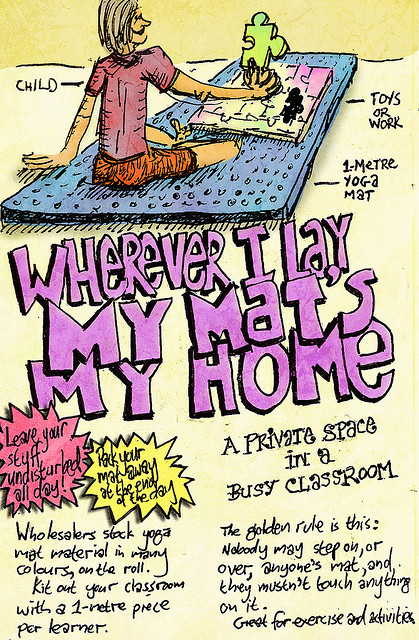

Negotiating a salary is a conversation that aims to reach an agreement with someone whose interests are not perfectly aligned with yours. Everyone with the right Psychological strategy and conversation tools can sway the opinion of another through a pleasant negotiation.

Here are 4 Ways to help you Negotiate Salary Increase Efficiently…

1. ASK AND YOU SHALL RECEIVE

There are many people who hardly negotiate at interview, and during employment, they fail to negotiate a pay raise. If you do not ask then you won’t get it.

Realize that your bargaining strength is all in your head. If you act as though you are prepared to walk away from a deal unless you achieve your desired goal, your bargaining partner will be far more eager to meet your requirements.

2. BE AWARE OF YOUR CAPABILITIES AND BOUNDARIES

As I said, your bargaining strength is all in your head, so are your assumptions about yourself and your job. Negative assumptions (e.g., I am inexperienced, I shall not ask because of the bad economy, and I am not capable of doing all the job requirements) hinder the person to negotiate for a pay rise.

Evaluate these assumptions because you may fail to realize that the company needs you as much as you need them.

Believe that you are worth it. Throughout the negotiation interview, you shall highlight how much of an asset you are to the company and prove how you are the best candidate for the job.

3. ASK FOR MORE THAN YOU ACTUALLY WANT

Your first offer must be slightly higher than what you want to avoid remorse and to give you a room to bargain. It uses the door-in-the-face technique wherein the employee starts with a huge and unreasonable request in order for the employer to settle with a smaller request.

4. COMPETE

Negotiating a salary is a conversation that aims to reach an agreement with someone whose interests are not perfectly aligned with yours. Negotiating your salary is also a game with all of its players attempting to dominate each other. Dominate the game by researching all the needed information.

Go in-depth about the complete aspects of the job and the company. Also, collect data about the average pay and accurate salary opportunities in your position.

Use persuasion and assertion if necessary because research show that competition is a successful negotiation strategy (Marks & Harold, 2011).

Sources: Spring and Wealth Informatics