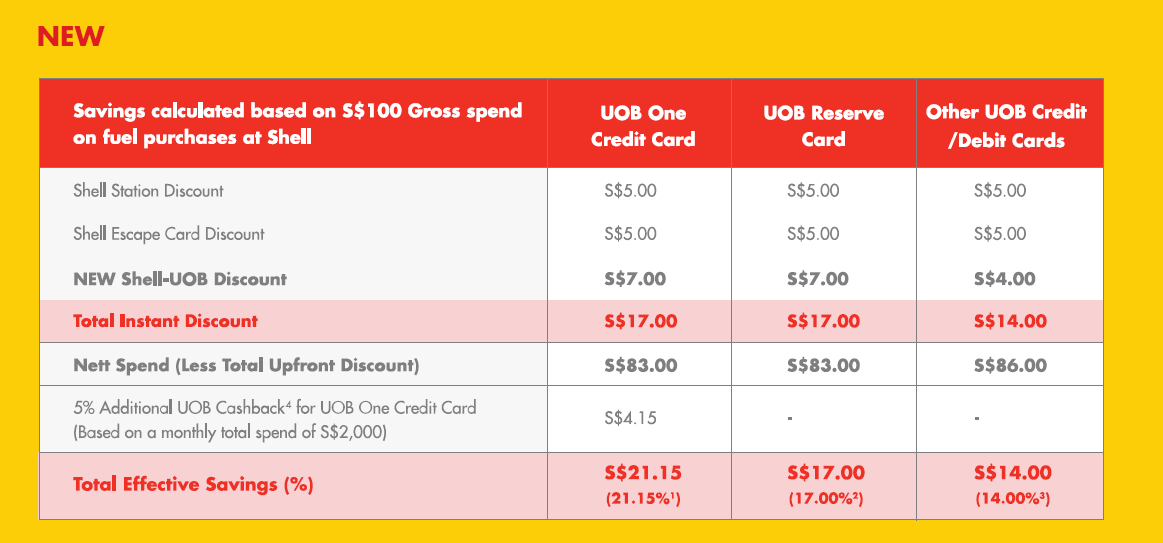

From today, enjoy EVEN HIGHER fuel savings of up to 21.15%* at Shell with UOB Credit Cards! Here’s the quick lowdown of this fantastic collaboration:

- UOB One Credit Cardmembers enjoy 17% instant fuel discount at Shell + up to 5% cashback*.

- UOB Reserve Credit Cardmembers enjoy 17% instant fuel discount at Shell.

- All other UOB Credit Cardmembers enjoy a 14% instant fuel discount at Shell.

Find out more below on how you can enjoy higher fuel savings at Shell with UOB Credit Cards!

Score Higher Upfront Savings

Holding a UOB Credit Card? Score even higher instant discounts at Shell! Cardmembers will be pleased to know that Shell and UOB Cards have increased their instant discount component to bring you even higher fuel savings as shown below.

Terms and Conditions Apply:

1 Up to 21.15% savings for UOB One Credit Card is calculated based on 5% upfront Shell station discount, 5% upfront Shell Escape discount, 7% UOB One Credit Card instant discount, and, if applicable, up to 5% UOB One Credit Card cashback.

2 Instant 17% discount for UOB Reserve Credit Card is calculated based on 5% upfront Shell station discount, 5% upfront Shell Escape discount and 7% instant discount for UOB Reserve Credit Card.

3 Instant 14% discount for other UOB Credit Cards is calculated based on 5% upfront Shell station discount, 5% upfront Shell Escape discount, 4% upfront discount for other UOB Cards.

4 Enjoy up to 5% cashback based on a spend of S$2,000 monthly for each qualifying quarter with min. 5 purchases monthly to earn the quarterly cash rebate of S$300. Visit uob.com.sg/one for full terms and conditions.

Valid Shell Escape Card must be presented to the cashier to enjoy the bank upfront discounts. Other terms and conditions apply. Visit uob.com.sg/fuelpowershell for more details.

Please note that there has been an update to the UOB SMART$ programme at Shell. Earning of UOB SMART$ at Shell has ceased and the last day of redemption of UOB SMART$ at Shell will end on 16 June 2021, 23:59.

As shown above, UOB One Credit Cardmembers who pump at Shell can earn up to a whopping 21.15% discount as shown in the example above. This makes it one of the most enticing offer in the market today!

To earn the attractive cashback from your UOB One Credit Card, simply pick up your daily necessities available at the Shell Select stores. Shell Select are stocked with a variety of snacks and beverages along with other convenient items, all selected for the high quality to ensure that you get the best available. Refuel your car for the journey ahead and enjoy a pleasant and hassle-free customer experience at Shell Select!

Earn More Rewards With Shell Escape Loyalty Programme

To enjoy upfront savings, don’t forget to sign up for the Shell Escape Loyalty Programme card.

Simply pick up a Shell Escape Card and register for the Shell Escape Loyalty Programme online at your convenience. Once you have registered, you are on your way to earn Shell Escape points on your fuel purchases. Pump more at Shell today to accumulate more Shell Escape Points! Thereafter, treat yourself to a plethora of deserving rewards simply by redeeming your Shell Escape points.

Sign up For UOB One Credit Card Now

If you do not have a UOB One Credit Card, simply sign up for one so that you can immediately enjoy higher fuel savings at Shell! Remember to present your Shell Escape Card to boost your rewards at Shell further! Sign up now for a UOB One Credit Card today at https://www.uob.com.sg/onecards/apply-now.html