Upon entering the room, every employer is on the lookout for a specific set of skills that is necessary for the vacant position.

You must be aware of these “job-specific” skills as well as the ones that are generally sought after by employers all over the world. Fortunately, most people have these skills to some extent while others can improve these skills through mentorship, training, and professional development.

What skills do you really need in order to get ahead from the rest?

1. COMMUNICATION SKILLS

It is no secret that developing good relationships and successfully delivering your ideas is critical in business. Whether you are looking for a job or wanting to get a promotion, communication skills is an asset that will get you to where you want to go.

Communication skills encompasses your ability to fluently converse through written and oral forms. It builds genuine relationships where you can count on others for information and help. Also, it serves as a tool to convey your thoughts on how to improve the organization. Now, that is a sure-fire way to get noticed!

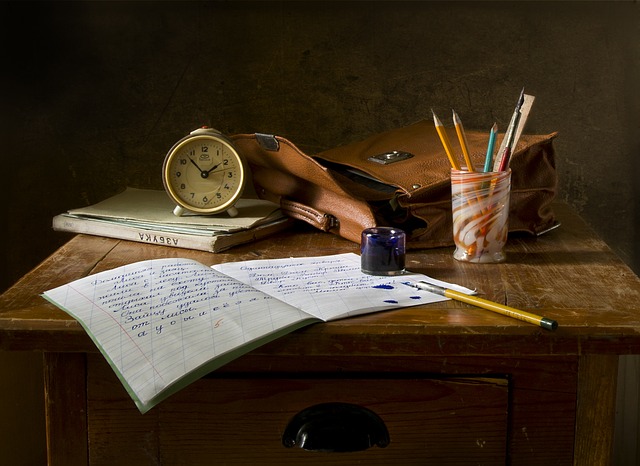

2. TIME MANAGEMENT SKILLS

One of the most important commodities on Earth is time. Once it is gone, you cannot take it back nor can you buy it in bulk. Time is very precious and wasting it can result to loss of profits. This is why employers value job hunters that are able to efficiently divide their time to meet the urgent tasks and deadlines.

Great time management skills produce many benefits such as higher productivity, reduced stress levels, and better quality of work.

Always remember that it is healthy to spare some time for yourself and your family too!

3. PROBLEM SOLVING SKILLS

Henry Kaiser once said: “Trouble is only an opportunity in work clothes.”

Troubles or problems in the workplace are inevitable. And, having strong problem solving skills can help you manage these daily hurdles. Start by defining the situation and the problem at hand. Then think of the available options, resources, and alternatives. After which, you must analyze and select the best solution.

Showcase your creativity and reasoning abilities by approaching the problems from different angles!

4. LIFELONG LEARNING

Your ability to continuously learn is possibly the most important skill you need to cultivate your edge from the rest. Formal education and its resulting qualifications are viable. However, lifelong education maximizes your potential to get better jobs and to earn more.

Lifelong learning involves your motivation to deliberately develop throughout the course of your life. As of now, jobs require you to have the basic understanding of computer softwares and applications such as word processing, spreadsheets, and emails.

So whether it is learning a new technological device, a new skill, or a new attitude…there are untapped worlds to discover and many of which can open remarkable opportunities for you! 🙂