Time is your best friend when it comes to investing. The longer time you allow your assets to develop, the bigger your retirement fund will be. The problem is that most individuals aren’t educated about investing until they’re in their adult years. And by that time, most have already squandered over two decades.

Traditional educational systems often do not educate children about investing, such as why they should acquire stocks while they are young and how to build a diversified portfolio that will last them until retirement. As a result, it is incumbent on parents to prepare their kids for financial security. Fortunately, financial literacy can be taught from the comfort of one’s own home.

Here are tips to educate your kids on investing.

Patience is key

Investing, like most pleasures in life, takes patience. Instill in your kids the understanding that investing is not a get-rich-quick gimmick. Rather than anticipating a rapid return, the idea is to put money into the stock market and watch it increase over time. This piece of advice will set more realistic goals for your child when it comes to investing from the get-go.

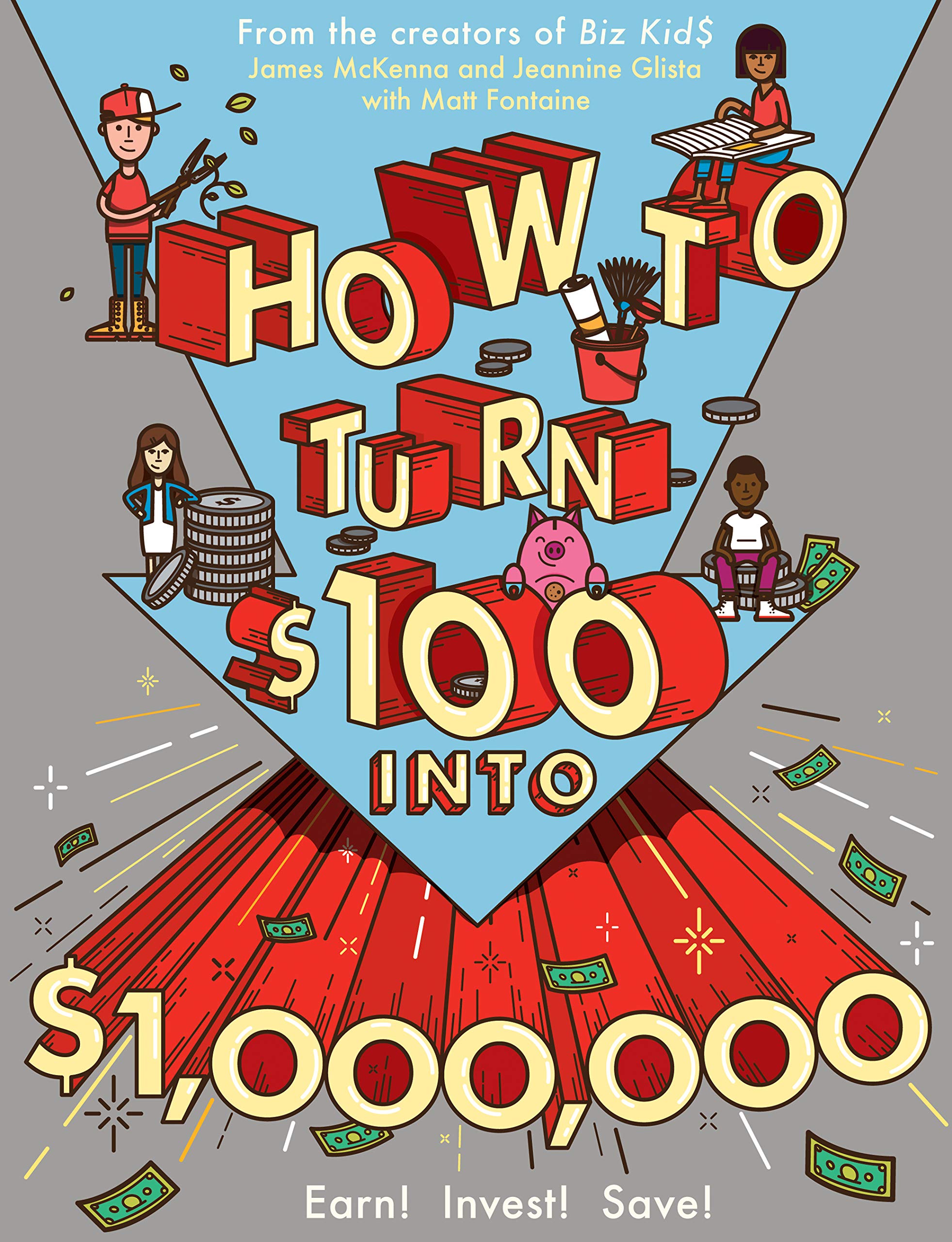

Gift them investment books

Image Credits: amazon.com

There are several excellent finance-related books for kids and teenagers that may help your child learn more about investing. For example, How to Turn $100 into $1,000,000: Earn! Save! Invest! is ideal for any parent who wishes to raise a child who is financially savvy and secure. The quest begins with instructions on how to make a first hundred bucks while the rest of the book follows the path to a million dollars. What’s there not to like about it?

Introduce familiar companies

For years, the expression “buy what you know” has been tossed about in investment circles. It’s important to teach kids how to invest by putting their money in firms they recognize. Today’s children are well-versed in product branding and are adept at conducting web searches. Consider inviting your kid to spend time with you investigating the stock price of a firm they are interested in.

Look up the payout history during the search and clarify why they will get the declared dividend amount for each share of stock they hold. You could perhaps suggest reinvesting returns to continue expanding the asset, based on your child’s financial literacy level. Kids may become long-term investors by investing in what they know: if they clearly understand the firm and grasp what drives its operation, they are more inclined to stick it out during moments of instability.

The sooner you start introducing concepts of investments to your children, the more probable they will establish good financial habits and accumulate money over time. You may even be amazed at how much your children can comprehend, notably if you start teaching them diverse tactics at an early age. Don’t put off the thought of helping them start saving for retirement; they will thank you down the road.