We live in an era of consumerism.

With multiple sources of influence, such as that new Dior perfume advertisement on the television, or your friend’s #humblebrag about her newest bag on Instagram, it is certainly exceedingly easy to fall into the trap of compulsive shopping.

Or perhaps, you may find yourself overspending due to your tendency to hoard stuff that you take a fancy to.‘See that dress over there? Well, it’s the last in stock, so you’d better get it if you like it, or it’ll be gone when you actually do come back for it.’ And as this train of thought follows you into every boutique store that you enter – well, it is hardly surprising that you find your arms laden with shopping bags a mere three hours later.

Another reason why you might be finding your wallet losing it’s weight way faster than it ought to be, would be your tendencies to engage in retail therapy. Indeed, shopping may be a rather effective way of dissipating any negative thoughts, as the joy of purchasing items that you have been hankering for may be sufficient to negate these unpleasant feelings that have been building up inside of you. However, as you pull item after item off their rack in pursuit of such short term gratification, you might find yourself chalking up a debt on your credit card that would merely return to haunt you in the long run.

Our penchant to spend uncontrollably is further compounded by the fact that online shopping is bigger and better than ever, and it’s ability to influence consumers like you and I, has expanded to an unprecedented scale. With such frequent ‘Black Friday free shipping promotions’, ‘New Year’s sale’ or ‘20% off flash sales’ notifications constantly being sent to our very inboxes, it may certainly be difficult to resist the lure of online shopping. Before you know it, you have just carted out yet another 3 items. Uh-oh.

(Image credit: http://blog.credit.com)

Yes, the struggle is only too real.

Soon, you’ll be finding yourself with a bank account that has been run dry, with a closet that is bursting at the seams yet comprises largely of unnecessary buys, and a despondent heart that aches for the credit card debts you’ve accumulated – an absolute financial nightmare realised to its full potential in the remarkable span of only a few months.

(Image credit: http://www.psychalive.org)

Fear not, all is not lost! Just because you have found yourself ensnared in the ways of compulsive shopping, does not necessarily mean that it is impossible to extract yourself from this painful situation of cyclical impulse and regret.

Here are 5 ways to reign in that shopping addiction of yours!

1. Shop with a supportive friend

(Image credit: http://s290.photobucket.com)

See, we all have two types of friends – the supportive friend and the enabler.

If you’re genuinely out to save money and cut costs, shopping with an enabler is just about one of the worst decisions you can make – you’ll most likely end up splurging again, if not more! The enabling friend will probably encourage any compulsive shopping behaviour, instead of dissuading you from buying into unnecessary wants. Certainly, this is not to say that enablers aren’t good friends in general. They’re most likely avid shoppers themselves, who may be addicted to shopping just like you are, and the both of you will merely suffice to mutually enable if you shop together.

Instead, shop with a supportive friend – a friend who doesn’t gush quite as much about clothes as you do, or perhaps a friend who is always practical and grounded. While a supportive friend may not be the most engaging shopping buddy (they probably won’t rave about the newest fall trends or the latest designer shoes along with you), you can always count on him or her to ground you when you’re getting over your head (and your budget) while shopping. The supportive friend knows that you have a hard time controlling your spending urges, and forces you to think about whether you really need that item, or whether it is within your range of affordability. Certainly, by shopping with a supportive friend who is genuinely concerned and bothered by your spending habits, you’ll find that you will be able to cut down significantly on your monthly shopping expenditure. In other words, there’s nothing quite like a killjoy friend to cut your shopping frenzy short, and pressure you into making wiser spending decisions.

On a sidenote, if you’re simply too stubborn to be talked out of a spending decision, have your friend hold on to your wallet for the rest of the day. A little desperate in measure, but I’d figure this would work best when it comes down to the crunch.

2. Unsubscribe from newsletters and email notifications

(Image credit: http://www.aloud.es)

For massive online shoppers like myself, you’ll find that unsubscribing yourself from the frequent newsletters and notifications that flood your inbox on a weekly basis does wonders in helping you to spend less. With the rapid pace of the online shopping industry, in which new collections and fresh arrivals are churned out relentlessly each week – or even every three days, it is exceedingly easy to fall into their marketing trap and spend beyond your limits. While you may not feel the pinch of taking your pick of just one item from each new collection, just buying 1 item each week from a single webstore would equate to 4 new wardrobe additions each month. Imagine the full extent of such an online shopping obsession if you purchase 1-2 pickings from a spread of several webstores each week! An online shopping addiction can be a scary reality indeed.

To cut down on online shopping, start by unfollowing your favourite stores on Instagram, unliking their Facebook page, and removing yourself from any mailing lists or email subscriptions. By cutting yourself off from these sources of marketing and promotions, you are effectively cutting yourself off from the irrational impulse to buy, buy, buy as well! After all, the urge to splurge certainly will not surface, if you do not even know about that latest flash sale in the first place!

It may be a painful process to remove yourself from these channels, as this inevitably leads to an unpleasant foreboding that you will be missing out on a lot – but trust me, if you are genuine in restricting your spending, this method will prove duly effective (or so I have indeed learnt from personal experience).

3. Switch out all your credit cards for debits

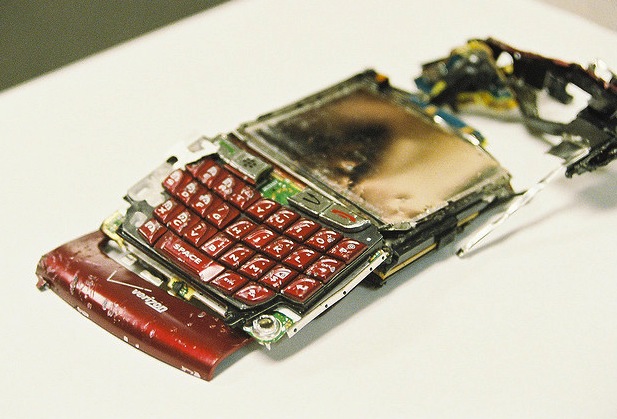

(Image credit: http://www.digitaltrends.com)

If you have a tendency to overspend, perhaps it may be timely to use debit cards in place of your usual credit cards. Given that every purchase made using a credit card is first paid for by your bank, it is terrifyingly easy to lose track of your spending and splurge over your limits. The consequences of such overspending will only come back to haunt you after each month, as your credit card bills arrive, and your bank demands for repayment. Failure to repay any credit card bills in full could lead to an accumulation of credit card debt at an astounding interest rate, and could soon snowball into a massive debt if not managed properly.

To avoid such an unpleasant situation, switch to debit cards instead, where your spending is directly linked to a bank account and expenditure is much easier to track. Witnessing your depleting bank balance when you overspend could also serve as a wake up call for you to cut down on your shopping immediately, in comparison to credit cards where you may be more tempted to spend beyond your thresholds given that your shopping is paid on loan which makes it tough for you to visualise the toll that your spending is taking on your hard earned savings.

If you are aware of your compulsion to shop, and that you have poor financial responsibility, making the decision to switch to a debit card would certainly be wise in the long run. Sure, you may not be able to enjoy as much rewards and additional perks or discounts when using a debit card, as compared to a credit card, but hey on the brighter side, at least you can be pretty sure that you won’t find yourself debt-ridden anytime soon.

4. Replace your shopping habits with new hobbies

(Image credit: http://www.startmarriageright.com)

Your shopping addiction may have arisen due to the emotional dependence that you place on it. Perhaps you used to turn to retail therapy as a way to assuage your fears, worries or troubles, but you grew reliant on shopping as a way to relieve all your emotional woes over time. This eventually culminated in an obsession to impulse buy whenever your psyche takes a turn for the worse – a costly habit indeed.

Instead, opt for a more financially savvy method of lifting yourself from an emotional low. After all, shopping is just one of many other ways that can provide emotional healing. Why not spend some time exploring alternative hobbies that can provide you with the same sense of escapism and momentary uplift that shopping does for you? For instance, running, watching television, knitting or reading are all viable alternatives that you can employ to substitute your compulsive shopping therapy habits, as they provide a source of distraction, and they each have a calming effect on the mind as well.

Find your own alternative past-times – surely you’ll be able to find a leisure hobby that is more productive and less expensive than shopping, yet able to provide you with the same amount of therapeutic help.

5. Pay for all your shopping using cash – and only cash!

(Image credit: http://purenintendo.com)

It may indeed be tempting to seek the convenient way out and simply use a credit or a debit card to pay for all your purchases, as the swift checking out process of merely a swipe and go of your card makes shopping all the more breezier. While this is appealing in concept, the reality is that it is so much easier to overspend and get ahead of yourself while shopping this way, as there is no visible form of monetary exchange, and it takes a longer time for the painful truth to set in that you have entirely blown the roof off your budget – yet again.

Instead, opt for payment by cash for all necessary transactions. Watching the cash deplete from your wallet is more likely to ground you, and force you to face the truth that you ought to slow down on your spending. Furthermore, by choosing to pay for your purchases strictly using cash, it makes it so much easier for you to budget, as you can decide on the exact amount that you’d like to spend on shopping and food for the day.

A little rudimentary, yes. But the feeling of accomplishment that you will get when you finally realise that you have managed to curb your shopping addiction, and that you’re finally able to chalk up a decent set of unspent savings for the first time in several months, will certainly be well worth this slight effort.