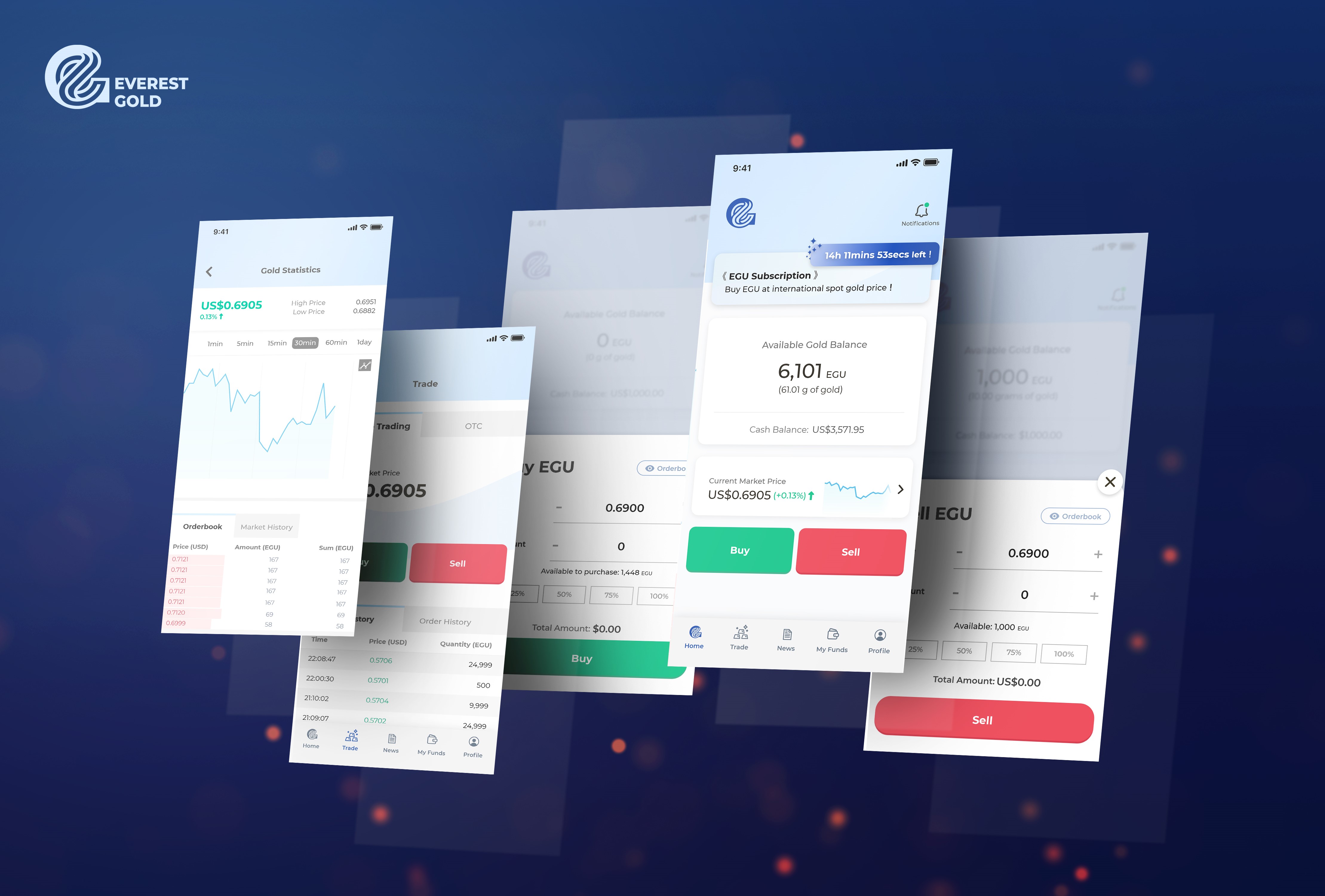

Everest Gold is a Singapore fintech company working to make gold trading and investment accessible and affordable for retail investors on a secure online platform. It employs advanced technology which allows clients to track real-time gold prices as they seamlessly build, invest, trade and sell their gold portfolios.

Investors do not need any specialised trading experience to yield higher profits when investing in gold via Everest Gold. Simply buy when the price of gold is low and sell when price is high to get instant profits! With zero transaction fees and no minimum amount required, take advantage of price movements to execute unlimited trades! Everest Gold is truly the most affordable and accessible platform for retail investors to start investing in gold today.

Read: How To Maximise Your Returns Investing In Gold With Everest Gold

Investment safety

Even more reassuring is the fact that Everest Gold recognises that being able to invest in a safe and secure portfolio is often the utmost important criteria in the minds of investors. Therefore, it has made investment safety and security its top priorities. To ensure that its customers have peace of mind while trading gold, it has entered into a tripartite supervision agrrangement with Pacific Trustees Singapore and Malca-Amit. This ensures that no party can unilaterally exercise its rights over the gold. Here is how each party plays a part in ensuring investment safety for clients trading on Everest Gold’s platform.

Third Party Custodian

Pacific Trustees Singapore is appointed as the gold custodian in the Everest Gold and the appointment. After users purchased gold on the platform, the ownership of the gold is transferred to PTS. Investors can rest assured that Everest Gold has no authority over gold assets.

With over 25 years in business under the Pacific Trustees Group International, Pacific Trustees (Singapore) Ltd (“PTS”) has over 4 years of experience in the corporate and individual trust. PTS provides a comprehensive end to end clearing and Trustees services for global and domestic equities and fixed income securities. As a fully licensed Trust Company by Monetary Authority of Singapore, PTS has full capabilities to provide for full range of trust and other related services thereto for major domestic corporates and regional corporates and financial institutions.

Third Party Storage

Malca-Amit, an international vault chain established since 1963, provides storage of luxury goods for high net worth individuals and internationals banks. Its global team of experts have vast experience over logistics, security, customs house and special operations. Malca-Amit has over 70 offices in 40 countries worldwide and uses highly secured and strategically located facilities.

Gold purchased by customers on Everest Gold’s platform is fully insured and stored securely in Malca-Amit’s state of the art facility located in the Singapore Freeport.

Regular Audits by Professional Company

Everest Gold has appointed a professional firm, Crowe Horwath First Trust LLP (“Crowe Singapore”) to perform independent verification of its gold supply, gold reserves and gold collection, on a quarterly basis, in accordance with Singapore Standard on Related Services. This is to ensure amount of digital gold issued on the platform is equivalent to amount of physical gold stored in the vault.

Crowe Singapore is part of an international professional services network, Crowe Global. Ranked as the eighth largest global accounting network, Crowe Global consists of more than 200 independent accounting and advisory services firms in close to 130 countries around the world.

The tripartite supervision arrangement between Malca-Amit, Pacific Trustrees Singapore and Everest Gold will allow retail investors to trade safely and securely while building up their dream gold portfolio. Investing in gold has never been safer.

Everest Gold is available for download on Android, iOS and desktop.

For more information, visit https://everestgold.sg

In line with this year’s National Day celebrations, Everest Gold will be giving 400,000 reward points (worth 55 SGD) for every new-sign up upon successful account verification. Reward points can be converted to gold during Gold Subscription Events. Enter referral code “WAVTW” when you register your Everest Gold account. Promotion valid from 8 to 31 Aug.