Navigating personal finance can feel like navigating a maze, especially for Singaporean millennials facing unique financial challenges.

From student loan debts to saving for a home in one of the world’s priciest property markets, the journey can seem daunting. But fear not, with the right mindset and strategies, financial security and success are within reach.

EMBRACE BUDGETING

Budgeting is the cornerstone of personal finance. It empowers you to track expenses, prioritize spending, and work towards financial goals. Start by understanding Singapore’s cost of living and allocate your income accordingly.

Track expenses diligently; even that artisan morning coffee can add up. Utilize budgeting apps and tools to streamline the process and stay accountable. Take advantage of credit card perks responsibly to avoid debt accumulation.

MANAGE LOANS

For eligible Singaporeans, Tuition Fee Loan and Study Loan are available options. To assist those grappling with student loan debts, explore repayment options and loan consolidation programs.

Craft a repayment plan that aligns with your budget and lifestyle. Consider making extra payments whenever possible to expedite debt payoff. Remember, managing student loans is a marathon, not a sprint. Stay disciplined and patient.

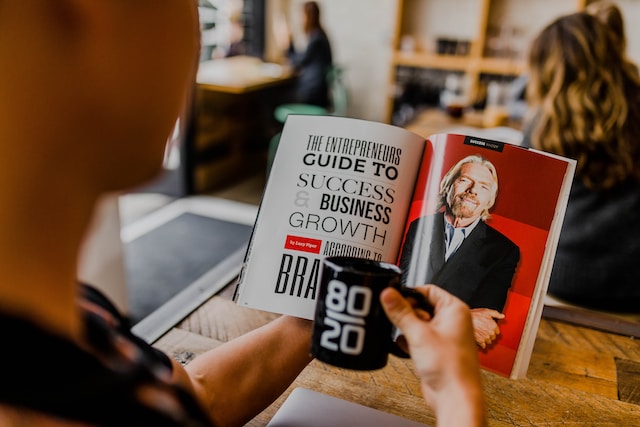

TAKE ADVISE WISELY

Image Credits: unsplash.com

According to research, nearly a quarter of Millennials (22%) have turned to family and friends for financial advice. While seeking financial advice from friends and family is natural, be discerning. Advice from unqualified sources could lead to costly mistakes. Listen to advice, but ensure your financial decisions align with your long-term objectives and risk tolerance. Better yet, seek professional advise.

SAVE FOR YOUR HOME

Owning a home is a common goal for Singaporean millennials. Start by setting realistic savings targets and explore government housing schemes like the Central Provident Fund (CPF) Housing Grant or HDB Loan Eligibility (HLE) letter.

Consider alternative housing options like Built-To-Order (BTO) flats or resale flats in non-mature estates to maximize affordability. Boost your home-buying fund by exploring side hustles or investments.

PLAN FOR RETIREMENT

Though retirement may seem distant, it’s never too early to plan. Take advantage of employer-sponsored retirement schemes such as CPF Special Account (SA) or Supplementary Retirement Scheme (SRS).

Consider diversifying investments across asset classes to minimize risk and maximize returns. Automate contributions and regularly review your retirement plan to ensure alignment with your goals.

IN A NUTSHELL

Image Credits: unsplash.com

Navigating personal finance can be challenging, especially for Singaporean millennials. But by adopting proactive strategies like budgeting, loan management, home saving, and retirement planning, financial stability and success are attainable.

With determination and discipline, pave your way to a secure financial future.