Freelancers, rejoice! Great Eastern has rolled out an insurance just for you. Coined as the ‘GREAT Comprehensive Care‘, it allows you to enjoy the healthcare support you need for lower than a dollar a day. Now, you can continue the flexibility you’ve always fancied without worrying about coverage.

The insurance is a policy in partnership with Doctor Anywhere. Doctor Anywhere is one of the telemedicine providers we’ve previously covered in one of our articles. Carry on reading if you’re keen to know more about the key benefits and more information about the insurance plan.

#1: KEY BENEFITS

There are three main benefits of the GREAT Comprehensive Care insurance. They are convenient outpatient care, personal accident coverage, and daily hospital cash.

Convenient outpatient care

This refers to the online video consultations with a doctor. You can benefit from up to 12 consultations via Doctor Anywhere. Say goodbye to physical queues and hello to convenience from the comfort of home, wherever that might be.

Personal accident coverage

Get the protection you need against death and Total and Permanent Disability (TPD) in the case of an accident. First up, for deaths and TPD due to an accident, you will get 100% of the sum assured as stated in your Certificate of Insurance. Next, for deaths in Singapore due to COVID-19, you will be assured 10,000 SGD.

Daily hospital cash

In short, you will receive a daily hospital allowance if required to stay in a hospital in Singapore. This only applies if you’re warded for at least 12 hours with the reason being an illness or accident that has happened within 36 hours. There’s also additional daily cash allowance if you’re admitted to the Intensive Care Unit (ICU).

Exclusions may apply.

#2: BASIC AND DELUXE PLANS

There are two plans to choose from – basic and deluxe. The key difference is in the maximum payout amount should you submit a claim. Thus, do expect to pay a different price under each plan.

Price

The basic plan starts from $264 per year while the deluxe plan from $446 per year.

Outpatient care

The basic plan allows up to six video consultations. The deluxe plan at twice the amount, at 12 video consultations. This benefit is transferable to your friends and family members. You can do so via the UPGREAT mobile app.

Hospital and surgical benefits

Under the basic plan, you will obtain a daily hospital cash amount of 100 SGD. In addition to that, if warded in the ICU, you will receive another 100 SGD per day. While for the deluxe plan, both amounts are at 150 SGD respectively.

Personal accident benefits

For deaths and TPD due to an accident under the basic plan, you will get a lump sum payout of 100,000 SGD. As for the deluxe plan, you will secure 150,000 SGD instead. Both plans provide a payout of 10,000 SGD if the death is caused by COVID-19.

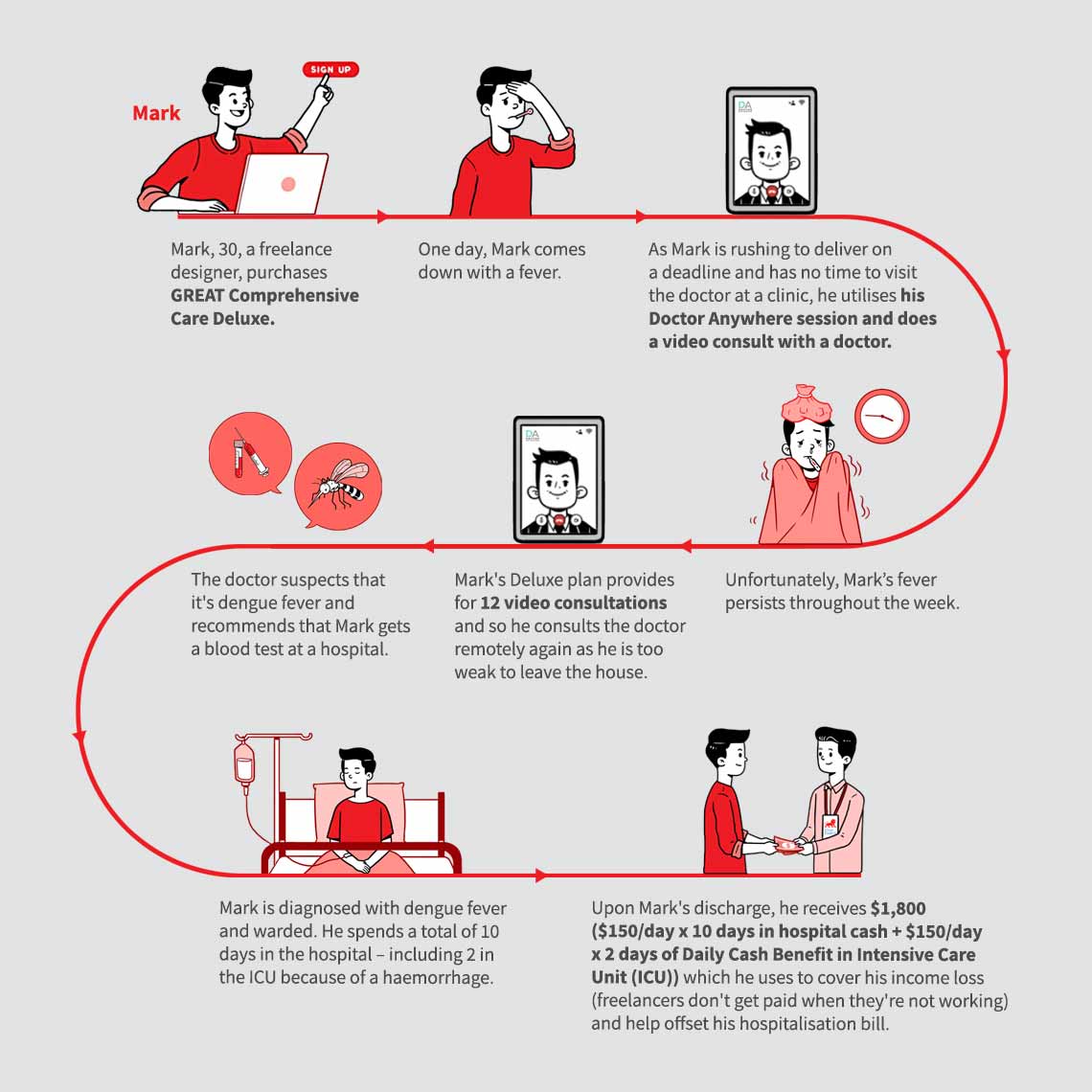

#3: SCENARIO

Great Eastern has done a great job with this infographic. Take a look at the scenario created to have a better idea of how the GREAT Comprehensive Care insurance works.

Image Credits: greateasternlife.com

Check out the FAQs here. If you have more questions, contact their customer service via 6248 2112. You may also email them at [email protected].