Are you looking for a new insurance savings plan that allows you to Protect, Earn, and Transact (PET)? Then you might be interested in a project called Dash PET. If you’ve read the title and clicked in, you would have known that this policy is not for your pet.

The insurance savings plan is part of a product offered by Etiqa Insurance in collaboration with Singtel Dash. Etiqa Insurance is a licensed life and general insurance company registered in Singapore. They want you to think of Dash PET as the PET that takes care of you.

“We saw a gap we could fill amid the uncertain climate to help our customers grow their money smarter and faster. Using insights gleaned from the success of Dash EasyEarn, our first insurance savings plan, Dash PET is a new product with greater flexibility and a lower entry point,” Singtel’s International Group CEO Arthur Lang said.

To that, Etiqa Insurance Singapore’s CEO Raymond Ong added that they had designed Dash PET to be an innovative all-in-one insurance plan with a savings component and on-demand protection for the end consumer.

Peeps searching for an insurance savings plan where they can take full control of their finances, look no further! We will guide you through what Dash PET can offer you.

What Is Dash PET?

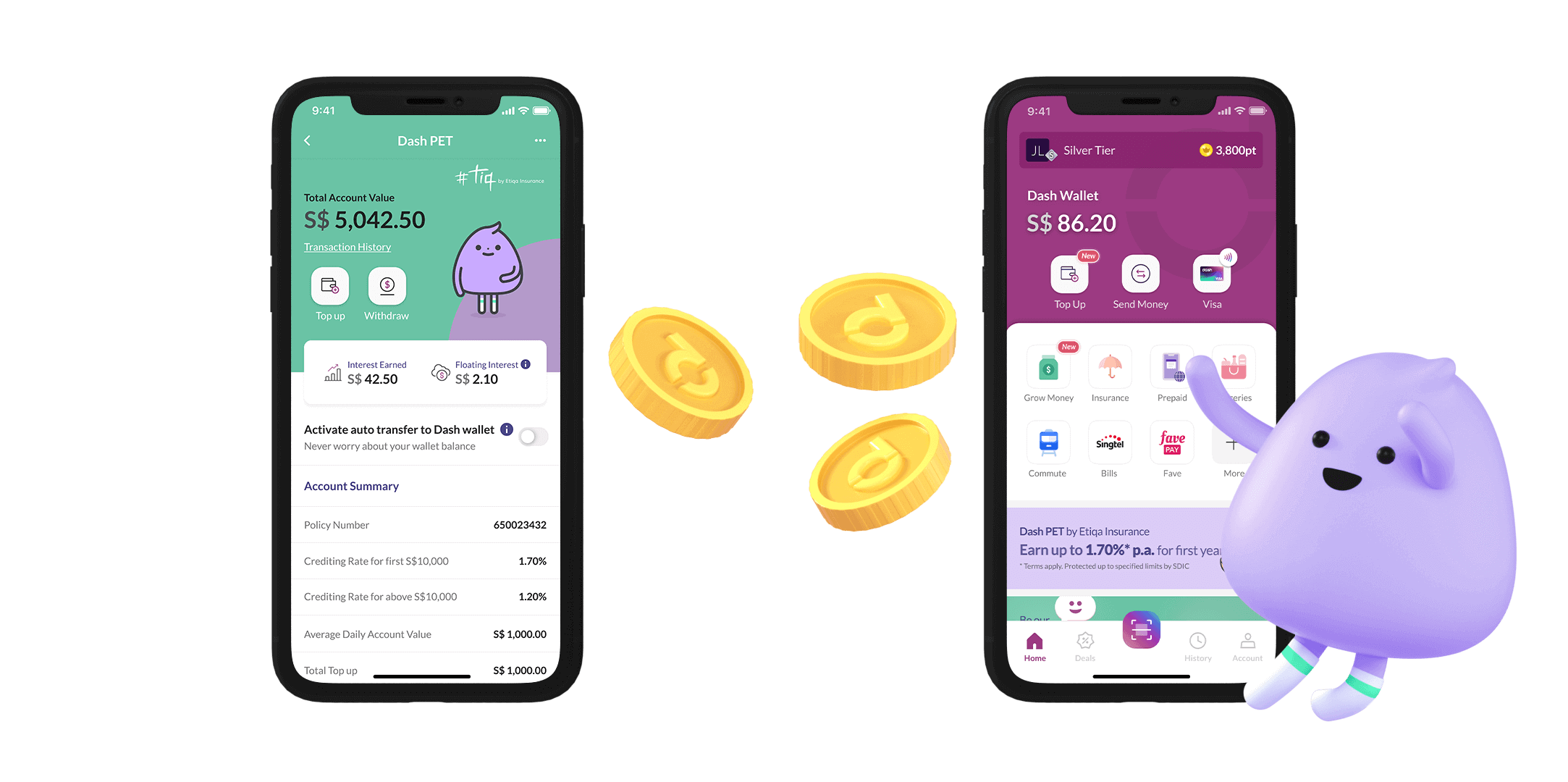

Dash PET is as cute and as useful as it sounds. It helps you maximise your money with savings at high returns, gives you guaranteed capital, and full flexibility of funds. As you invest more money into your savings account, your Dash PET will grow and provide a desirable incentive in the long run.

A comprehensive insurance plan focused on achieving simplicity for you; there are no unnoticed loopholes that could cause you problems later. Keep reading to find out the gains of Dash PET.

How can I benefit from it?

Dash PET has an eclectic range of benefits that are solely focused on bettering your financial health. It also provides you with the support you may need through the pandemic. Worry not about a thing if you face challenging times.

Here’s a breakdown of the main benefits:

- High returns: It allows you to earn up to 1.7% interest every year* on your savings. As such, Dash PET makes a great plan to have as you continue to accrue your savings.

- Easy starting requirements: Whether you start with S$50 or S$10,000, Dash PET allows you to begin small and build your savings up to S$30,000.

- Flexibility: The fear of a lock-in period should not stop you. With Dash PET, there is no lock-in period. This means you can withdraw and top up funds anytime you like without the threat of a penalty.

*First S$10,000: 1.7% p.a. for the first year. Above S$10,000: 1.2% p.a. for the first year.

Is it still not enough to sway you towards the multitude of benefits Dash PET can provide you? Maybe the fact that the policy is administered by the Singapore Deposit Insurance Corporation (SDIC) might give you peace of mind.

Everything else is automatic upon sign-up, so you’re covered without having to take any further action (except for the management of your account).

How do I sign up?

Are you a Singtel Dash user?

Great! If you’re aged between 17 and 75 and have a valid Singapore NRIC or residency/work pass, then you are easily eligible to sign up for Dash PET. You can also check against the eligibility rules set by Etiqa Insurance.

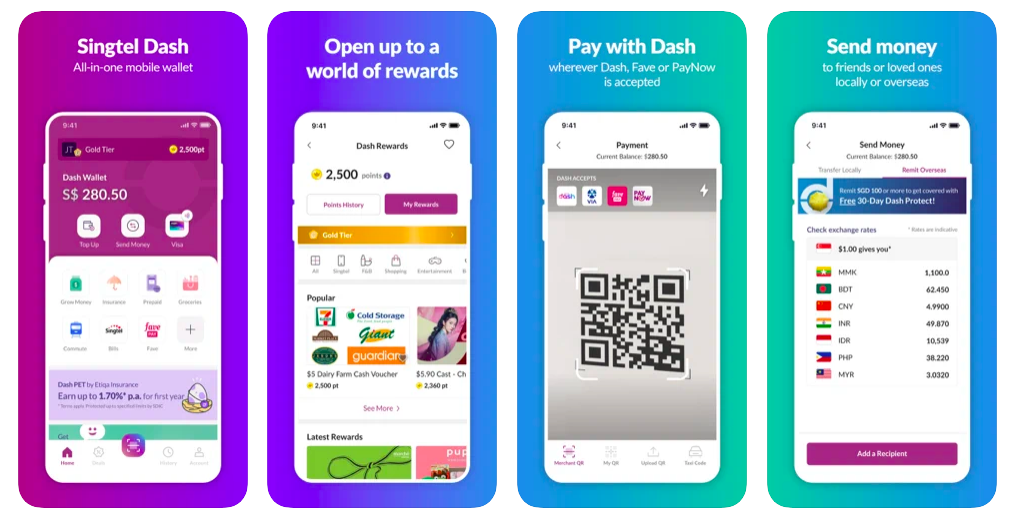

Download the Singtel Dash app right now or click here to kickstart your savings journey today!