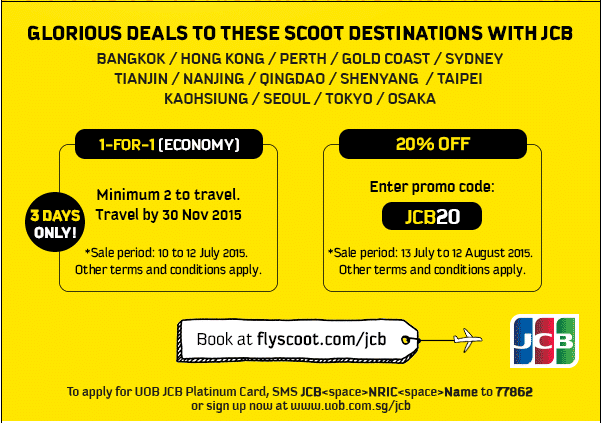

JCB has collaborated with Scoot to offer its loyal customers some perks.

From 10 to 12 July 2015, JCB’s Credit Card Members enjoy 1 for 1 fares on Scoot’s Economy Class.

Fly to the following destinations with your partner for the price of one: Bangkok, Hong Kong, Perth, Gold Coast, Sydney, Tianjin, Nanjing, Qingdao, Shenyang, Taipei, Kaohsiung, Seoul, Tokyo and Osaka.

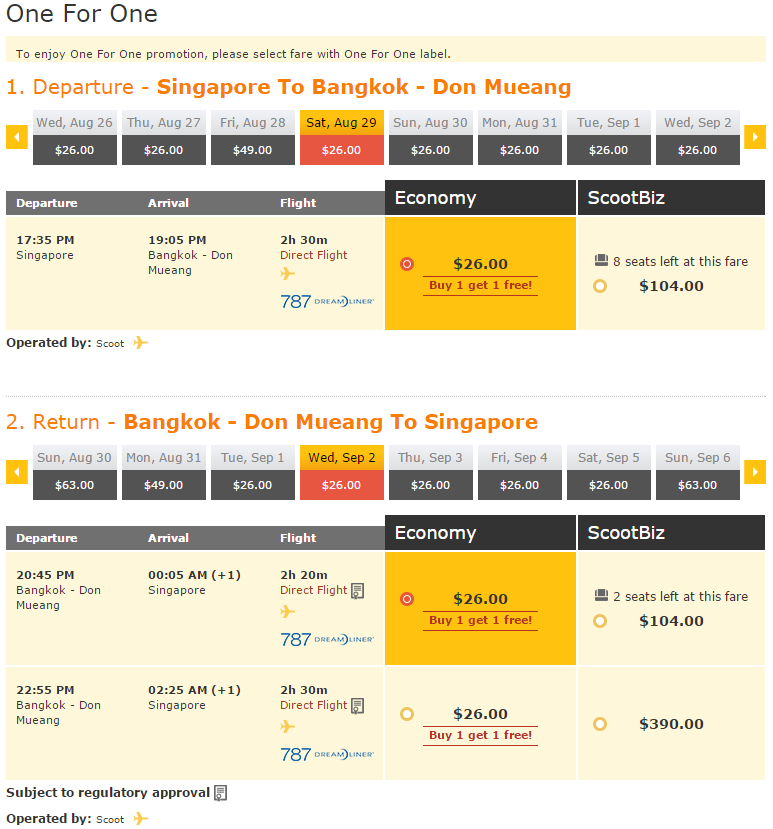

More details below:

Even the return flights are going at 1-for-1 offer!

Book your tickets at www.flyscoot.com/jcb

Miss their flash sale? You will still get to enjoy 20% off Scoot airfares from 13 July to 12 August 2015. All you need to do is to key in the promo code “JCB20” to enjoy the offer!

Not a JCB Cardmember yet? Apply now at uob.com.sg/jcb today or share this post with someone you know that owns a JCB-UOB Card!

Sale Period: 10-12 Jul 2015

Travel Period: By 30 Nov 2015

Terms and Conditions

*Offer is valid for a minimum of 2 adult passengers, for Economy class bookings made at www.flyscoot.com/jcb only. Taxes and surcharges apply, and are subject to change due to currency fluctuations. Economy fares exclude checked baggage, meals and inflight entertainment. Full payment is required at the point of booking, and must be made with JCB cards. Payment processing fees per guest segment are not included. Full list of fees are available at www.flyscoot.com. Offer is subject to availability and confirmation. Seats are limited and may not be available on all flights or all dates. Bookings are not refundable except as provided in the Conditions of Carriage. All the terms and conditions are available at www.flyscoot.com.