To most people, early retirement would probably be at the age of 55. That’s when you bid goodbye to your tie, suit and briefcase and donned your polo tee and go golfing. You will travel around the world not once in a year but once every few months. That’s the dream retirement for many. Let’s take Tom, a 24 years old who has just graduated from his university. He found a job that pays him an average of $3,600 a month. He is a saver and his monthly expenses adds up to $400 a month. After CPF deduction, that would leave him with around $2,500 a month. Now Tom cracks his head and wonders what would be the best possible way to grow this $2,500 a month.

1. List down and prioritise his financial goals

Listing down his goals give him a clearer picture of what he need to achieve and how to plan for his finances. Tom has goals ranging from short to long term which he wants to achieve.

Short Term (1-5years)

1. Getting married

2. Buying a house

Mid Term (5-15years)

1. Saving for children’s expenses

2. Purchasing a family car

Long Term (>15 years)

1. Children tertiary education

2. Retirement

3. Health expenses

2. Starts budgeting

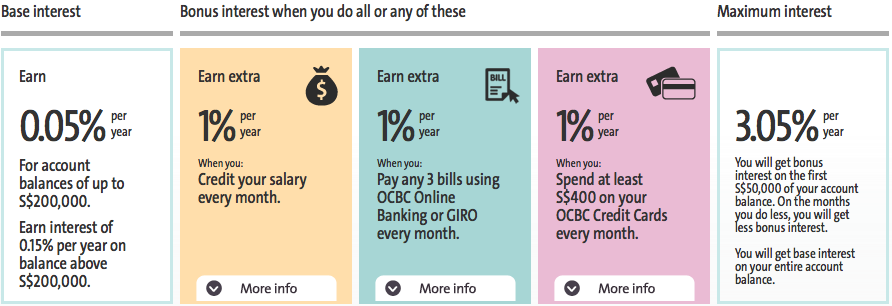

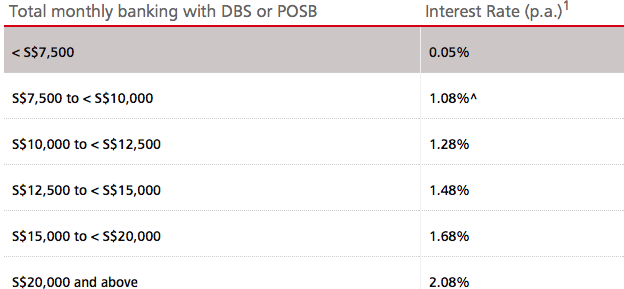

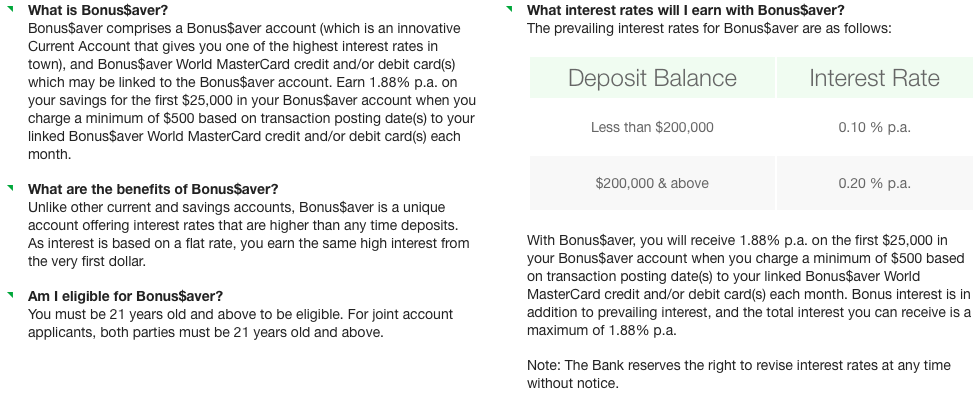

Short term goals come first and that is something that he needs to set away without taking too much risk. Let’s make the assumption that he will need to accumulate $40,000 in 5 years time to meet his short term goals. He needs to stash away $8,000 a year, not in a bank, but in higher yield assets such as the SGS government bonds or T-bills.

3. Make plans to invest the extra dollars

Many people are risk-adverse and when the word ‘investment’ is mentioned. They shun it because the older generation told them that putting away your money in the bank is the safest and best option. Wait. Best? If you want work to a 9-5 job all the way to 65, then by all means. Otherwise, make your money work harder. A general rule of thumb of investing is do a ‘110 minus your age’ stock-bond portfolio . That is to say Tom should allocate his remaining money into a 86% stocks and 14% bond portfolio. READ ALSO: How to invest in STI ETF? We can’t foresee Tom’s future whether he will be able to rise up in ranks to take home a bigger paycheck, win a lottery or whether the stocks market will go smoothly. So we have to make some assumption of all other things being equal, a 8% growth of $2,500 a month. When he turns 40 and assuming the stock market has not crashed, he would be sitting on a portfolio of close to a million dollar. He could also explore other ways such as investing in dividend yielding stocks or property to generate a passive income.

4. Re-visit his plan and make changes accordingly

As his life stages change, his income and expenses changes and he will need to revisit his strategy to see if it is in line with his retirement goal. The more Tom reduces his expenses, the earlier his retirement would be. Furthermore, as he grows older, he will need to adjust his holding in different assets to minimise the risk exposure.

5. Throwing in the towel and retire

Once Tom has reached his goal, it’s time to consolidate all his assets and starts to calculate if the money and asset he worked all his life for would be able to last him a lifetime. Most financial planners would say you can draw down at 4% – but wait, what if you live longer than expected? Mortality rate in Singapore has been increasing and with better healthcare, your money might run out while you are still around to witness the birth of your great-grandchildren. Aim for the ideal withdrawal rate that doesn’t touch the principal and you will be able to live off with passive income supplement by your CPF and other annuities. Some of you might think that to die with too much money left might be foolish but why not leave a legacy to your loved ones or people whom you care about?