Get ready for some amazing sign-up offers with SingSaver! Just apply for these selected Standard Chartered credit cards by February 29, 2024, and you could be enjoying awesome gifts like the Apple iPad 9th Gen, AirPods Pro Gen 2 + Magsafe Bundle (worth S$425.20), AirTag 4 Pack (worth S$150.35) & more.

And the best part? There’s no cap on the number of people who can grab these deals. As long as you fit the bill, you’re in for a treat. Since its launch in 2015, SingSaver has been making financial decisions easier with a wide range of options to choose from. For those who are unfamiliar with SingSaver, you can check out their reviews on Google:

Choose from the credit cards below:

Standard Chartered Simply Cash Credit Card

Elevate your financial journey with the Standard Chartered Simply Cash Credit Card, a gateway to a world of exciting possibilities and unbeatable rewards. Imagine earning a generous 1.5% cashback on all your expenditures, transforming your everyday transactions into a treasure trove of savings. But the benefits don’t stop there – this card is designed to revolutionize the way you manage your finances. Whether it’s settling your IRAS dues, investing in education, securing insurance coverage, or managing rental payments, the Simply Cash Credit Card showers you with not just cashback, but also reward points and even bonus interest.

First 5 applicants: From 20 – 29 Feb, daily at [12pm] and [3pm], get an additional FREE Sony PlayStation® 5 Disc Console (worth S$799) or a S$500 eCapitaVoucher on top of the Welcome gift below. Click here for more details.

Welcome gift: Receive a Dyson SuperSonic (worth S$699) or Dyson AM07 + S$50 eCapita Voucher Bundle (worth S$509) or Apple iPad 9th Gen 10.2 Wifi 64GB (worth S$508.30) or S$330 cash and get up to S$40 e-capitaland voucher

Requirements: Activate the physical card and make minimum spend of S$500 within 30 days of card approval to be eligible for rewards.

Standard Chartered Smart Credit Card

The Standard Chartered Smart Credit Card allows you to earn 6% cashback in the form of reward points on selected merchants with no min. spend required. You can also enjoy S$0 fees on annual fee and cash withdrawal with 3-month interest-free instalments with 100% cashback on service fees. Now that is the smarter way to spend and you can say goodbye to fees!

First 5 applicants: From 20 – 29 Feb, daily at [12pm] and [3pm], get an additional FREE Sony PlayStation® 5 Disc Console (worth S$799) or a S$500 eCapitaVoucher on top of the Welcome gift below. Click here for more details.

Welcome gift: Receive a Dyson AM07 (worth S$459) or Apple AirPods Pro 2nd Generation (worth $365.70) or Apple Watch SE (2022) (worth S$382.50) or S$300 and get up to S$40 e-capitaland voucher

Requirements: Activate the physical card and make a minimum spend of S$250 within 30 days of card approval to be eligible for rewards.

Standard Chartered Rewards+ Credit Card

Up your rewards game with the Standard Chartered Rewards+ Credit Card, your passport to exceptional benefits. Earn up to 10x rewards points on foreign currency for overseas retail, dining, and travel adventures, and enjoy up to 5x rewards points on dining transactions in SGD, adding a new dimension to your dining experiences. Plus, the perks kick in from the get-go with S$200 cashback upon spending S$388 within 30 days of card approval, setting the stage for a rewarding journey. Terms and conditions apply, so seize the opportunity to unlock a world of enhanced rewards and privileges.

First 5 applicants: From 20 – 29 Feb, daily at [12pm] and [3pm], get an additional FREE Sony PlayStation® 5 Disc Console (worth S$799) or a S$500 eCapitaVoucher on top of the Welcome gift below. Click here for more details.

Welcome gift: Receive a Dyson AM07 (worth S$459) or Apple AirPods Pro 2nd Generation (worth $365.70) or Apple Watch SE (2022) (worth S$382.50) or S$300 and get up to S$40 e-capitaland voucher

Requirements: Activate the physical card and make a min. spend of S$250 within 30 days of card approval to be eligible for rewards.

Standard Chartered Journey Credit Card

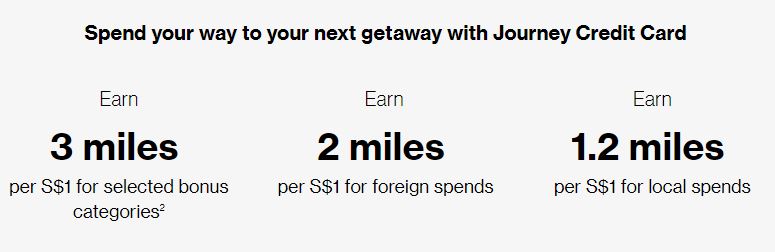

Experience the extraordinary with the Standard Chartered Journey Credit Card, where every purchase becomes a gateway to your dream vacation. Earn 3 miles per S$1 for selected bonus categories, 2 miles per S$1 for overseas spending, and 1.2 miles per S$1 for local expenses, accelerating your rewards like never before. Revel in exclusive travel benefits, from 3 miles per $1 on online transactions to non-expiring rewards points that kick in from your very first dollar spent. Indulge in 2 complimentary Priority Pass lounge visits annually and travel with peace of mind through up to S$500,000 in coverage. Embrace a world of travel and rewards beyond the ordinary – your journey starts here.

First 5 applicants: From 20 – 29 Feb, daily at [12pm] and [3pm], get an additional FREE Sony PlayStation® 5 Disc Console (worth S$799) or a S$500 eCapitaVoucher on top of the Welcome gift below. Click here for more details.

Welcome gift: Receive 1x Laifen Swift High Speed Hair Dryer (worth S$239) or 1x Apple AirTag 4-Pack (worth S$150.35) or up to S$120, plus S$40 eCapitaVoucher

Requirements: Activate the physical card to be eligible for rewards.

How to redeem your rewards:

- Search for any of the cards that matches your spending habits

- Click on Apply Now and Enter your email address on the new page (SingSaver will be sending the redemption instructions here. Check SPAM folder if you don’t receive any emails)

- Click Start Application / Apply with Myinfo

- Complete the application form from the bank and remember to take a screenshot upon completion so you can take note of the application reference number (ARN). Here’s where to find it.

- Submit your Rewards Redemption Form with your Application Reference Number and Choose your preferred rewards and submit the form.

- Important: If you did not received the Rewards Redemption Form, please check your SPAM folder in your email OR drop and email to [email protected] with your application details.

- Once you fulfill all the requirements (i.e. meeting the $250 mininum spend in 30 days from card approval), please allow some time for SingSaver and the bank to validate. Click here to understand more about the process.

You can click here to check the rewards redemption status.

For redemption follow-ups and enquiries, drop an email with your details to [email protected]

This promotion is not affiliated, associated, authorized, endorsed by, or in any way officially connected with Apple or any of its subsidiaries or its affiliates. The names Apple as well as related names are registered trademarks of their respective owners.

READ ALSO: Get an Apple iPad (worth $508.30), Dyson Supersonic (worth S$699) & more when you apply for Citi Credit Cards from 8 – 15 Feb 2024