The size of all transactions within the foreign exchange market is substantially higher than stocks at around $5 trillion a day versus $200 billion a day. Investors or traders looking to take advantage of superior liquidity in a market open 24 hours are faced with an easy decision.

Importance Of Research

Given the sheer size of the global forex market, many brokerage firms across the world compete for your business. Many firms will offer rebates or promotions which gives the impression it is the best deal to be found.

However, some firms simply add on higher fees elsewhere making it an overall more expensive choice. It is very important for would-be customers to take their time and compare forex brokers with a focus on the different organizational structures and services each unique company offers.

Here is an overview of five tips to consider as part of the process of comparing forex brokers.

- Safety

You work hard to earn your money and plan on investing or trading it diligently. Naturally, you need to make sure whoever you hand your money over to will keep it safe.

The good thing is multiple government agencies have done the homework for you. They are tasked with separating reputable and secure firms from those who won’t keep your money safe.

For example, the Monetary Authority of Singapore, commonly known as MAS, establishes rules and regulations for all entities in the country to follow. The MAS is responsible for licensing each Forex trading company to protect clients by offering a safe and secure investment environment.

- Cost Of Doing Business

Every time an investor or trader enters into a forex transaction they will be charged a fee or transaction cost. While low transaction cost is important to everyone, some forex brokers will offer cheap transaction costs but with hidden fees elsewhere.

Everyone should evaluate all associated costs and compare it with their individual trading needs. Some traders could enter into dozens of transactions each day while an investor would oversee at most five transactions a month.

The cheapest per transaction cost could end up the most expensive option for some!

- Sending And Receiving Money

Perhaps one of the scariest parts of opening a forex brokerage account involves wiring a deposit and requesting a withdrawal.

A reputable broker will make sure the initial wiring deposit is as smooth as possible with clear directions posted for everyone to see. Similarly, a broker should have a “no questions asked” policy about withdrawals.

It is your money and no forex broker should ask why you want some or all of it back.

Also important to consider is if a foreign exchange broker will add leverage to your deposit. This may be vital to experienced individuals but something novice investors and traders should avoid given its high level of risk.

- The Platform

A forex trading platform needs to be fast, steady, stable, and free of any hiccups. The forex market moves fast and a trading platform needs to keep up with the speed of the exchange.

When selecting a forex trading platform, always look to see what options are included. Some platforms may offer a news feed while others would supply it for an extra fee. Make sure to find a platform which offers exactly what you want to avoid paying for something you don’t need.

If you can’t find some of the information you need, be sure to inquire with the forex broker.

Contacting a support team will also satisfy another component of testing a brokerage firm’s customer service. If a firm won’t take the proper time to answer your questions about a trading platform, chances are more likely they won’t take proper care of you when you are a paying client.

- Speed Of Transaction

Perhaps more important than evaluating a forex trading platform is the actual speed of a transaction. The fastest and most high-tech trading platform is useless if a trade can’t be completed faster than a blink of an eye.

For example, if the EUR/USD pair is trading at 1.24500, you should be able to enter into or out of a transaction at that price or within micro-pips.

If your forex broker takes too long to complete a trade or it finalizes at a transaction that isn’t within micro-pips, it may be a sign to look elsewhere.

Using Comparison Websites

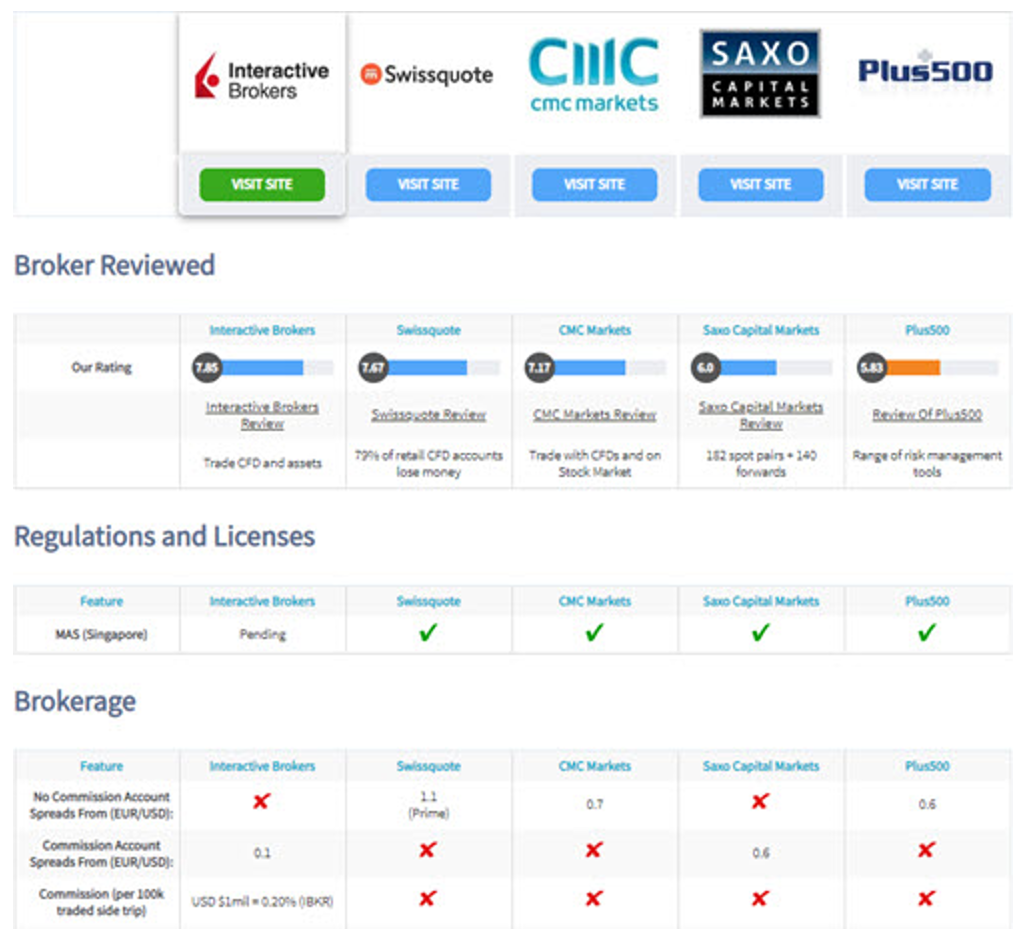

There are multiple comparison sites within the forex space but many recommend forex brokers that are not MAS regulated. Justin Grossbard from Compare Forex Brokers explained that it’s important to make sure that any comparison table factors in regulation, reputation, brokerage and forex trading platform. This should be customized for the forex traders location such as Singapore.

Conclusion

The process of choosing and selecting a foreign exchange broker is daunting and presents its set of challenges. The good thing is once a trader or investor finds a broker which works best for their individual needs, the process won’t need to be done again and you can focus on the markets.

As is often the case, the best method of conducting due diligence is to ask around. Find a reputable internet forum or group and chances are likely that it will be full of friendly people looking to offer a lending hand.