The Ministry of Finance has announced in a press release that 1.6million Singaporeans will receive a letter in the first week of July with details about the 2015 GST Voucher Benefits (GSTV), as well as information on other Budget benefits such as Service and Conservancy Charges (S&CC) rebates, U-Save and Medisave Top-ups.

If you are eligible, you will receive the payout in the month of August.

To find out how much you are eligible for, you can log on to https://www.gstvoucher.gov.sg with your SingPass. *Make sure you check your payment mode is correct.

1. Cash Payouts

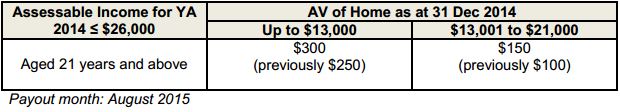

a. GST Vouchers – Cash payout (Age: 21 and above)

This applies to most Singaporeans if you have an assessable income (YA 2014) of less than or equal to $26,000 with Annual Value of Home less than $21,000.

More info on Assessable Income and Annual Value: http://bit.ly/1LFbylE

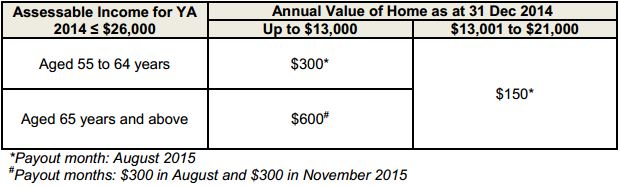

b. GST Vouchers – Additional Cash Payouts as Seniors’ Bonus (Age: 55 and above)

In addition, those aged 55 and above can receive payouts of up to $600 to help with their daily expenses. (Note: This means up to $900 in cash per person when you include the previous payout in 1a.)

2. Medisave Payouts

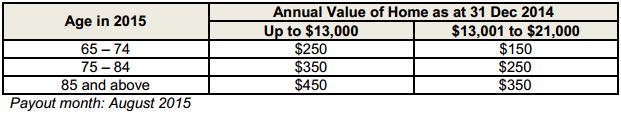

a. GST Vouchers – Medisave Top-up (Age: 65 and above)

Those aged 65 and above can receive GSTV – Medisave top-up of up to $450.

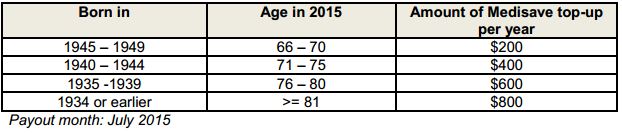

b. Pioneer Generation Medisave Top-up (Age 66 and above)

In addition, those that belong to the Pioneer Generation can receive top-up that ranges from $200 to $800 annually. (i.e a 76yo retiree Pioneer that lives in a HDB flat and do not own a second property will receive $600 + $350 (from 2a.))

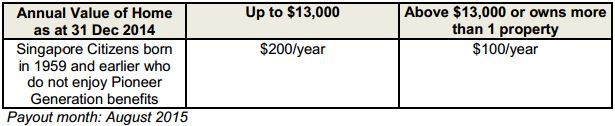

c. 5-year Medisave Top-up (Age: 56 and above who do not enjoy PG benefits)

Singaporeans born on or before 31 Dec 1959 (i.e. aged 56 years and above in 2015), who do not enjoy Pioneer Generation benefits, will receive Medisave top-ups of $100 or $200 annually from 2014 to 2018, as announced in Budget 2014. This will benefit about 528,000 Singaporeans. The vast majority (i.e. those living in HDB flats who do not own more than one property) will get the higher top-up of $200 a year.

3. Other Budget Benefits

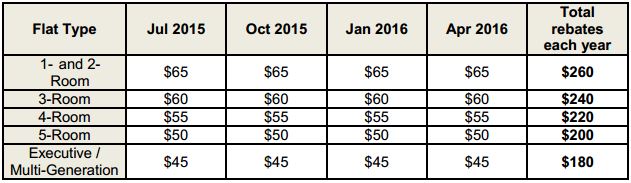

a. GSTV – U-Save

The regular GST Voucher – U-Save is given out quarterly to help offset utilities directly, and costs $180 million annually. This July, over 800,000 eligible households will each receive up to $65, depending on their HDB flat type.

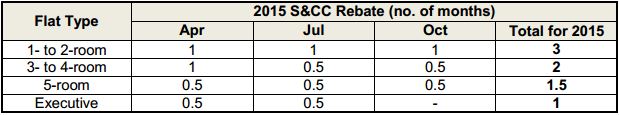

b. S&CC Rebates

The S&CC rebate is given out in April, July, and October this year, and costs $80 million in 2015. This July, around 800,000 eligible households will receive the S&CC rebate which will offset half a month to one month of charges, depending on their HDB flat type.

Additional Information

Most Singaporeans will automatically receive their GSTV payouts and 5-Year Medisave top-ups. For the small number of citizens who have not signed up for past Government payouts and/or are not CPF members, the letters they receive will inform them of the actions they need to take by 31 December 2015 to receive their benefits.

More details on the GST Voucher can be found at www.gstvoucher.gov.sg, and information on the other Budget benefits can be found at www.singaporebudget.gov.sg. If you require more information, the contact details are as follows:

Source: Ministry of Finance