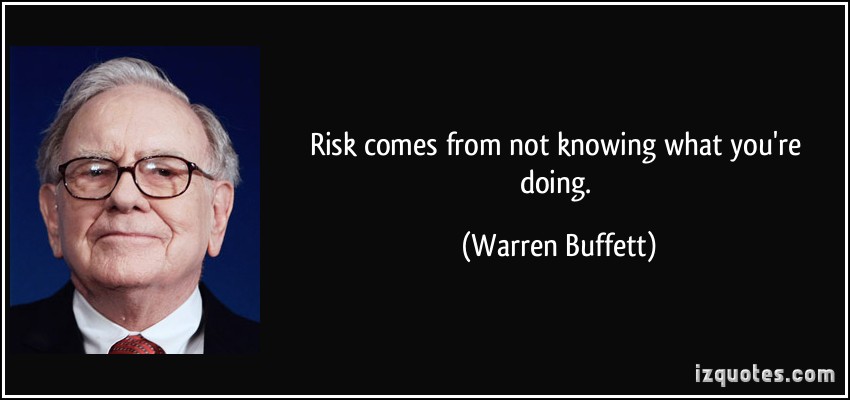

No, this is not some sort of elaborate psychological test or a thought exercise. It a genuine question, do you know why known risk is the best type of risk?

Well, let’s use a hypothetical scenario: you are sitting on a park bench on a cool spring day, what would be more dangerous – a brick falling from an adjacent building that you are completely unaware of or a brick headed in your direction, that you have seen with enough time to avoid.

A risk that is known, is preferable than a risk that is unknown – very simply…because you can avoid risk you know about. This is the genius behind easyMarkets latest product – easyTrade – but it’s not the only feature this innovative and surprisingly smart way to trade offers.

Known Risk, Fewer Problems

Because of the underlying financial product easyTrade is based on – vanilla options – it also allows clients to trade without margin requirements. Margin, if you are unfamiliar is the minimum amount in a trader’s account necessary to trade with leverage – if the account goes below that required amount, trades start closing until it is reached again. This could include profitable trades. Another problem “margin stop out” could create when trading is your position (trades) closing and then shortly after the price recovering.

Another benefit which is similar to the advantage no margin trading offers, stop out is also not needed due to the known maximum risk. Stop out is a risk management tool that allows you to set a level at which your trade will close if you are incurring losses. This carries the same danger as margin stop out though – a change in the price’s direction could potentially close your trade. This isn’t a problem if the rate (price) continues going against your trade, but it can be very damaging if the price recovers. Again, this is due to having known risk and no need for risk management tools you would use if your risk was unknown.

Quickly React

Many traders seek robust ways to trade, that give them immeasurable options and tools. Although these are undeniably robust, they can be a hinderance when you want to react quickly. If you are a trader you know that those slight few seconds are important to make or break a trade. If you aren’t a trader – then let me inform you – markets never sleep, they are in constant flux and a few minutes can make a significant difference to your profit or worse your loss.

Although easyTrade can be used in a sophisticated trading system – as hedging against other trades for example – it is also exceptionally engineered for simplicity. This simplicity can translate into speed when needed. In just four steps – choose what you would like to trade, set the maximum risk you are comfortable with, decide the trade time and then choose if the price will move up or down.

Innovation, Support, Experience

easyMarkets has been in business since 2001. It was one of the very first brokers to offer negative balance protection and free guaranteed stop loss (and still offers it today along with many more tools and conditions), to help customers better manage their risk. A long time has passed since then and easyMarkets has managed to remain relevant through its constant innovation and true dedication to its clients.

Its latest innovation easyTrade which offers no margin requirements, high leverage (in a way that is still regulator compliant) and known risk is yet another great and beneficial tool offered to easyMarkets clients.