And they are none other than DBS and UOB, the two big local bank names we’re aware of.

So news has it that new security measures will be implemented to protect customers from scams.

These measures include…

DBS’ anti-malware tool for Android

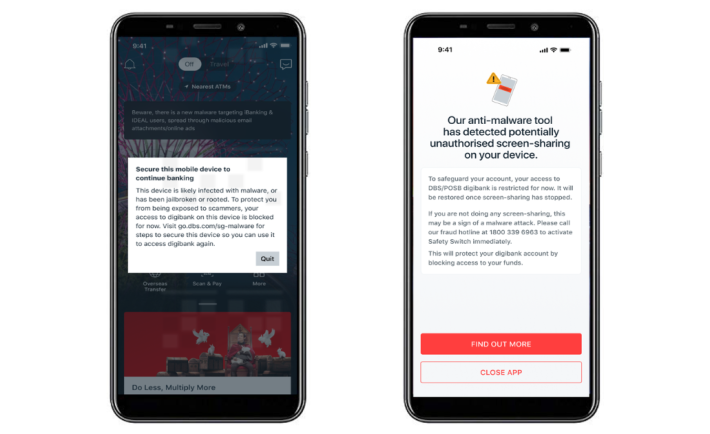

Following in the footsteps of OCBC and Citibank, DBS announced that they have developed an anti-malware tool for Android phones.

This tool aims to prevent scammers from illegally accessing customers’ accounts by limiting app access when potential risks such as malware or malicious applications on customers’ phones are detected.

Starting early this month, if sideloaded apps with accessibility permission enabled or ongoing screen-sharing or mirroring are detected on devices, access to DBS’ banking app will be restricted.

Customers will only be able to regain access once they have taken the necessary action to secure their phones.

I’ve received an email with official updates from DBS yesterday (30 September 2023) since I’m their customer:

Check your email if you don’t want to take my word for it.

UOB, too, rolls out anti-malware security features

Similarly, UOB will be introducing new anti-malware security features on its banking app gradually.

These updates will restrict access to the app if apps downloaded from third-party or unauthorized sites with risky permissions are detected.

An error message will be sent, indicating the name of the potentially risky app.

To continue using UOB’s digital services, you will need to uninstall or disable accessibility permissions for the mentioned app.

Similar to DBS, access to UOB’s banking app will be denied if screen-sharing on other apps or tools is detected on your phone.

This measure aims to prevent scammers from gaining control of your device and compromising banking information.

You can only resume using the app by disabling screen sharing.

What bank users think

If you don’t already know, OCBC was the first to implement these new security measures in September 2023, followed by Citibank.

While these measures are designed to counter the threat of malware scams, not everyone accepts them with a huge “thank you.”

Some OCBC customers have expressed concerns about privacy on the bank’s social media platforms.

But it’s rather uncalled for because the head of anti-fraud at OCBC group financial crime compliance noted that it’s a misconception that the bank can scan phones and view personal content.

In short, your information does not get to the bank. Your privacy is yours to keep.

DBS Singapore Country Head also acknowledged that these measures may cause some inconvenience for customers but emphasized their importance in ensuring secure digital transactions.

UOB also reassured customers that their new security features do not monitor phone activities or collect and store personal data.

The Monetary Authority of Singapore (MAS) says it supports local banks’ initiatives to increase the safety of online banking.

So while you may experience some additional inconvenience due to the recent security measures, they are necessary to maintain the security in digital banking.