According to the multi-ministry task force handling COVID-19, Singapore may enter Phase Three by the end of 2020 should the community cases remain low in the country. The restrictions reflected by this upcoming phase may last for a year or more. That being said, more and more people are working from home.

This huge shift in the global workplace has brought many changes in our lives. Whenever big transitions occur, it is a good opportunity to re-assess all the aspects of our lives including our finances. What has changed in your budget ever since you started working from home?

Reduced costs on transportation, work clothing, daily coffee stops, and dining out were usually observed in the previous months. In contrast, many experience a spike in utilities, groceries, and online shopping fees. How can you better prepare for your future with this new set-up?

#1: RE-EVALUATE WHERE YOUR MONEY IS GOING

Get a realistic view of your finances by pulling out your bank statements, credit card bills, and other month expenses from the past three months. If you are using a budgeting app such as Mint, you may track your spending using the information inside the app. Look for unnecessary categories or recurring expenses that you can do without. This will help you spend less than what you have originally planned.

Aside from your spending, concentrate on other parts of your personal finance such as investments and emergency funds. You have the luxury of time to re-evaluate how much you are saving in your emergency funds. Ensure that the money you put inside will be sufficient to cover unforeseen events such as unemployment. We must overcome complacency during these tough times.

#2: CONSIDER DIFFERENT BUDGETING STRATEGIES

As you establish your new budget to suit your work from home lifestyle, you may employ different strategies such as goal-specific budget and the 50/30/20 method. The former focuses on the goal and not the percentages. You may start with a specific short-term goal such as saving S$50 for your emergency fund this week or a long-term goal such as putting away S$5,000 for a vacation next year. Break down your goals and allot how much you need to save per week or per month. Ensure that you meet your other financial responsibilities as you prepare for your goals too.

The 50/30/20 method entails putting 50% of your take-home pay to your fixed expenses including groceries and rent. 30% needs to go to your variable expenses such as entertainment and clothing. While, 20% is dedicated to your savings. Choose a strategy that will best work for you.

#3: STORE EXTRA CASH IN YOUR HOME

Many of us are working from home because there has been a shift in the economy due to the unpleasant effects of the pandemic. It helps to be prepared as we live within the realms of uncertainty. Store extra cash in your home for emergency situations. You may label this as your emergency fund, which can cover your expenses for at least six to nine months.

Knowing that you will be alright for a considerable amount of time before needing to use other financial resources can help you sleep better at night. This will prevent you from incurring debts.

#4: MAXIMIZE YOUR TELECOM AND INTERNET PLANS

Because most of our time are spent at home, it comes as no surprise that our utilities are higher now. Do your best to ensure that you are getting the most out of your telecom and internet plans. If your plan has an inclusion of data, try to substitute a costly mobile call for calling over at WhatsApp or Telegram. Various online platforms offer free calling and video-conferencing services worldwide. Take advantage of that!

#5: CONSERVE ENERGY

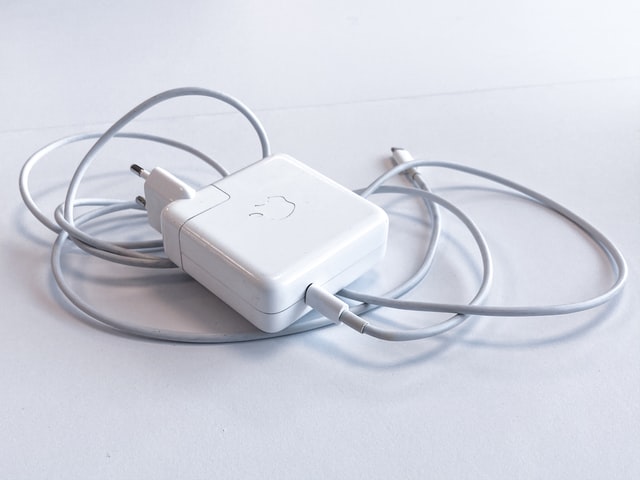

This new living and working arrangements have considerable effects on our electric bills. As much as possible, conserve energy on the devices and appliances that you work with. Unfavorable habits such as leaving your laptop constantly plugged in or forgetting to unplug your smartphone charger can cost you.

Image Sources: unsplash.com

One of the easiest ways to save energy is by ensuring that your cables or chargers are unplugged. Most devices work best with the 40-80 battery rule. You must plug the charger when your battery drops below 40% and disconnect the plug when the battery reaches 80%. Leaving a laptop or handphone constantly plugged in can cause extra wear and tear to the battery. Take care of the devices, which you use on a regular basis.