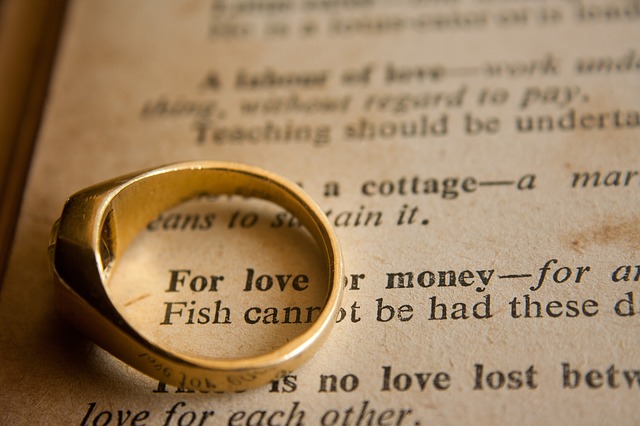

Financial matters are one of the top-cited reasons why conflicts in marriage occur. Although some couples do not like talking about money, it is still a key area to discuss with transparency and respect. Every relationship is different and there is no single right solution to tackle the finances of a couple. Having a joint bank account may be God sent for one couple, and a disastrous ordeal for another couple. Choose a solution that works best for you and your partner.

ADVANTAGES

#1: EFFICIENCY OF HOUSEHOLD MONEY MANAGEMENT

It is easier to write one cheque under a shared account when you are sharing your rent, utilities, and other household expenses. Other household expenses include your insurance costs or auto loan payments. With a joint bank account, you can streamline a lot of financial processes to manage your household. You and your partner can make equal contributions or contribute proportionally to your income.

#2: APPLICATION OF RIGHT OF SURVIVORSHIP

If an unforeseen event occurs and your partner passes away, you do not have to go through the tedious legal process of accessing your partner’s money. The right of survivorship can be applicable in this situation.

For instance, DBS can release all remaining account balance to the surviving joint account holder. The entire process can take anywhere from a few months to a year depending on the size of the estate and on whether your partner has a will.

#3: INCREASED TRANSPARENCY

Having a joint bank account diminishes secrecy. You will be able to see where your dollars are going, especially with online banking. You and your partner will see which categories you spend most of your money on. Thus, you will be able to pay taxes, balance check books, and plan your finances together.

#4: MAXIMIZE YOUR SAVINGS

Apart from getting closer to each other as you agree on your shared expenses and income, sharing a joint bank account can be financially beneficial for you. You can maximize your savings for better returns by sharing a joint bank account. Most high-interest savings accounts require salary crediting as one of the requirements. Contact your preferred financial institution to learn more.

Image Credits: pixabay.com

DISADVANTAGES

#1: DIFFERENCES IN FINANCIAL HABITS

Sometimes, you will not be able to control how your partner spends your money. If your partner has different spending patterns and decides to spend your money frivolously, you will both feel its consequences. It can be hard to explain why you spent S$200 on a shopping spree and skipped on a gift for your sister-in-law.

#2: CARRYING FINANCIAL DEBT

People come from diverse backgrounds. You bring different things into a relationship such as credit history, debts, liabilities, and other obligations. Marriage does not affect your individual credit score or credit history. However, opening a shared account could impact the credit scores of all its account holders.

#3: RISK OF RELATIONSHIP TERMINATION

What happens to your shared account once you break up? We cannot deny the possibility of relationship termination and failure. In fact, the rates of divorce in Singapore increased over the years. For instance, 16 percent split up before their 10th wedding anniversary among those who wed in 2006. This is nearly double the percentage of those who split up in 1987 (i.e., 8.7%).

#4: LACK OF PRIVACY

Now that your accounts are merged into one, you need to be open to your partner about your individual debts and spending habits. It takes time to be comfortable with a portion of your income going toward your partner’s debt and prior commitments. You need to strike a balance between privacy and transparency. Otherwise, one’s independence may be compromised.