Living barely within your income is not a laughing matter. When you are living paycheck to paycheck, you live a life of constant stress, worry, and dread that you might be stuck in an unfortunate debt. It is a struggle to gain control of your money and your commitments. So, here are 3 Simple Tips To Stop Living From Paycheck to Paycheck…

1. CREATE A SYSTEMATIC FINANCIAL OPERATING SYSTEM

In order to cease your worries, a huge turnover can be money flow management. You must give conscious effort to know about where your money flows in and out. Once you have control over your money flow. Then, you will be able to create a systematic financial operating system that consists of: money flow management and budgeting.

Money flow management is accomplished by using a ledger or an app. There are a couple of efficient yet free apps that can help such as: EXPENSIFY, EXPENSE MANAGER, MONEYWISE, POCKET EXPENSE PERSONAL FINANCE, and MINT.

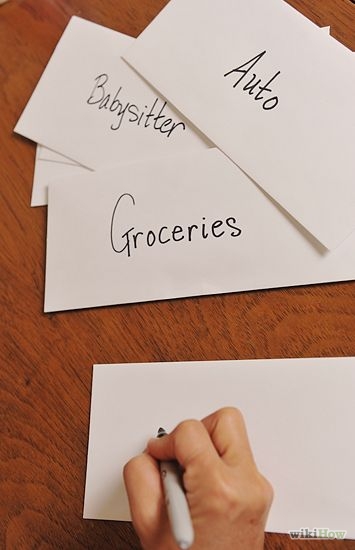

Likewise there are a couple of budgeting such as STATIC or FLEXIBLE budgeting. For personal finances, I highly recommend a simple technique called ENVELOPE budgeting. It starts by storing the cash into separate categories of household expenses that are allocated in separate envelopes.

Budgeting will surely help you gain clarity and control. Start by writing down your monthly income, followed by your monthly expenses, and then subtract the two. Plan and search for a suited technique.

2. PREPARE MONEY FOR YOUR BILLS ACCORDINGLY

Some bills are due frequently while some are semi-annually. Prepare money for your bills accordingly by noting them down. If you have a monthly bill, you may try a trick called half payments. For half payments, you prepare the payment for the bill by subtracting half of the bill’s amount to your bank account per two weeks (bi-weekly).

3. BOOST YOUR EMERGENCY FUND

Prepare for the unforeseen events and financial failures by saving at least 8% of your income per month. You shall call this category your “emergency fund”. It is better to save a certain amount of money than to have nothing save at all.