Living from paycheck to paycheck can cause stress, especially when you cannot cover all your needs and wants on a monthly basis. Constantly scrambling to make ends meet can feel like running on an endless financial treadmill.

A combination of practical strategies and a positive attitude can help you make real progress. The most crucial step is to start – now!

#1: EXPECT THE UNEXPECTED

When you are struggling to pay for all your current expenses, it can seem impossible to put anything aside for your future. However, unforeseen circumstances can happen anytime. Job loss or accidents could put you in a bigger financial trap. Cushion these circumstances by building and emergency fund.

While people usually put six months’ worth of expenses in their rainy-day fund, you can aim for saving at least S$1,000 first. Even if you start with just S$50 per paycheck, you will become more confident in managing your finances as time passes.

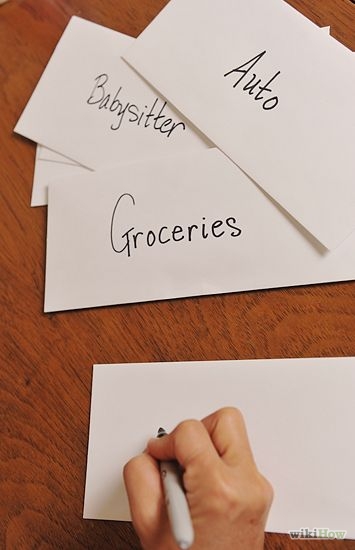

#2: CREATE A REALISTIC BUDGET

Be honest! Do you know where all your money goes to? If you are merely paying for the incoming bills and ensuring that everyone is fed, you may not have a system in place. When you have a budget, you can easily monitor where your money goes and where it should be.

A budget also uncovers your spending habits. Examine these spending habits to make necessary changes. Cutting down on non-essential expenses can help save money for your future.

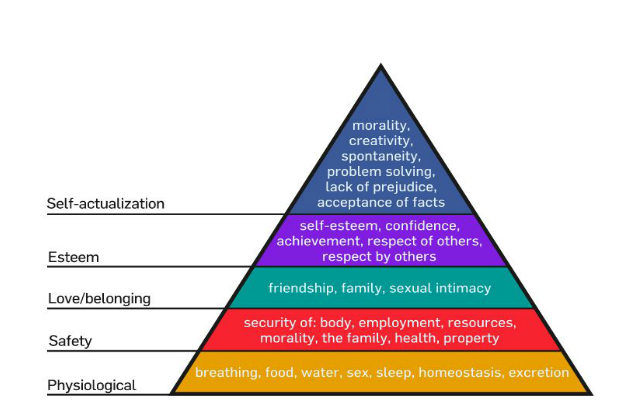

#3: TACKLE THE FOUR WALLS

According to financial author Dave Ramsey, you must take care of your Four Walls first. These fundamental walls include food, utilities, shelter, and transportation. Put these on the top of your budget priorities and write down other categories that you need to pay for. List these categories based on their importance.

Image Credits: pixabay.com

When you run out of money, that is it. Stop spending!

#4: LIVE BELOW YOUR MEANS

Don’t get a part-time gig to keep living a lifestyle that you can’t afford! Increasing your income streams can help with your situation, but you must be responsible with your money. Remember why you took on that additional job in the first place.

Seek the help of others to ensure that you are not tempted to spend your extra money. Stay intentional and stick to your budget.

#5: AVOID THE CREDIT CARDS

Are you trapped in a mountain of debt? Well, you won’t get out of it if you continue using your credit cards.

As much as possible, avoid using your credit cards until you are completely out of debt. This will help you control your spending. If you lack the willpower, eliminate all your credit cards except for one. Put all your credit on this card and pay off the minimum each month (on time).

#6: BE PATIENT

Getting out of this situation can’t be achieved overnight! Start with small positive steps toward money management. Think of money that you can save and watch it add up. This process takes time and commitment, but you can do it.

Image Credits: pixabay.com

Just have the courage to start now!