A credit score is a measure of your credit behavior, predicting the likelihood of you paying back loans on time based on information from your credit reports.

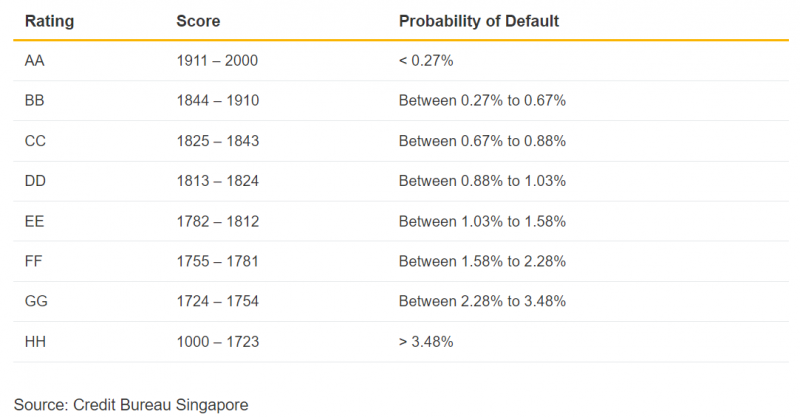

In Singapore, credit scores are determined by algorithms that track credit usage. Credit scores are ranked according to the following risk grades: AA is the highest, while BB or CC indicate late repayments or delinquency, and DD or lower indicate defaults. The credit score risk grades are as shown below.

Image Credits: valuechampion.sg

You can easily obtain a credit report from the Credit Bureau of Singapore’s website (CBS) for S$8.00 with prevailing GST. Alternatively, you can get it for free by applying for a new credit card or a loan facility.

Before we dive into ways to improve your credit score and manage your debt, it’s important to understand the significance of having a good credit score. A good credit score in Singapore can provide you with access to larger loans and better interest rates. You see, your credit score is a key factor in determining your loan eligibility for purchases like a flat or a car.

In addition to facilitating loan approvals, a good credit score can also have a significant impact on your career in finance. The Monetary Authority of Singapore (MAS) considers credit checks to be essential for employees and potential hires in financial institutions. Low credit scores can lead to job rejections in the finance industry.

Now, let’s focus on how to improve your credit score. As mentioned above, a good credit score can help you to elevate your career in finance and to boost your eligibility for larger loans. In a place where the cost of living is relatively high, it’s necessary for you to manage your debts and maintain a good credit score to be financially stable. Here are some tips to help you manage your debt and improve your credit score:

#1: MANAGE YOUR DEBT

Be organized. Make a list of all your debts, including your personal loans, credit card balances, and mortgages. Keep track of the interest rates, due dates for each debt, and the minimum payments.

#2: PRIORITIZE HIGH-INTEREST DEBT

Focus on paying off high-interest debt first, such as credit card debt. Prioritizing debt can affect how quickly you can become debt-free. Focusing on high-interest debt will save you more money and allow you to redirect your funds to other financial goals, while following the timeline you set.

#3: AVOID LATE PAYMENTS

Can you imagine how continuously paying for late fees can affect your motivation levels to pay off your debt? By the time you receive your third delinquent payment letter, your credit score would already have dropped, regardless of whether the bank waives your late payment fee. Late payments can hurt your credit score, so ensure that you pay your bills on time.

Set up virtual reminders to help you stay on track. Or ask your financial institution how you can set up automatic payments.

#4: KEEP YOUR CREDIT UTILIZATION LOW

Your credit utilization ratio is the amount of credit you’ve used compared to your credit limit. Maintaining low credit utilization can improve your credit score. If possible, try to use no more than 30% of your available credit.

#5: MONITOR YOUR CREDIT REPORT

Check your credit report regularly to ensure that all the information is accurate. Get your credit report from the Credit Bureau of Singapore. If you find any errors, do not be afraid to raise them.

#6: WORK WITH YOUR BANK

Do not avoid calls or letters from your bank, its debt collectors, and lawyers. Hanging up the call can affect your opportunity to find better ways to pay off your debt. Remain cooperative and reachable. If you are cooperative, your bank is more likely to help you restructure your payment schedule.

Image Credits: unsplash.com

In conclusion, managing your debt and improving your credit score in Singapore requires good financial habits and discipline. By following these six tips, you can upgrade your financial situation and achieve your financial goals in a realistic timeline.