Lending money to your lover is a tricky business. You may be in a position where trust is completely present but, financial debts can pull you apart. An otherwise happy, supportive, and healthy relationship can come to an end if the money you borrowed is left unpaid.

With the exclusion of married couples, here are the things you must consider if you are thinking of lending your boyfriend or girlfriend money…

OBSERVE YOUR SIGNIFICANT OTHER

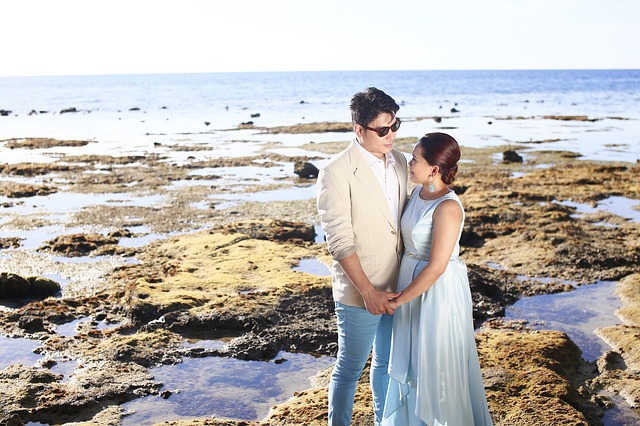

As societal norms dictate, lending your money to your fiancé or your spouse is acceptable as you handle payments together. If you are not on that stage yet, you must make a decision with your head and not your heart. Observe the actions of your boyfriend or girlfriend carefully and compare it against your preferences. Opt for someone who is financially stable and fiscally responsible. This does not mean that you are a gold digger rather it shows your perceptive nature.

For instance, your boyfriend borrows money from you in order to pay the bills because he spent his salary on the new game console. Are you going to lend him the money knowing he might not be able to give it back? Can he be able to handle greater financial issues as they arise? Think about it.

MAKE IT A PRESENT

If the amount is relatively small, consider it as a gift that you do not expect back. Do not lend an amount unless you are able to accept the fact that you may never see it again. That is always a possibility and you do not want to ruin your loving relationship with a “couple of bucks unpaid”!

EXAMINE YOUR FINANCES

Before anything else, make sure you can afford to lend and are not in debt. Just because you love your significant, does not mean that you are encouraged to loan him or her money despite being stuck with debt. Do not put your financial future on a downward slope just because your partner cannot manage his or her money too.

PUT AN INTEREST TO IT

When lending money for bigger things such as “buying a motorcycle”, you are bound to get paid for the full amount for a long period of time. For this, you need to make a signed contract that lay outs the amount of money borrowed, the interest rate, and the date/s of repayment.

Chances are, your partner is asking for your help to avoid high interests offered by the banks. Consider having your partner match your savings account interest rate instead.