When you are young, in your 20s or 30s, retirement feels like a looooong way ahead.

Typically in your 20s, the only person you have to spend for is yourself. In your 30s, you will have new financial priorities such as the wedding, child’s schooling, house loans, etc.

If you consider all the aspects of your finances and fast-paced life today however, you will realize that it is the best time to start saving for retirement before you hit 35. Even the strategies to save for retirement are in-lined with the ideal to start saving while you are young.

Here are the 4 strategies to save for your retirement before your mid-30s…

1. PAY OFF YOUR DEBTS

It makes sense to pay off your debts or at least your high-interest debts before you save for your retirement. Since not all debts are equal, pay off your high-interest debts first followed by the lower ones.

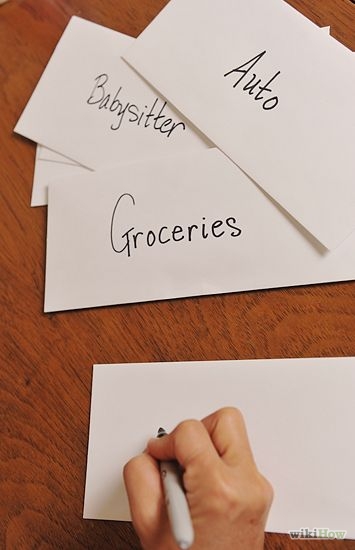

2. SET UP A BUDGET

Systematically allocate your income onto different categories and stick to that budget. Do not spend beyond what your budget is for that month. This allows you to save regularly rather than arbitrarily.

3. SEEK FOR AN EMPLOYER THAT SUPPORTS YOUR GOALS

As much as possible, look for an employer that supports your long-term goals. If your employer offers Retirement or Pension Plan then embrace this company benefit.

4. TRACK YOUR RETIREMENT SAVINGS

During your…

a. 20s

It is best to start saving at least 5% of your income or sign up for your employer’s Retirement Plan. Avoid debt as much as possible and get educated about your finances.

b. 30s

Invest your money and check whether it is in lined with your goals. Increase your contribution to your Retirement Savings while preparing for your child’s school fees.

c. 40s

Make thought-through decisions about your expenses and cut down the unnecessary. This is when you hit your savings to the maximum. By this time you should have at least S$80, 000 to your Retirement Savings.

d. 50s

During your 50s, you must prepare for the unexpected. Seek the financial experts’ help if you must. Then, plan your exit with glee because you are well prepared for it.

Note: This is just an ideal time frame for your Retirement Savings. Contemplate and reconsider the realistic measures that are suited for you.