By Jaspar Lim

If you are reading this, be glad that something has not yet happened to your child.

Child suicides are on the rise, as youngsters were pushed beyond breaking point and ended their lives. 10 fingers 10 toes. That was all that mattered in the past.

Now children are measured by a different set of numbers. 70 marks implies lack of effort. 80 marks is not good enough. 90 marks means room for improvement. When is enough?

倦子2: PSLE GO shouts out this message. Your child is tired, yet still trying. Remember, not regret.

As a parent, I urge you to help spread this message. Treasure your child, not their grades. It is not too late.

I was teleported back to a nostalgic era when I was invited to a premier screening of 倦子2: PSLE GO. The venue was perfect in echoing chapters of the past. Numerous movie posters of old greeted me as I entered. It reminded of my childhood, a much simpler time.

Every morning I looked forward to school to make new friends. Not to compete with my classmates. Each time the school bell rang, I dashed out of class to join my friends. It was a beautiful childhood. Do you remember those lovely memories? These moments made me a happy and balanced adult.

Your child may have been denied this privilege to feel happy. Do you remember when you first held your new born? Back then, your child was perfect. You do not remember. Your child became less every day, and had to try harder to achieve more just to make you happy.

10 fingers 10 toes. That was all that mattered in the past. Now children are measured by a different set of numbers. 70 marks implies lack of effort. 80 marks is not good enough. 90 marks means room for improvement. When is enough to satisfy your expectations?

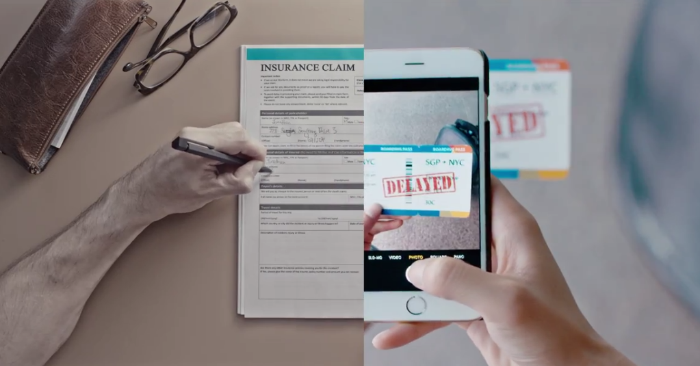

Stills: Zi Hui depressed, 倦子2: PSLE GO

Would you relent only when you witness an irreversible end? Suicides are no longer uncommon among the young. Each news report is heart wrenching; deepest pain only the parent would feel. It is an inevitable end, a result because of our actions, our inaction in protecting our most loved from the harsh judgement of others (and ourselves).

As a professional working adult, every day is an exam. Every hour we endure endless challenges. Do we score 100 marks each time? At home, we comfort ourselves with rest. We pamper ourselves with rewards. Yet, we forcefully push our child through additional stress after school. Your child needs your encouragement, not your enforcement.

倦子2: PSLE GO shouts out this message. Your child is tired, yet still trying. Remember, not regret. A great team effort, displayed most selflessly as Splash Productions embarked on a non-profit filming journey. Splash is to hit something or someone with full impact. In that moment of contact, the origin spreads out and covers a larger area than anticipated.

Splash Productions did exactly that. Impact and Influence. Never once had I been so proud to see familiar names when the credits were rolling. As a parent, I urge you to help spread this message.

Treasure your child, not their grades.

You can watch the video here:

Website: http://www.juanzi.sg/

Facebook: https://www.facebook.com/juanzi2pslego

HELPLINES

- Samaritans of Singapore (24-hour hotline): 1800-221-4444

- Tinkle Friend: 1800-2744-788

- Singapore Association for Mental Health: 1800-283-7019

- Care Corner Counselling Centre (in Mandarin): 1800-3535-800