Many people believe that the “student life” is golden. I firmly agree! The holistic experiences and social exposures you receive during the course of your tertiary education are heavily treasured. You cannot get these things anywhere else!

Ease your financial load by following these tips:

JUST KEEP PEDALING

Automobile companies lure us with their promise of privacy and convenience during our daily commute. Owning a car may add a level of prestige, but it comes with a hefty price! You must cover several expenses such as gas, parking, and maintenance. Just thinking about my car’s maintenance gives me a headache!

As a thriving student, it is a good idea to steer away from this financial burden. Consider the alternative types of commute such as public transportation, cycling, and walking. You are eligible to apply for an Undergraduate Concession Card as a full-time undergraduate from a government or government-aided tertiary institution (T&Cs apply). This card allows you to save a decent amount of cash for your entire matriculation.

Image Credits: pixabay.com

Secondly, cycling to school is beneficial for the environment and for your health. The same benefits apply to walking. When I was a university student, I spared 40 minutes of my day for travelling. I walked to school every morning with music in my ears. I can either feel the breeze or focus on my thoughts. Do the same thing if you are going to travel short distances.

As a friendly reminder, stay safe by having someone accompany you while walking to isolated areas. Let a family member or a friend know about your whereabouts at all times.

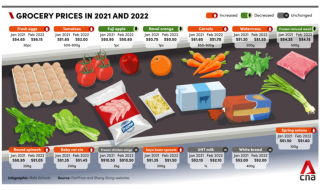

SELL YOUR BOOKS

It goes without saying that the product of one’s intellect comes with a price. Reference books or textbooks suited for tertiary students costs as low as S$50 each. It is a significant price to pay for a book that you will use for barely 3-4 months. Thus, students must employ different strategies to save money on their books.

Firstly, you can rent a book for free at the National Library. Secondly, you can purchase second-hand books online. Lastly, you may sell your old books to afford another one. Aim to sell your books to the next batch of students.

I am well aware that some people refuse to discard their belongings, including the ones that are seemingly useless (e.g., old newspapers). Hoarding can harm your chances of getting the best deals as the books’ resale value lessens in time.

EARN ON THE SIDE

In general, tertiary students are divided into two financial groups. The first group of people can survive solely with their allowance. While, the second group survives by earning money on the side. It is easy to immerse yourself with your academic responsibilities without having to worry about your finances. However, you may want to invest on your financial freedom. Extra money entails that you can build a travel or an emergency fund.

Image Credits: pixabay.com

I belonged to the first group. During the first year of my tertiary education, I underestimated the weight of earning my own money. I handpicked the friendly gatherings that I will attend to maximize my allowance. My perception all changed when my friend pointed out that I must choose the restaurant to eat at. I was given the tasked as she perceived me to be the “poorest”. I decided to boost my financial capacity by working as a secretary at my mother’s workplace. This experience has exposed me to the diverse work culture in the country. Not to mention, it benefited my career profile.

Make money on the side by working part-time at a restaurant, by distributing flowers, or by opening a blog shop. Find part-time jobs at freelancezone.com.sg.