The majority of investors are cognizant that the market goes through bulls and downturns. So, what transpires when the market is volatile?

To make it clear from the beginning, financial market volatility is the measurement of the size and speed of an asset’s price movements. Volatility exists in any asset whose market price fluctuates over time. The broader and more regular these swings are, the higher the volatility, and making a terrible move might wipe out earlier profits and much more.

When investing in turbulent markets, there are a few things to keep in mind.

Diversify

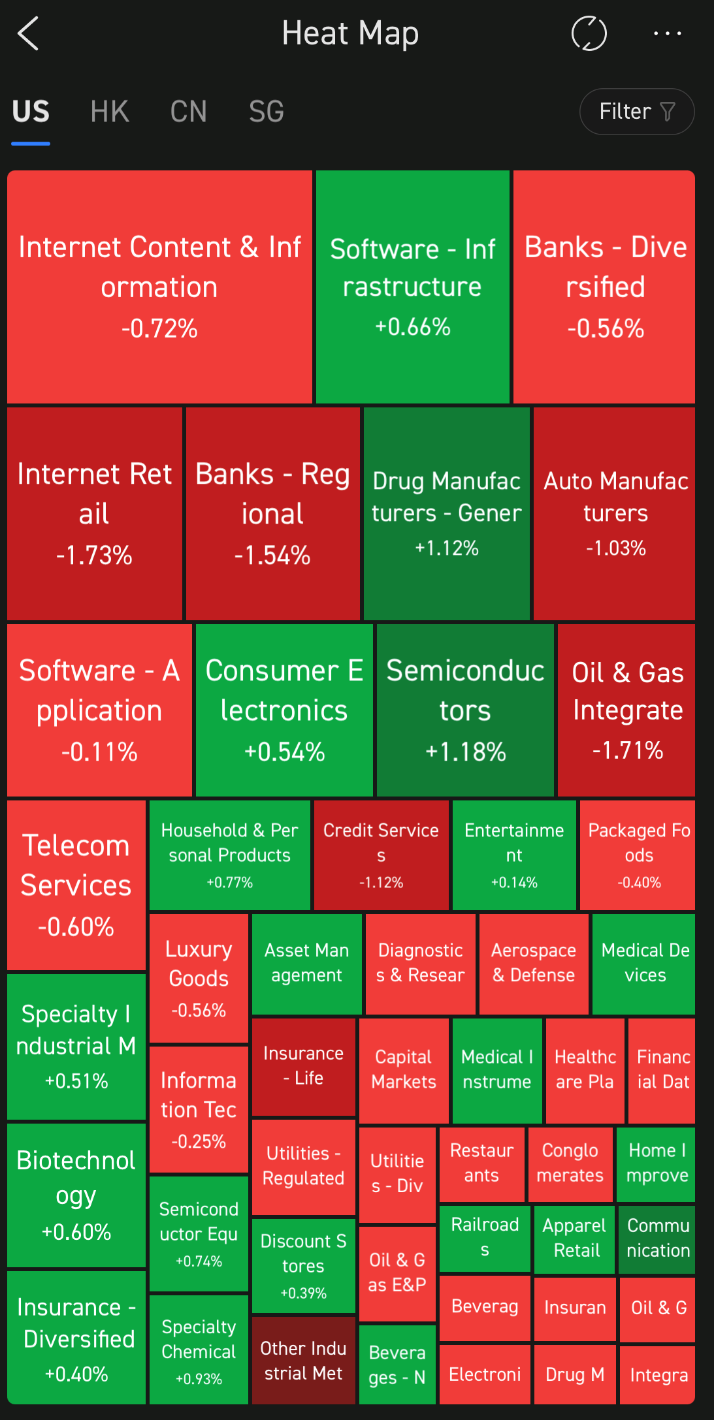

Volatile markets might expose that investments believed to be properly diversified, in fact, are not. If you haven’t recently reviewed your portfolios to ensure that you understand how each asset class is performing and that the mix fits your investing strategy, now would be an excellent time to do so.

Rebalance

Assets that have appreciated in value will make up more of your portfolio over time, while those that have decreased will make up less. Rebalancing entails selling positions that have become overweight in comparison to the rest of your portfolio and reinvesting the profits in underweight ones. It’s a sensible move to repeat this process frequently.

Go for long-term

Image Credits: towardsdatascience.com

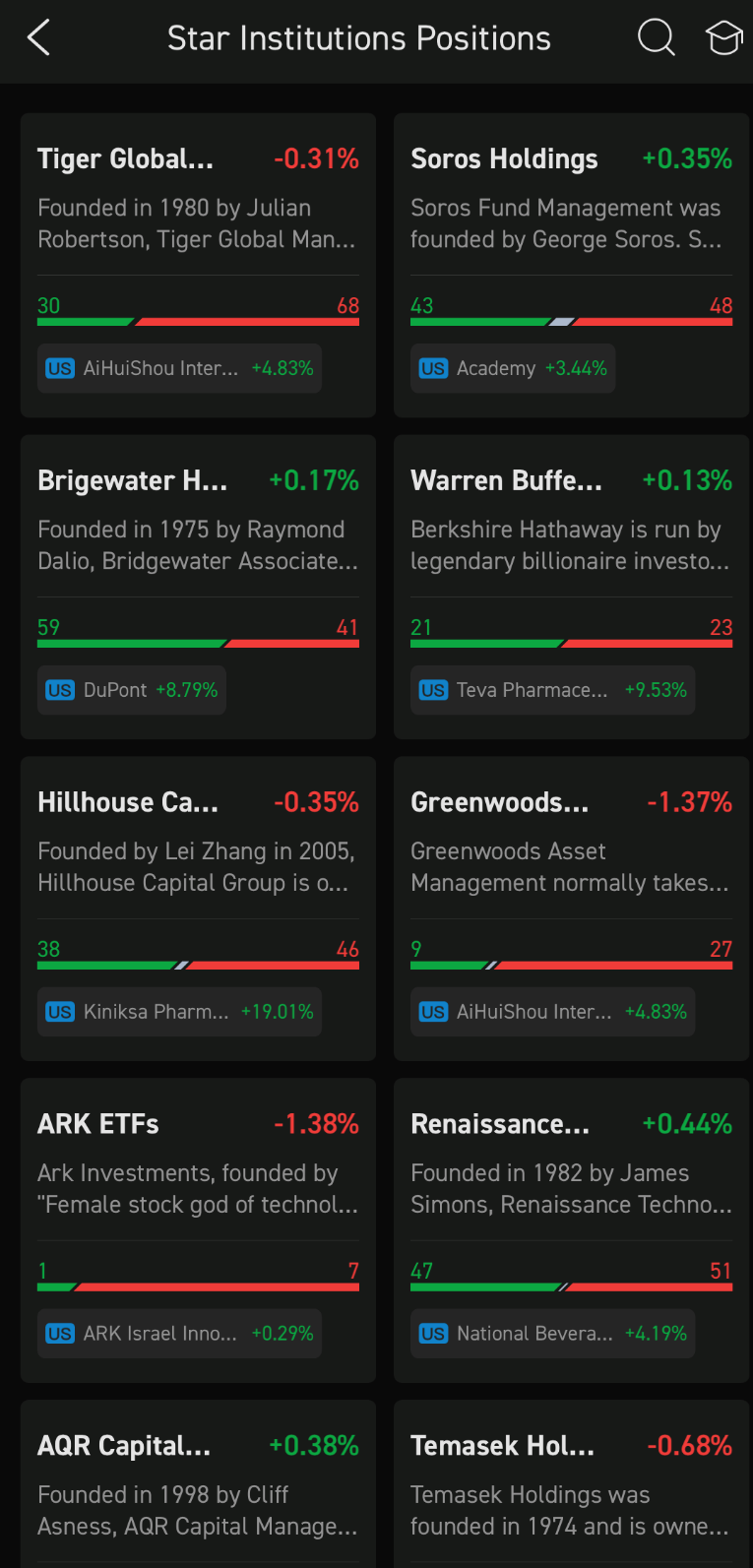

Markets fluctuate, and you’re bound to see multiple major drops throughout your investment journey. When compared to bull markets, even instances when the market plunged by more than 20% have traditionally been quite brief. Because it’s impractical to time the market’s ebbs and flows, all investors should tune out the buzz and fixate on their long-term goals.

Stay the course

If you’re retired or on the verge of retiring, your stance on investing in a volatile market can be a little different. Rather than attempting to chase high gains in the short term, your priority should be on safeguarding the assets you’ve amassed via long-term investment. To keep on track, create a retirement investing framework before you bid goodbye to your monthly paychecks, so you won’t make rash judgments about your assets during market downturns.

Keep day trading at bay

When you day trade, you purchase and sell investments quickly in the hopes of profiting from small price variations. While this may appear to be a simple, low-risk approach to making money, it is complicated and time-consuming. Day traders must build a system to track stocks, keep a constant eye on the markets, and have an uncanny ability to determine when the optimum moment to buy or sell is, which may feel like a full-time job. Day trading can potentially result in significant losses if you aren’t 100% sure what you’re doing.

When stock markets begin to plummet, daily doses of negative updates may seem inescapable. Even the savviest investors might worry, doubt, and make drastic judgments as a result of it. Panic, on the other hand, brings you nowhere. When markets get stormy, it’s critical to stay calm. Don’t be hesitant to speak with a financial professional if you’re concerned about market fluctuations. They can provide expert guidance, review your financial strategy, and assist you in determining the best actions to take.