The GST Voucher (GSTV) Scheme for 2025 continues to provide vital financial support to help Singaporeans handle everyday costs arising from rising prices. It’s part of the larger Assurance Package, alongside Community Development Council (CDC) vouchers. The scheme comprises four key components designed to benefit different needs: GSTV Cash, U‑Save utility rebates, MediSave top‑ups, and Service & Conservancy Charges (S&CC) rebates.

Let us start with GSTV Cash. It is available to Singapore citizens aged 21 and above with an assessable income of S$39,000 or less and who own at most one property with an annual value (AV) of S$31,000 or less. Applicants in homes with AV up to S$21,000 receive S$850, while those with AV between S$21,001 and S$31,000 receive S$450.

Next, MediSave top‑ups are offered to Singaporeans aged 65 and above, subject to the same AV and property criteria . Recipients aged 65–74 receive S$250 (AV ≤ S$21,000) or S$150 (AV up to S$31,000); those aged 75–84 receive S$350 or S$250; and those 85+ are awarded S$450 or S$350.

Thirdly, U‑Save rebates are provided quarterly to eligible HDB households that have at least one Singapore citizen and must not own more than one property. These rebates are automatically credited to SP utilities accounts in January, April, July, and October 2025. The quarterly amounts are S$95 for 1‑ and 2‑room flats, S$85 for 3‑room, S$75 for 4‑room, S$65 for 5‑room, and S$55 for executive or multi‑generation flats.

Lastly, S&CC rebates offset town council charges and are similarly credited quarterly. Depending on flat type, households receive between 1.5 and 3.5 months’ worth over the year, including a bonus half-month rebate in January 2025.

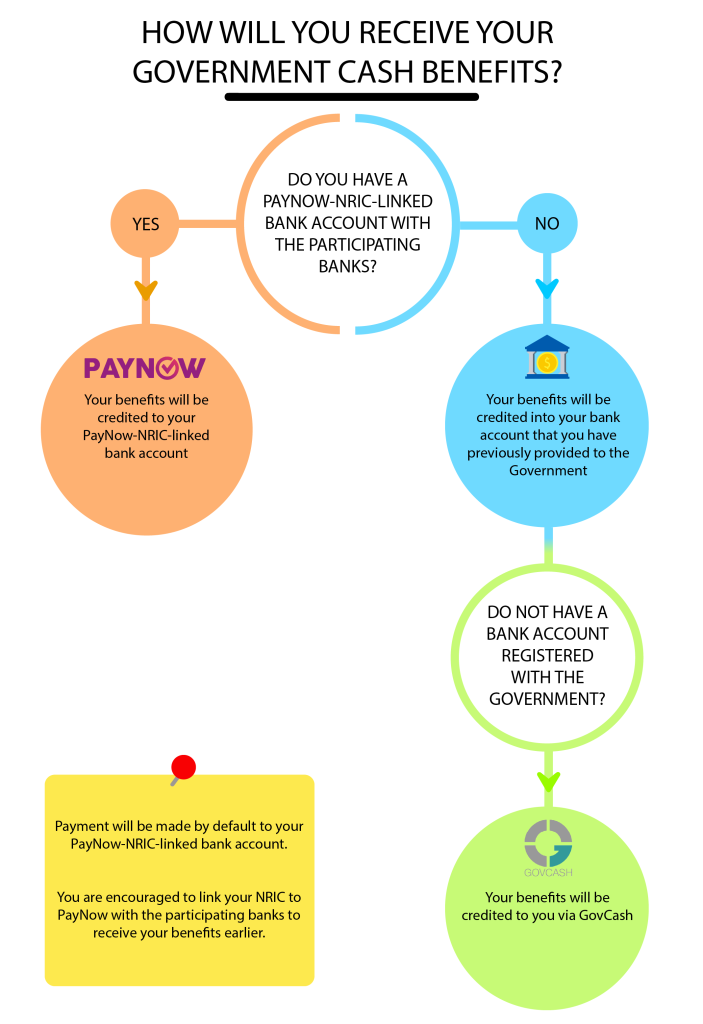

PAYOUT PROCESS

To receive GSTV Cash, register for PayNow‑NRIC by 27 July 2025 or update your bank details by 28 July. Payouts begin on 6 August via PayNow‑NRIC, 15 August via direct bank credit, and 22 August via GovCash for those without bank accounts. MediSave top‑ups are credited from 11 August 2025 for those already signed up or who sign up by 13 July 2025. Later registrants (14 July 2025 to 20 June 2026) will receive their top-up within two months of signing up. On the other hand, no action is needed for U‑Save or S&CC rebates as they’re automatically applied.

You can check eligibility, update payment details, or review payout statuses through Singpass or at govbenefits.gov.sg.

Image Credits: govbenefits.gov.sg

IN SUMMARY

The following is a quick summary of the key details above to help you better understand the 2025 GST Voucher benefits. Do check govbenefits.gov.sg regularly for the latest updates, as details may change.

GSTV Cash

- S$850 for AV ≤ S$21,000

- S$450 for AV between S$21,001–31,000

- Income limit: S$39,000 or less (YA 2024)

MediSave Top‑ups (age 65+)

- S$250 (AV ≤ S$21,000) or S$150 (AV S$21,001–31,000) for ages 65-74

- S$350 / S$250 for ages 75–84

- S$450 / S$350 for ages age 85+

U‑Save Rebates (quarterly)

- S$95 (1–2 room)

- S$85 (3‑room)

- S$75 (4‑room)

- S$65 (5‑room)

- S$55 (executive/multi‑gen)

S&CC Rebates (quarterly)

- 1.5 to 3.5 months’ worth based on flat type (+0.5 month in January 2025)

Payment Dates

- GSTV Cash via PayNow‑NRIC: From 6 August 2025

- Bank crediting: From 15 August 2025

- GovCash: From 22 August 2025

- MediSave: From 11 August 2025

Actions Required

Image Credits: unsplash.com