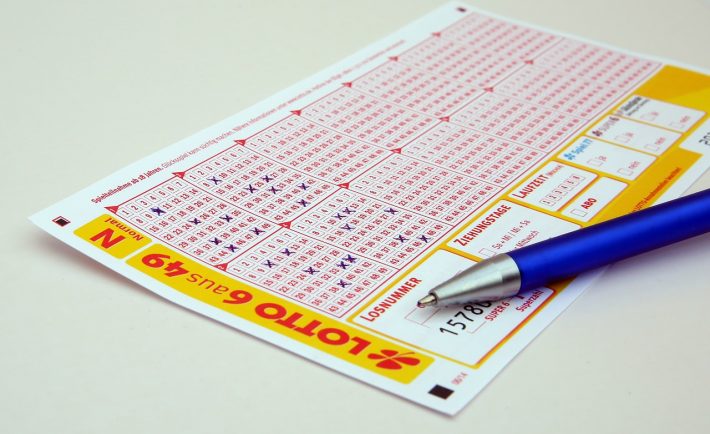

One of the pastimes that my father has passed on to us was betting on the lottery. Whether you are an avid fan of the 4D or TOTO, many people believe that winning these can give them a shot to be a crazy rich Asian overnight.

Reality check! That is not the case for many of us. In fact, a recent Facebook post showed that you can earn a significant amount of money by saving your “lottery funds”. Eilin Tan from Malaysia shared how her father saved up all the money he would normally spend on buying 4D. He started last January 2018. A year later, he found that the total savings was equivalent to the top prize. Both were shocked! Netizens estimate that the money could be worth RM6,000 to RM15,000 (about S$1,900 to S$4,900).

Image Credits:pixabay.com

Much like Eilin’s father, you can commit to simple changes in your life to improve your finances. Start with these aspects:

#1: ASSIGN A FINANCIAL DATE

Much like designating a day for your beloved, you must assign a day to assess your finances. The first step towards saving money is to look at your current spending habits. Which categories can you cut down on? Find specific areas in your expenses which you can reduce without compromising your lifestyle.

Image Credits:pixabay.com

Afterwards, you must track your progress in relation to your financial goals. Spend time with your money to improve your financial life.

#2: WAIT BEFORE YOU CHECK OUT

When it comes to saving money, make delayed gratification your best friend!

These days, you can get anything you want with a quick click or tap of a button. There is an instant gratification for almost anything you can think of. To combat impulse buying brought by said convenience, you may find a buffer. Employ a self-imposed waiting time. Wait a day or two before spending your money on things that cost more than S$60. When you practice this on a regular basis, you will realize that most of your purchases are triggered by wants rather than your needs. Moreover, you will be able to save more money and work towards mindful spending.

#3: CHOOSE QUALITY OVER QUANTITY

Minimalism is one of the latest trends that I subscribe to. It encourages consumers to choose quality over quantity. This can be applied to clothes, gadgets, food, home decorations, bags, and so on.

Yes! It may be tempting to purchase cheaper alternatives on a regular basis. However, you must remember that your small purchases add up! Choosing quality products will help you save money in the long run.

Image Credits:pixabay.com

What is the best that you can afford now? Use the cost-per-wear philosophy when it comes to clothing, accessories, and shoes. Stick to classic silhouettes, which you can use for a long time.