You may have noticed prices going up for the everyday items you buy. This is because we are now experiencing inflation.

For folks who have been following the news, you would have come across the revelation that core inflation in Singapore has reached its highest level in more than 13 years in May 2022, driven mostly by increased food and utility prices. While some people may be struggling to get by, there are ways to thrive during times of inflation; you just need to know what they are.

In this post, we will share with you tips on how to thrive during times of inflation.

What is inflation?

Inflation is an economic term that refers to rising prices of goods and services in a country. This can be caused by a variety of reasons, such as an increase in the money supply or an increase or decrease in the value of the currency. If you’re feeling the effects of inflation, don’t worry – you’re not alone. Keep reading for tips on how to thrive, not just survive, during these challenging times.

How can you thrive during inflation?

There are a few key ways to thrive during inflation.

- Get the best value for your money. Compare prices before you buy and avoid purchasing things on impulse. If you can’t afford something, wait until you can.

- Use your money in the most efficient way possible. Make a budget and stick to it, even if it means making some sacrifices. Try to save money wherever you can, and invest in things that will hold their value over time, like gold.

- Diversify your income. If all of your eggs are in one basket, you’re going to be in trouble if that basket starts to wobble. Spread your money out into different investments, and always have a backup plan in case of emergencies.

What are some things to avoid during inflation?

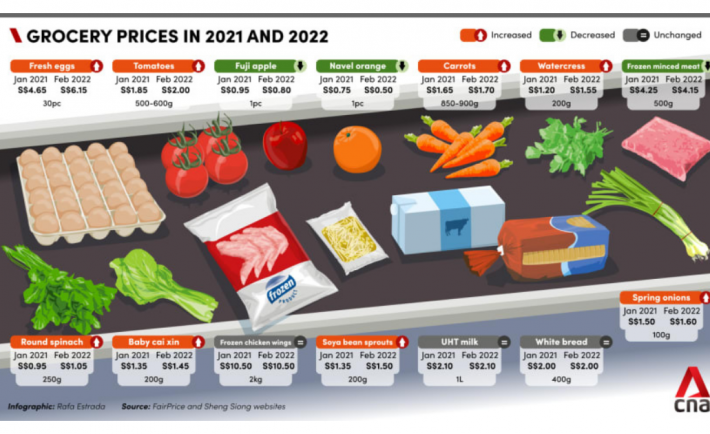

Image Credits: todayonline.com

There are a few things you should avoid doing during inflation to make the best of the situation. For one, don’t overspend. Just because prices are going up doesn’t mean you have to buy everything that’s in sight. Try to be mindful of your budget and only buy what you need.

Also, avoid taking on additional debt. When prices are rising, it’s easy to get swept up in the hype and go into debt buying things you don’t need. But remember that you will be paying back that debt with inflated dollars, so it’s important to stay away from high-interest loans and credit cards.

Finally, avoid hoarding. It can be tempting to stock up on things when you know they’re going to become more expensive soon, but this can do more harm than good. Not only will you end up spending more money in the short term, but you will also be sacrificing storage space at home.

What should you do if your income doesn’t keep up with inflation?

If your income doesn’t keep up with inflation, you’re not alone. So what can you do to make ends meet? Here are a few tips:

- Ask for a raise at work or find a new job that pays more.

- Live within your means and don’t succumb to social media pressure.

- Review your expenses and see where you can make adjustments. Maybe you don’t need that expensive subscription anymore or you can start cooking at home more often.

You may be feeling the effects of inflation in your everyday life. Prices for utilities, groceries, and transportation continue to go up, and it sometimes feels like there’s nothing you can do about it. But don’t worry, the tips we’ve put together in this article will help you thrive during these tough times. Hopefully, you will be able to manage your expenses better and make the most of your money. So what are you waiting for? Start putting these suggestions into action today!