While getting your personal finances sorted out, it’s important to get your foundation right.

And one of the most basic things that you’ll need when it comes to managing your money is a savings account, preferably one with a high-interest rate.

With so many options available, how do you choose the best one for yourself?

Simple.

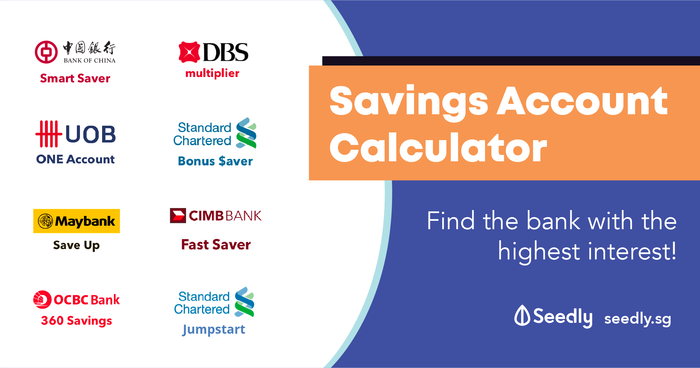

You just use Seedly’s Savings Account Calculator to help you.

And best of all, it’s completely free to use!

Free? Really Meh?

Here at Seedly, they’re all about helping Singaporeans make smarter financial decisions.

So in order to get as many people as possible on the right track, it’s important that they get their basics right.

To do this, they created this Savings Account Calculator:

They’ve also managed to do this without the backing of any bank or financial institution. And they deliberately chose to do so in order to create a calculator that is unbiased and that will truly identify the best savings account with the highest interest rates for you.

Yep.

That means that they’re not sponsored in any way for the creation of this calculator.

How Can The Seedly Savings Account Calculator Help Me?

The interest rates of savings accounts differ widely between bank to bank.

Some banks even have different savings account with varying interest rates.

Naturally, the highest interest rates are awarded only if you fulfil certain criteria like:

- credit your monthly salary

- spend a certain amount every month

- have an investment account and actively make monthly investments

- take a housing loan

- own insurance policies

Once you get all of this information, you would have to compare the savings accounts in order to find out what is the highest interest rate you can qualify.

The problem with doing this manually is that it’s an extremely tedious process.

Ain’t nobody got time for that.

Enter the Seedly Savings Account Calculator – a simple tool that can help you calculate the highest interest you can potentially get.

How Do I Use The Seedly Savings Account Calculator?

Integration With Seedly’s Main Site

What if you’re still unsure about the recommended choice?

Well, you’ll be pleased to know that the calculator is also integrated with SeedlyQnA and SeedlyReviews.

This means that you can click on “More Details” and the dropdown list will display questions which other people have asked (and answered) as well as user reviews about the particular account you’re recommended.

That way you can make a more informed decision.