Last year, the Parliament brought the 2028 Digital Learning Device plan to 2021. All secondary school students will be equipped with a digital learning device by the end of 2021. This initiative aims to improve the digital literacy of today’s children.

Not only will the devices enhance their learning experience, but also support the Ministry’s plan to implement the Blended Learning. The Ministry plans to implement Blended Learning in all secondary schools, junior colleges, and the Millennia Institute in Term 3 of 2021. The Blended Learning incorporates the regularly scheduled home-based learning (HBL) days.

The digital learning devices will support the virtual lesson plans and allow the teachers to personalize the students’ learning experience.

EDUSAVE AND DIGITAL LEARNING DEVICES

According to the Ministry of Education (MOE), payment for these devices will be covered through Edusave. The Government added a S$200 top-up in April 2020. This will total to about S$75 million.

Those who need financial assistance will receive help. Students who come from lower-income households will get further subsidies to ensure that their out-of-pocket cost is S$0.

EDUCATION AS A GREAT EQUALIZER

One of the biggest issues to solve on a global level are class divisions. Singapore is not immune to this. Thus, MOE promised that students from lower-income households will not be disadvantaged.

Moreover, the MOE is making investments by setting up the National Institute of Early Childhood Development. We all know how important early childhood is to a person’s life.

DIGITAL LEARNING DEVICE UPDATES

(Disclaimer: Some secondary school students may be given different learning devices apart from Apple iPads.)

MARCH 2021

Riverside Secondary School previously posted that their Secondary 2 students received their personal learning devices. The iPad came with an Apple Pencil and a Logitech keyboard case to allow students to fully utilize their tablet for their learning.

Image Credits: facebook.com/RiversideSS/posts/1190034841452870

SEPTEMBER 2021

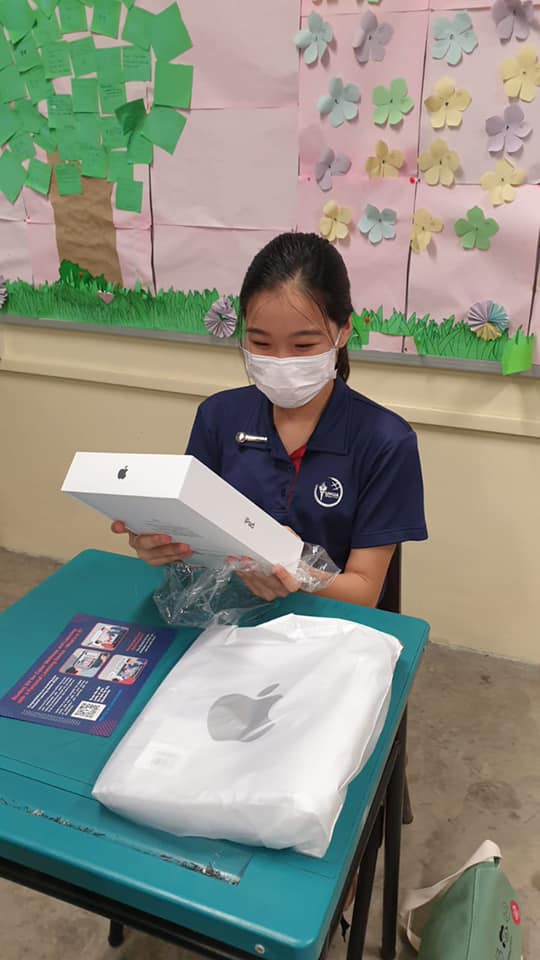

Yuhua Secondary School students received their brand-new personal devices and could not hide their excitement behind their masks. Since the sole purpose of the tablets is education, a device management software was installed. Students will not be able to play games such as PUBG during their lectures.

Image Credits: facebook.com/yuhuass/posts/1722476201285788