We’ve all heard the saying “positive thinking breeds positive results”. But what does that mean for your life, and how can you go about implementing it?

In this post, we will explore the benefits of positive thinking and discuss how to start thinking more positively. We hope that after reading this article, you will be inspired to take charge of your life and start seeing real results in every area.

What is positive thinking?

Positive thinking is the practice of looking at the bright side of any situation. When you do that, you focus on the good aspects of a situation and look for ways to improve it. This can be difficult when things are going bad, but it’s important to have hope for the future.

Positive thinking can change your life in several ways. It can help you stay motivated, optimistic, and satisfied. It can also assist you in attaining your goals, boosting your immune system, sweetening your current relationships, and enhancing new ones.

How to start thinking more positively?

Just like anything else, positive thinking requires practice. Start by making a conscious effort to think positively about yourself and your abilities. Give yourself credit for your accomplishments, no matter how small they may seem. Take time each day to reflect on your good qualities and write them down if it helps.

When negative thoughts start to creep in, remind yourself that these are just thoughts and not reality. Envision a joyful, more fruitful future for yourself, and focus on the steps you need to take to get there. If all else fails, try surrounding yourself with positive people who will support and encourage you along the way.

What are the benefits of positive thinking?

Image Credits: unsplash.com

When you think positively, your brain releases neurochemicals like serotonin and dopamine, which make you a little more upbeat and smiley. Positive thinking has also been linked with better physical health. When you focus on the positives, your body releases lesser stress hormones. This leads to reduced inflammation, which can cause all sorts of health problems.

In addition, positive thinking can change your life for the better. It can help you attract better job connections, achieve your long-term goals, and be more successful overall. Simply put, positive thinking is a superpower that can help you overcome any mental obstacle. It’s free too, so why not give it a try?

How can I help others think more positively?

One of the best ways to help others is to be a positive role model. When you’re constantly looking on the bright side and your actions reflect that, it’s contagious and others will be more likely to adopt a positive mindset as well.

You can also encourage others by sharing your personal stories about how you overcame negativity and embraced the power of positive thinking. This can help others see that change is possible and that they have the power to command their circumstances.

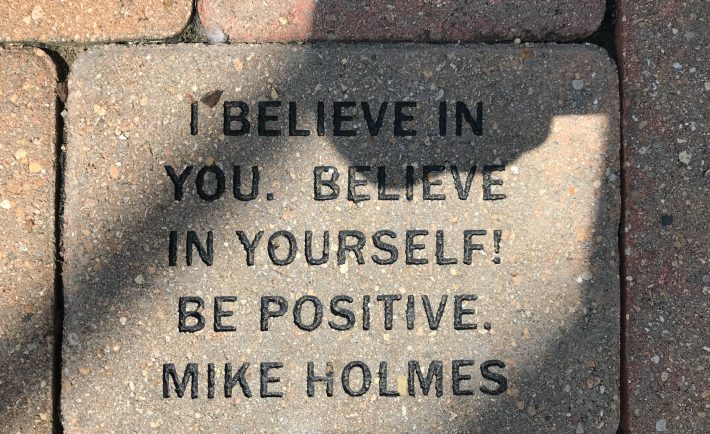

Last but not least, always be there to uphold and encourage others, even when they don’t believe in themselves. Just by being present and showing your support, you can make a huge difference in someone’s life.

People who think positively are generally cheerfuller than those who don’t. They find it easier to maintain healthy relationships and have more successful careers. Positive thinking doesn’t mean that you ignore problems or deny the negative aspects of life – it just means that you focus on the good things instead. If you’re not a naturally positive person, don’t worry. You can learn to think positively by changing your thoughts and attitudes, and by practicing mindfulness.