Based on a Worldwide Cost of Living survey conducted by the Economist Intelligence Unit, Singapore has been ranked as the world’s most expensive city to live in for the third consecutive year. Indeed, many living in Singapore have to contend with the high property and car prices. Healthcare and education costs are also not far from people’s minds.

Investment is seen as a way to potentially amplify one’s wealth to better fulfil these life goals. But what if you do not have a substantial amount of capital or time set aside for investing? A Monthly Investment Plan or what’s also known as a Regular Savings Plan, could be something for you to consider.

- Affordable

There’s a common misconception that you need to have sizeable capital in order to start building a nest egg through investing. However, with a Monthly Investment Plan, you can decide how much to invest based on your personal financial situation. You can even set aside just $100 a month, and put that money into blue chip stocks, exchange traded funds (ETFs) and Real Estate Investment Trusts (REITs) listed on global markets to build your portfolio.

- Takes Advantage of Dollar Cost Averaging

Monthly Investment Plans follow the principle of dollar cost averaging. By investing regularly every month instead of trying to time the market and find the best time to buy and sell shares, the risk of investing a large amount in a single investment at the wrong time is reduced.

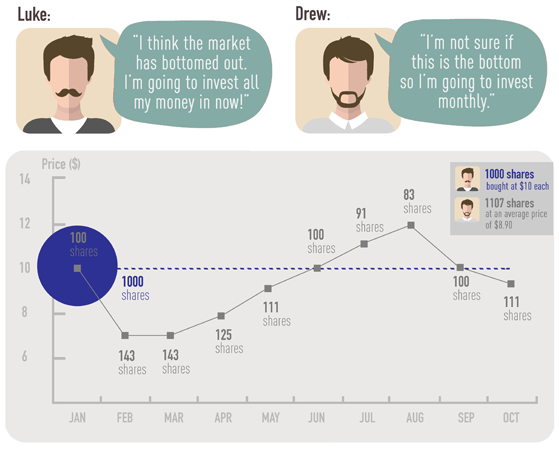

To gain a better understanding of dollar cost averaging, consider this example where two siblings are given $10,000 each, but choose to invest it in different ways.

Luke used the money to buy 1000 shares at $10. Drew, on the other hand, invested a predetermined amount each month, and he ended up buying more shares when the price was low and fewer shares when the price was high.

Drew’s average price per share ($8.90) is therefore lower compared to Luke’s ($10) – this is how dollar cost averaging works and by extension, how Monthly Investment Plans can help you achieve your investment goals.

- Automated and Hassle-Free

No one can exactly foresee and predict the behaviour of the stock market. Instead of trying to time the market and finding the right time to enter and exit, Monthly Investment Plans focus instead on long-term gains, and build your portfolio by automatically buying your shares for you every month. Your work is done at the outset. All you need to do is choose your desired shares and set your monthly investment amount. From that point on, you can sit back and watch as your portfolio grows and your shares accumulate.

- Diversification

Monthly Investment Plans enable you to diversify your investment portfolio in a couple of ways.

Most of these plans allow you to invest in ETFs like SPDR STI ETF or Nikko AM STI ETF which are funds that invest in the 30 largest companies listed on Singapore Stock Exchange. More conservative investors can go for these ETFs. In addition to these ETFs, your Monthly Investment Plan may allow for investments into REITs. If you are interested in investing in property, then this is something to look out for; REITs don’t just give you exposure to one property – they give you exposure to a whole portfolio of properties. Some Monthly Investment Plans will also allow you to access stocks listed in markets like the US, Hong Kong, Malaysia and Thailand. Expanding your horizons and looking at offerings listed on these global markets is another way to diversify your portfolio.

If any of these four benefits sound appealing to you, then you should find out more about how Monthly Investment Plans can help you along your investment journey.