Your heart is pounding as excitement and uncertainty clouds your mind. You are about to make a life altering decision. Pause for a moment. Before you do anything else, consider its financial outcomes.

Whether you are rendering your resignation or planning your engagement proposal, all these huge decisions can make or break your wealth. This is why it is important to have a substantial amount of time to analyze every factor including time itself.

To do this, you must master the art of time management. Time management refers to the way you organize and sort out how long you spend on specific tasks. After all, we are equally given the same 24 hours. Let us make the most of it!

For instance, here are some life events where time management is financially crucial…

1. GETTING MARRIED

Save lots of money by scheduling your big day during off-peak months. Generally, getting married in “off-peak” months such as November, March, and April can be less expensive than marrying in “peak” months such as December and February. However, you must always be cautious of the venue’s weather and conditions.

During off-peak months where the demand for weddings are lesser, couples get to negotiate for better prices. Tying the knot in these months means taking full advantage of the discounted prices on reception venues, catering, and photography. If you want to save even more, know the right time when the hotels and resorts are off-season and stay away from the weekends.

2. RENDERING YOUR RESIGNATION

Remaining in a horrible job or company for too long can be harmful not only to your career but also to your health. If you have tried your best to turn things around and have not seen any changes, perhaps it may be time to walk away.

According to Travis Bradberry of Forbes.com, here some signs that validate your desire to quit:

It is time to quit your job if you…

a. dread going to work.

b. know more than your boss.

c. are out of the workplace loop most of the time.

d. lost your passion.

e. have a horrible boss who is not going anywhere.

f. see no room for advancement.

g. are suffering health wise.

h. are suffering in your personal life.

i. think the company is in danger of closing.

If most of this or all of this are happening to you, consider your options before quitting your main source of income. Rendering a resignation is best done during the beginning of the month, wherein you are not holding any projects yet. Schedule your resignation email or letter and do so graciously.

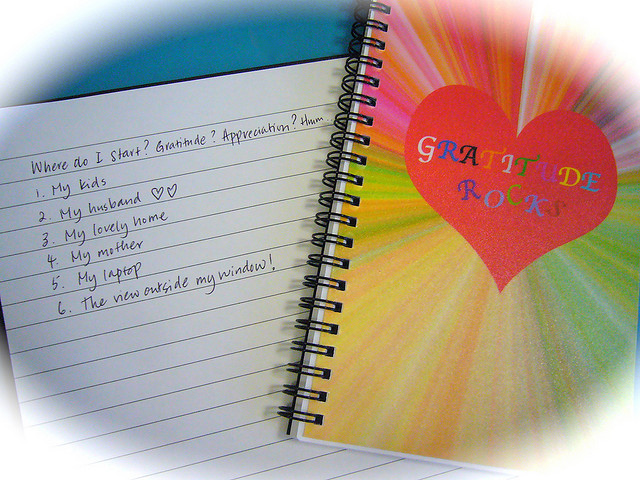

3. RECEIVING YOUR BILLS (AS A YOUNG WORKING ADULT)

As a young working adult, especially if you are living alone, you become responsible for keeping the household sharp. For the first time in your life, you are the chief of your own bills.

With this newly acquired responsibility, you must stay organized to keep up with your payments. Set aside some time in the beginning of the month to make a list of the bills you are expecting to receive. Put it on your working desk or create a file for it. This way, you will not pay a bill twice even if you received it simultaneously by e-mail and postal mail.

Alternatively, you can get your payments automated. Since you are prepared for the bills earlier on, you may have available money in the bank to pay it the same day as you received it. If you have automatic payment scheduled and you still received a billing statement, call your bank or creditor.