Nowadays, individual stress levels are at an all-time high. With long work hours, economic pressure, and growing mental fatigue post-pandemic, many Singaporeans are quietly hitting a wall. While some seek traditional talk therapy, a growing number are turning to a quieter and more expressive form of healing called art therapy.

Searches for “art therapy Singapore” have surged in recent months. Yet many still don’t know what it really involves or how much it actually costs. We break it down here.

MORE THAN JUST MAKING ART

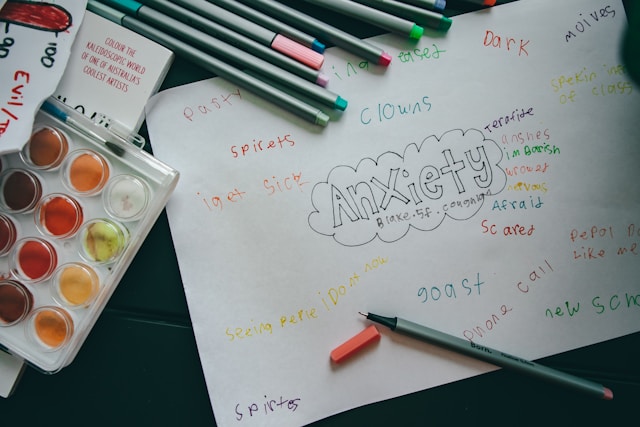

Let’s clear this up. Art therapy isn’t just arts and crafts. It’s not art class, and it’s definitely not only for artists.

Art therapy is a professional form of psychotherapy that helps people express and process emotions through creative practices like drawing, painting, or sculpting. It isn’t about making something pretty. It’s about releasing what’s hard to say in words.

As a psychometrician and mental health advocate, I’ve witnessed how powerful this can be. I’ve also lived it. One day, I picked up a brush. I just painted as I needed to let something out. That moment was a turning point.

WHY IT’S DRAWING PEOPLE IN

In a society where productivity is prized and emotions often buried, art therapy is emerging as a safe and nonverbal space to breathe. It’s gaining traction especially among those:

a. Burnt out at work

b. Coping with anxiety or trauma

c. Struggling to open up through talk therapy

d. Parenting neurodivergent or emotionally sensitive children

Singapore therapists are also adopting trauma-informed, psychodynamic, and mindfulness-based approaches. Truly, the field is becoming more diverse and adaptive.

Watch this introduction to understand it better:

HOW MUCH DOES IT COST

Art therapy in Singapore isn’t cheap, but it doesn’t have to break the bank. Some clinics even offer free consults or subsidized options.

1. Singapore General Hospital

Offers individual, group, and family sessions

Learn more: sgh.com.sg

2. The Red Pencil (Singapore)

A nonprofit offering art therapy for communities and individuals

Learn more: redpencil.sg

3. Ayana Art Therapy

Personalized sessions with a FREE 20-minute consultation

Learn more: ayanaarttherapy.com

4. Haven Art Therapy

Works with clients from 4 months to 97 years old

Learn more: haventherapy.sg

5. Art For Good

Therapy, enrichment, and community art

Learn more: artforgood.sg

Prices:

Art Jamming (2 hours): S$50

Individual Therapy (1 hour): S$150

Consultation (30 minutes): S$60

6. Solace Art Psychotherapy

Offers multi-session packages

Learn more: solace.com.sg

Prices:

Single Session: S$230

5 Sessions: S$1100

10 Sessions: S$2000

ARE ART THERAPISTS LEGIT?

In Singapore, qualified art therapists typically hold a Master’s in Art Therapy and are members of the Art Therapists’ Association Singapore. Many are also credentialed by ANZACATA, a professional body for creative arts therapists.

Their training includes:

a. Supervised clinical placements

b. Personal therapy

c. Rigorous ethics and trauma-informed education

Image Credits: unsplash.com

FINAL PIECE

You don’t need to be an artist to begin healing. You don’t even need to know where to start. All you need is the willingness to explore what you feel.

When words fall short, art speaks through color and movement. In those quiet moments of creation, you may find calm and clarity.