Being trapped into the majority’s preconceived beliefs about money is easy. However, debunking these misconceptions will help you to reach your financial goals.

#1: ALL THE SHOPPING MALLS IN SINGAPORE ARE EXPENSIVE

Potential Danger: Risk of diving into debt as you only frequent the high-end shopping centers.

Because of the harmony between the East and West, Singapore offers endless shopping opportunities for its inhabitants. There is a wide array of products sold at the stores. There is a place for traditional and contemporary tastes as well as for foreign luxury and locally-manufactured goods. You can find just about anything in Singapore.

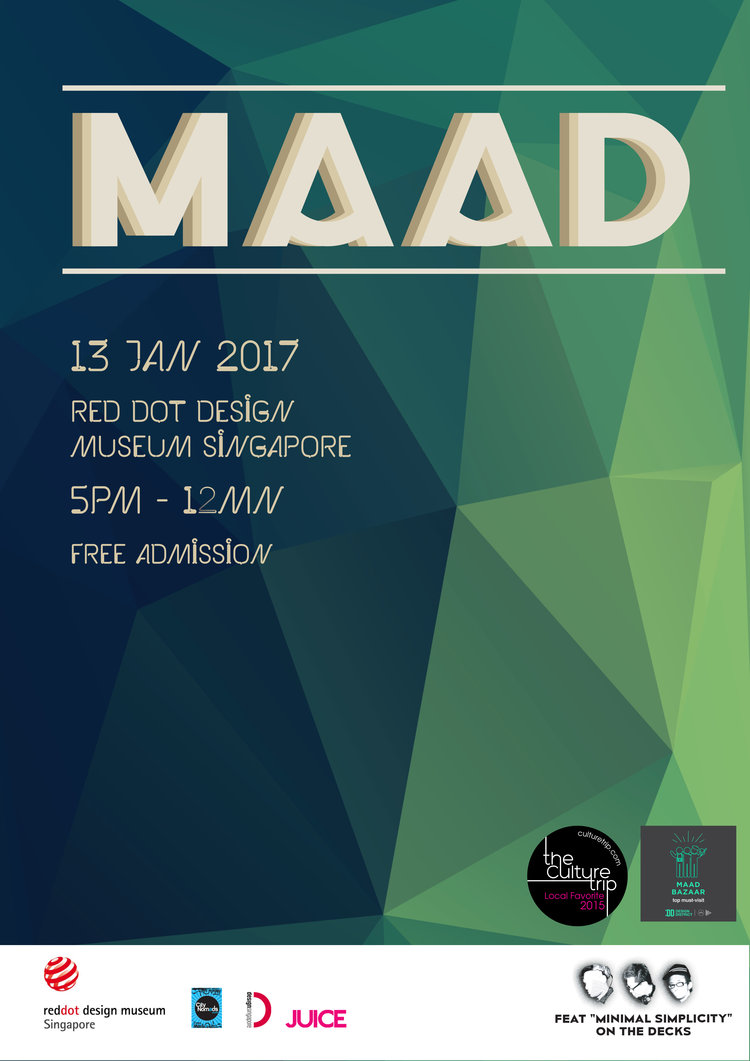

If your perception of shopping was boxed in the hefty category then, you must be frequenting the Orchard Road a lot! Consider heading to the funky flea markets that are starting to boom in the recent years. One of its most popular markets is the MAAD: Market of Artists and Designers.

Image Credits: museum.red-dot.sg/maad

MAAD houses pet-friendly and budget-friendly items for the whole family. Their innovative creators are from independent and are known for artsy fashion and artisan stationary pieces. Here you will find plush toys, handmade jewelry, and paintings. The price range starts from S$10 to S$50.

Related Article: Score Great Deals At Flea Markets In Just 5 Steps

#2: START WITH A HUGE EMERGENCY FUND

Potential Danger: Risk of setting yourself up for failure.

Emergency fund is an account utilized to set aside money in the event of personal financial dilemma such as unemployment or theft. Most financial planners suggest to build an emergency fund worth at least 6 months of your income. This is tough to accomplish if you are living from paycheck to paycheck.

For instance, your household spends S$5,000 each month. You managed to eliminate 10% of your expenses. Building a 6-month stash can set you back by nearly 5 years. This is too long! A better route is to start small by aiming for an emergency fund of S$1,000. This will help you cover minor financial hiccups. Once you are on track with your debts and retirement account, focus on growing your emergency fund.

#3: ONE’S CPF SAVINGS IS ENOUGH TO COVER RETIREMENT

Potential Danger: Risk of enduring an insufficient fund due to the over-reliance on a single welfare system.

Contrary to the popular belief, your Central Provident Fund (CPF) savings may not be enough to sustain the lifestyle you envision during retirement. Your CPF account is essentially a basic safety net to cushion the minimum standard of living during your golden years. Aim for other streams of income that can help grow your nest. Why?

For starters, your CPF savings depends on how much you earn during your working years. If your income is relatively low throughout the years then, you can expect to receive lesser payouts than your “higher earning” colleagues.

Furthermore, you may use your CPF savings to pay for your present necessities. If you exhausted your account to purchase an HDB flat then, you shall expect to receive lesser payouts.

Image Credits: pixabay.com

Stop making excuses! Plan strategically for retirement, now.