My house has got a whole new look – thanks to the interior designers which put the furniture and fittings in place. The family car which has served us well for months has just went for a major servicing after running for another 40km. And i just had my dinner in a restaurant – a bento set prepared by Japanese chefs.

The services sector is paramount to the Singapore economy and as we get more innovative, it is not uncommon to see businesses offering different value added services to meet the demand of its people. Think Uber and Helpling.

That being said, i never let a financial planner handle my finances. Why, you might ask, since they are all services that help make the life of the common folks easier?

True. We are human beings after all and we tend to follow the path of least resistance. Why burden ourselves with the technicalities on how to fix a car or the myriad ways of where to place my sofa sets? I can definitely make my own meals, but i probably can’t dish out the the Xiao Long Bao at Din Tai Fung or to enact the perfect ambiance in a fine dining restaurant.

And if things goes wrong, the most i probably have is an upset stomach or a house that looks like a hostel. (which can be easily remedied without much repercussion)

My finances? There is more to just switching to the next better plan – my future is at stake.

Taking responsibility of my own finances

As Dave Ramsey aptly put it,

Personal Finance is only 20% head knowledge. It’s 80% behavior!

Don’t get me wrong. Personal finance can be complicated if you put the dynamics of investment and financial risk into the equation. Financial planners like the insurance agent or the bankers have their place in today modern society.

But if you are the ordinary man or woman on the street, like myself, chances are you are qualified to make your own decision. The word here is qualified and by that, i don’t mean you need to be educated in the area of Banking or Finance. If you have manage to chance upon this article, you are probably savvy enough to hook yourself onto the World Wide Web. With the internet, you can do wonders with the vast amount of information and knowledge out there – from learning how to cook a Shepherd’s Pie to planning your solo trip to Europe.

Can you manage and plan your own finances using the internet? You bet!

A website with useful resources would be MoneySENSE, a national financial education programme in Singapore. It has almost everything you need to become a financial literate – from the theoretical aspect to the nifty calculators.

Financial planning involves a few steps, and while you can budget and plan for your retirement the way you want it, there is one important factor that many have overlooked. Risk.

You can craft yourself an ingenious financial plan, but it can never be perfect should something unfortunate happen yesterday and ruin it. And that’s where insurance comes into play – to transfer the risk of loss to another party (the insurer in this case)

Encounters with insurance agents

Why would i not consult the insurance agents then? Well, i did, few years ago.

After several sessions with 3 financial advisers from different companies, i have had umpteen reminders that i need to save for retirement since i’m in my twenties. Spot on. We should always start accumulating wealth early and take advantage of the effect of compounding, where returns are reinvested to generate their own earnings.

But that’s not what i’m looking for. As i already have some money invested in the Straits Time Index Exchange Traded Funds, or STI ETF, i’m looking at covering myself with term insurance to hedge the risk of loss from unexpected events.

However, I was informed that i need to diversify my investment and/or to have another account to grow my wealth so i was recommended a whole life insurance and endowment products on the basis that i need another saving plan. I was also informed that term plans has no cash value and i’m just throwing my money into the drain.

Being the skeptical me, i was not sold to their recommendation and furthermore i have just started working with not much funds for any other products.

Online Insurance Aggregators

Only recently when i came across the news that there were websites out there that actually helps you to compare the different insurance plans from different insurers, i know it’s about time to reconsider my options.

There are two useful sites which i have tried: compareFIRST and DIYInsurance.

Both are similar as they serve as a platform for consumers to compare the different insurance policies out there. They also provide handy calculators for you to work out the amount of coverage you need without consulting the insurance salesperson.

compareFIRST has a comprehensive list where you get to compare different insurance companies in Singapore. It even allows you to compare Direct Purchase Insurance (DPI), which is purchased directly from the company without any commission charged. The limitations of DPI is you can only purchase up to $400K of sum assured with a fixed term of 5 years, 20 years and up to age 65.

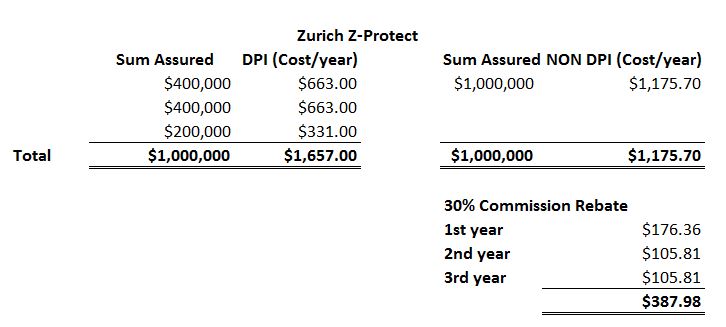

As i have calculated my need to insure myself up to $1 million, i could not take advantage of the more affordable DPI. I could have purchase two policies of $400K and one policy with $200K sum assured, but that is not cost-effective than if i were to purchase a single jumbo term insurance from a company.

Usually, insurance companies offer a substantial discount if you were to purchase a large term plans. I have used quotes obtained for Zurich Z-Protect in this example and as you can see, i end up paying $481.30 more a year if i were to purchase 3 separate DPI policies than a single non-DPI policy.

And this is where DIYInsurance has a sweet spot.

As its name suggest, you have to do your own planning and calculate your own needs and because of that they rebates 30% of the commission from non-DPI policies back to the customer. That works out to be a saving of around $387 (good enough to purchase a pair of Scoot economy tickets to Bangkok.)

If you think that you probably get little or no services because of doing it yourself, you are wrong.

Mr Christopher Tan, CEO of Providend said:

Instead of asking our insurance specialist to work out the insurance recommendations for you, we put that advice on the portal by way of the comparison tool. But anytime you need help or advice, you can always email, call or web chat our licensed and trained client service managers. Having said the above, when you come in for documentation, we will still do a final check for you to make sure your planning have been sound and we will still provide you with product advice, meaning, we will explain in detail the insurance you are buying.

That is basically saying you are getting your insurance with services – for less. Don’t worry about getting into sales talk with their client service managers because they are remunerated a fixed salary with no commission, so independent and transparency is the key here.

In conclusion

By taking responsibility of your own finances and doing it yourself, you not only save money but you also have a clearer picture of your own future – which means more flexibility to adapt to changes in different life stages. Would you rather be dependent and scramble to look for your insurance agent many years down the road when you get married, have your first child or buy your first apartment?

It’s your call.

(This is a sponsored post by DIYInsurance)