“You don’t have to see the whole staircase, just take the first step.” ― Martin Luther King Jr.

The first step is usually the hardest. However, you need to take the first step to live your best financial life. The longer you wait to establish your personal budget, the farther away your goals will be. Start by setting your money goals. Money goals include savings, investment, or spending targets that you hope to achieve over a given timeline. Money goals can give you a clear idea of why you are saving your hard-earned money.

Setting money goals is one thing but transforming these dreams into reality is another. Begin by giving your money a “job”.

#1: MAKE YOUR MONEY WORK FOR YOU

In the office, you have to accomplish tasks and finish them in the future. The same holds true for your money goals. What kind of life do you foresee for you and your family? Let money work for you!

Money goals are savings, investment, or spending targets you hope to achieve over a given timeline. Money goals do not have to be set in stone as you will revise them throughout your life.

#2: CATEGORIZE EACH MONEY GOAL

There are diverse types of money or financial goals. You can categorize each money goal as short-term, mid-term, and long-term. Short-term goals typically take six months to five years to complete. These goals include taking a vacation or purchasing a new washing machine.

Mid-term goals are accomplished within a period of five to ten years. It includes paying off your credit card debts and finishing a degree. Lastly, long-term goals take more than ten years to finish. It includes buying a new flat or saving up for your children’s education.

#3: SET A TIMELINE

You cannot achieve a goal overnight! Being specific helps make your goals more achievable.

If you have a toddler that is set to head into university by 2035, you must have a target date for your tertiary education savings goal. If you want to travel Europe for your 10th wedding anniversary, you must have a timeline that you are working toward.

#4: DO YOUR RESEARCH

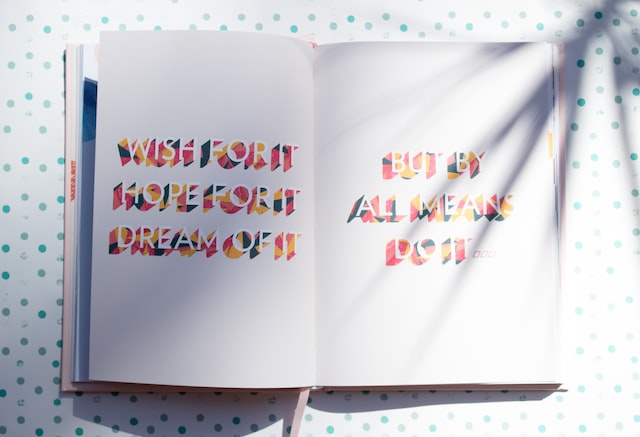

Look for goal setting tips and resources online to stay on course. Money apps for goal tracking can be helpful too. Additionally, you can use old-school methods such as placing a vision board in your bedroom. Affix a collage of pictures that represent your money goals. If you see it, you believe it.

Image Credits: unsplash.com

Having a tangible representation of the future you are working toward can help you stay motivated. Whatever method you choose, know that it will all be worth it.