So your spouse wants to retire early and you’re scratching your head until botak now trying to talk sense into them, worrying about how to pay bills if no more salary’s coming in?

Well, this one sure ain’t easy.

Your spouse is already excited at the thought of waking up late, going on long teh/kopi dates every day, and playing mahjong with the kakis. How to tell them that money is not yet enough for this kind of lifestyle?

Should you be the bad guy and pour cold water on their retirement dreams? Or let them retire and struggle together if the money isn’t enough? This is one big headache for you we know so let’s try tackling this together.

Signs your spouse may not be financially ready for early retirement

Image Credits: ichoose.ph

If your spouse wants to retire early but you have doubts about whether you have enough money, take these signs as a guide:

- He/she still has outstanding loans or mortgages to pay. If one hasn’t cleared their housing loan or has other big loans like car loans, retiring early means less income to service the debt.

- No proper plan or budget for how to spend money during retirement. If your spouse cannot show how much he/she needs to spend each month and where the money will come from, it’s likely they will end up withdrawing too much from savings.

- Not enough savings or investments to last in retirement. Most financial experts recommend having at least 10x of your annual income (if you’re in your 60s) in retirement savings these days. If savings are nowhere near that, the answer is clear.

- No idea how to pay for healthcare or insurance after retirement. Healthcare costs are one of the biggest expenses during retirement. If your better half has yet to think about how to pay premiums or out-of-pocket costs, retiring early is a recipe for disaster.

How to approach your spouse about financial readiness

- Have a heart-to-heart

Explain your concerns sincerely but with respect. Say how you want the best for both of you, but early retirement may be too risky if not ready financially. Listen also to their reasons for wanting this. Compromise and find common ground.

- Check your numbers

Suggest doing a “financial health check-up” with a professional advisor. See how much you’ve saved, how long it may last, investment returns needed, healthcare, and living costs. This can give a better picture to your spouse also on what’s needed to retire comfortably.

- Consider the risks

Early retirement often means less time for savings to grow and more years of expenses to fund. Inflation, healthcare costs, and unexpected emergencies can impact your nest egg. Discuss the potential downsides and have contingency plans.

Strategies to help your spouse prepare financially for retirement

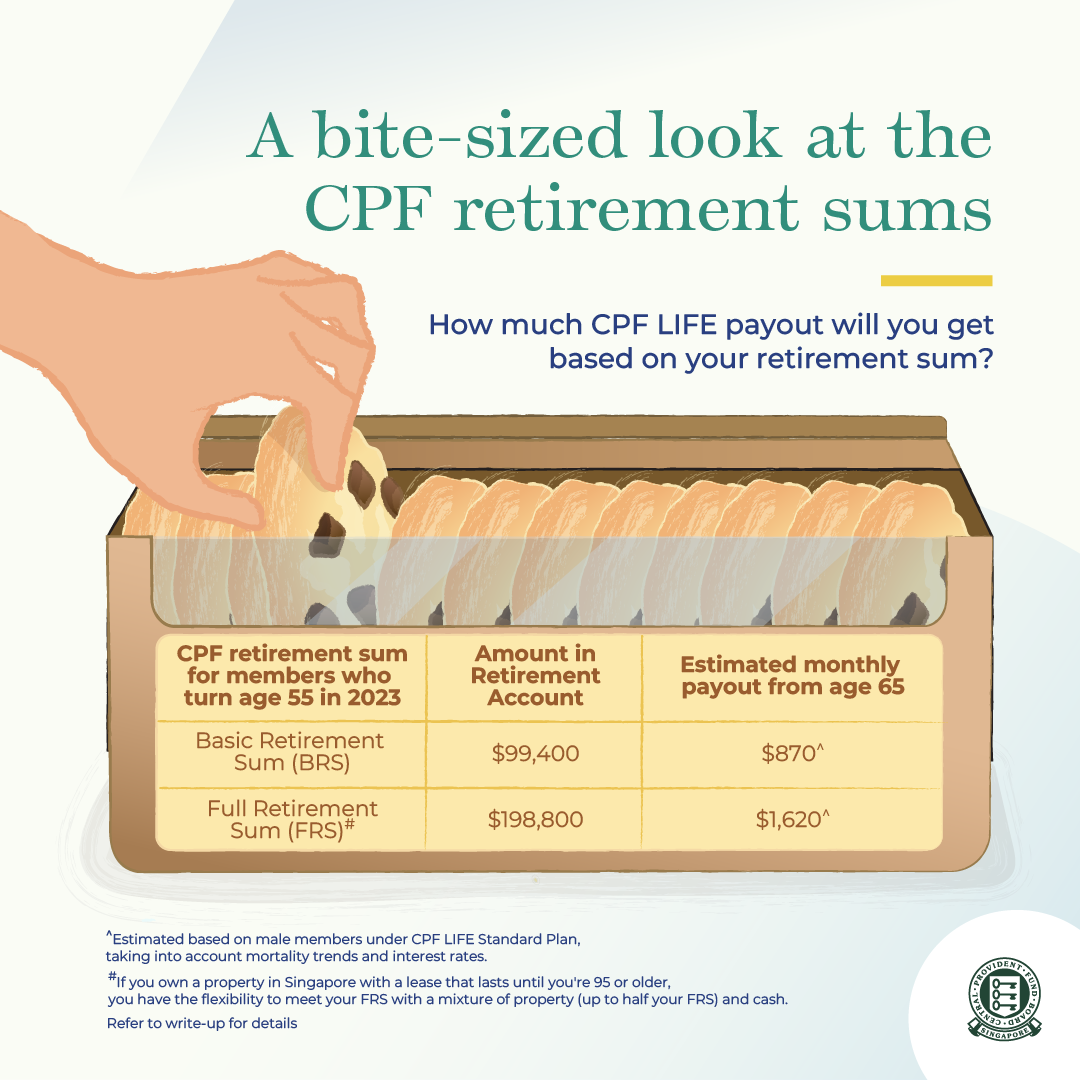

Check CPF and savings.

If it’s not enough to generate a steady income for potentially 20-30 years of retirement, your spouse may end up going back to work out of necessity, whether they want to or not.

Image Credits: cpf.gov.sg

Look into ways to earn passive income, like investing in stocks or real estate. Meet with a financial advisor to develop an investment plan. The sooner you start, the more time for the money to grow.

Discuss a realistic timeline for retirement that factors in your financial situation. Maybe your spouse retires partially by going part-time first before fully retiring. Or retire from their current career but start another, more flexible job.

Retiring early is a big life decision that requires careful planning. Help your spouse face the financial realities now so they can actually achieve their goal of a comfortable retirement, rather than struggling to make ends meet. With time and the right strategy, their nest egg can grow into something that can support him/her for life after work.

So if your spouse is insisting on retiring early when you are both not ready, don’t panic. Sit down, have a heart-to-heart talk, and explain how rushing into retirement when the money is not enough will only lead to more headaches and stress down the road. Show them the numbers, and let them see for themselves how waiting a few more years means a bigger nest egg and fewer worries. Early retirement is shiok but must do it right, not jump the gun. Take it slow, and plan properly. When the time is right, you both can retire comfortably without regrets, and start this new chapter of life on the right foot.