The traditional mode of how insurance is sold is a frustrating process for most people. Consumers do not know where to start when it comes to getting insured. In many cases, there is a sales-pitch and high pressure selling from advisers who have a conflict of interest.

To address these needs, Do It Your-way Insurance (DIYInsurance) was launched in 2014 to empower people to make informed decisions about their own insurance purchase and they started Singapore’s 1st Life Insurance Comparison Web Portal for users to compare insurance products and provide greater transparency. To-date, more than 150,000 users have used DIYInsurance.

Consumers find it difficult to know where to start when it comes to getting insured. To help consumers obtain an assessment of their life insurance needs, they have recently launched Selfcheck, Singapore’s 1st digital adviser to bring insurance planning to the next high level.

This is like having an insurance adviser help you with your insurance check-up and providing instant advice, but without you feeling the obligation to buy anything.

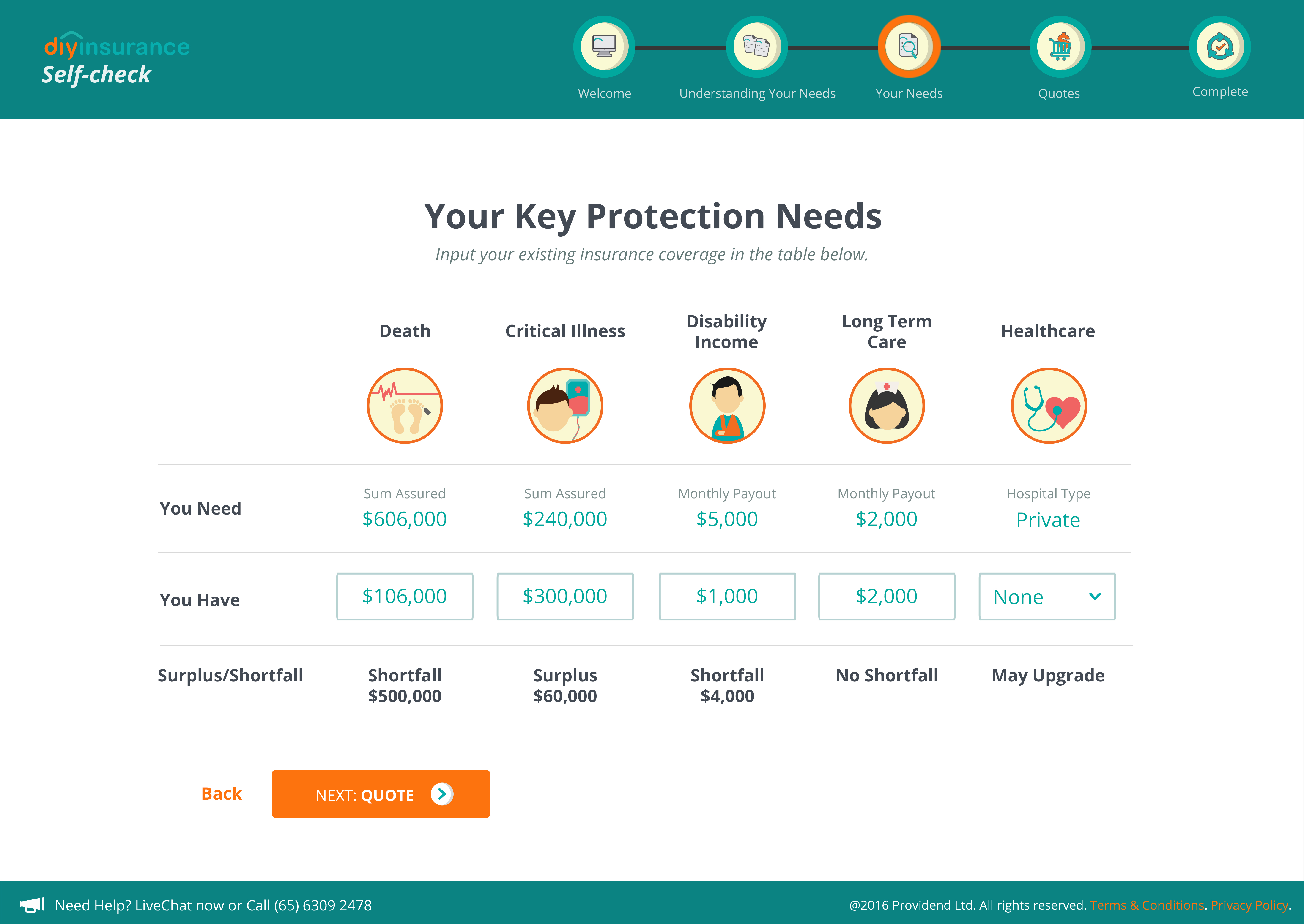

You can easily uncover:

- types of insurance you really need

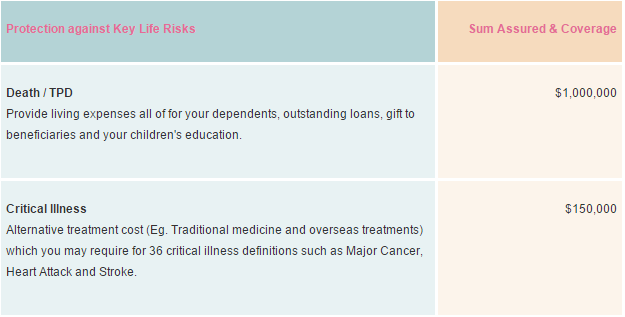

- how much insurance you require

- surplus or shortfall in your insurance coverage

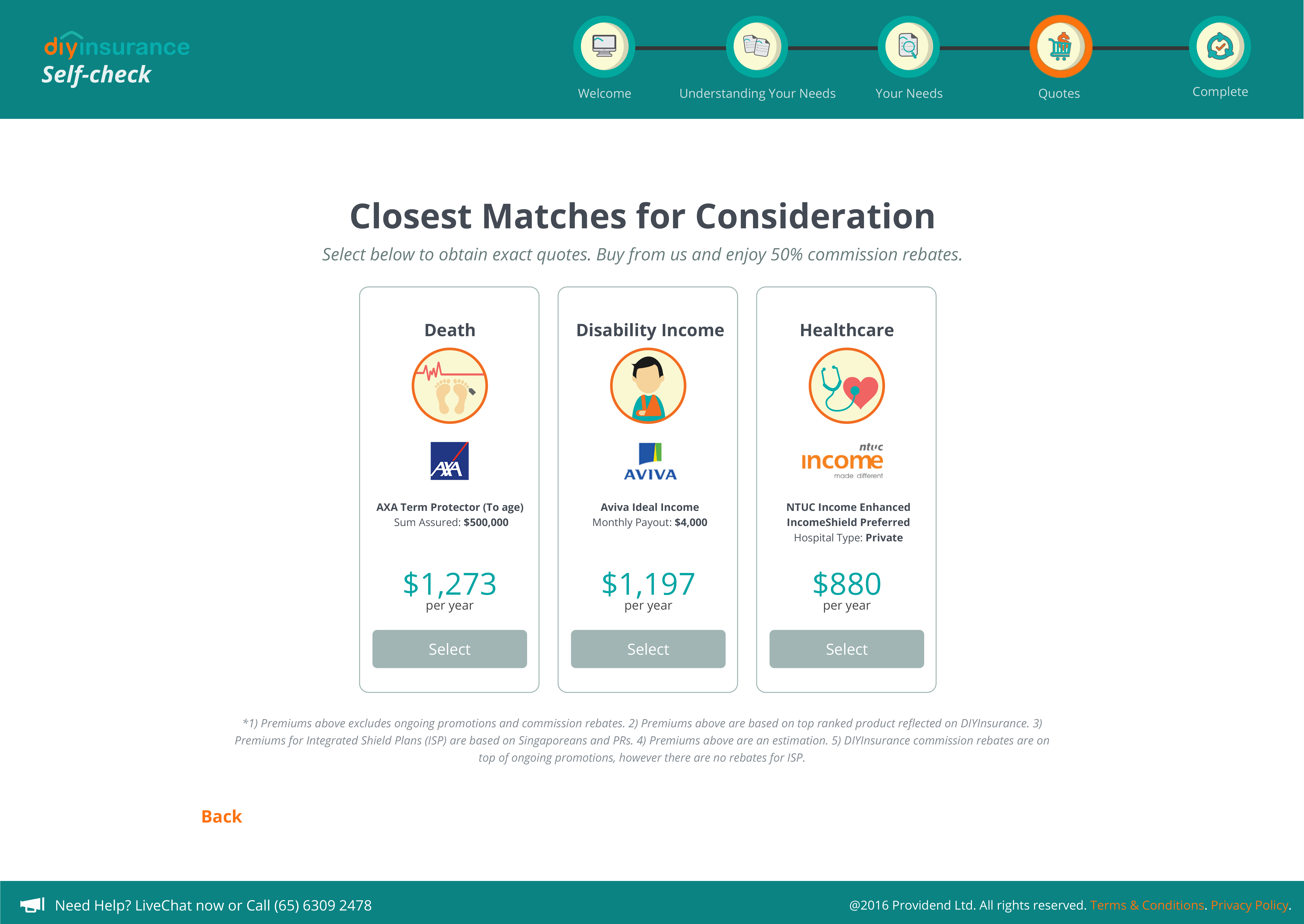

- recommended policies to meet your needs

Everyone can now perform a Selfcheck and obtain a customised and tailored insurance solution from a place they can trust.

The DIYInsurance Difference

Expert advisers to assist you

When you plan your insurance with DIYInsurance, they assign a dedicated expert insurance adviser to complete your planning process. Simply put, you use Selfcheck to build your own insurance plan and the human insurance adviser act as your guide to complete the process by fine tuning your plan. This is insurance advice at its best.

Honest advice

To avoid conflict of interest, all of their insurance advisers are salaried-based and not remunerated on a commissions-basis hence there is no incentive to hard-sell and push products that reward higher commissions. DIYInsurance wants to provide the most honest, independent and competent advice to their clients.

Dedicated after-sales service

If there are any claims or after-sales service requirements, you not only can approach your adviser, DIYInsurance has an entire team of Client Service Managers who stand ready to assist you. All you need is to contact them and they will do everything for you.

It is critical is that there is a trusted DIYInsurance adviser and a client service team whom you can always go to. DIYInsurance is not just High-Tech, they are High-Touch.

Lower Cost

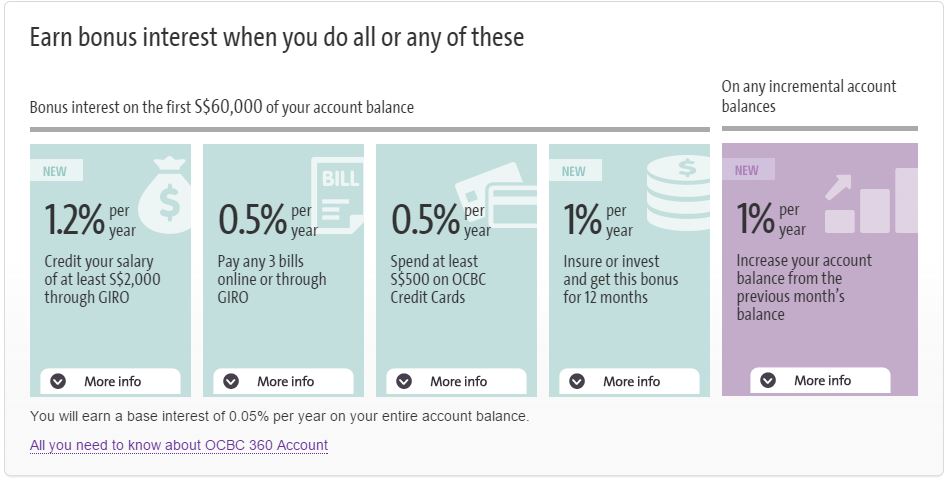

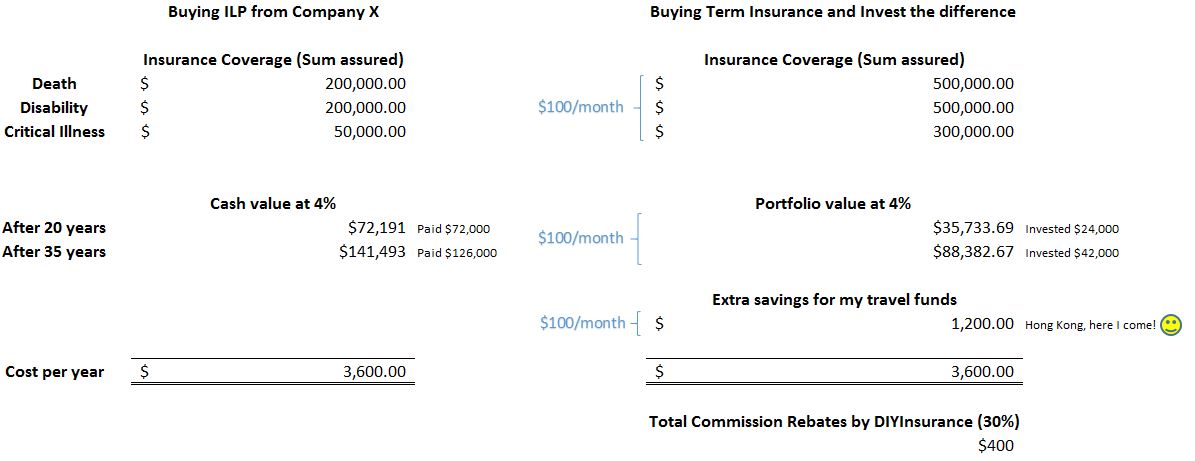

With Selfcheck, the insurance process is made more efficient and hence they are providing greater cost savings to their clients by increasing their commission rebates from 30% to 50%.

DIYInsurance rebates 50% of the salesperson’s commissions to their clients and retain the remainder of the commissions as their service fees. These rebates to their clients are on top of ongoing policy promotions offered by the insurers and they rebate the commissions for as long as the insurer pays them on a policy which could be over a period of 3-6 years.

Expertise

Started by Providend Ltd, a licensed financial adviser and registered fund management company with the Monetary Authority of Singapore (MAS) since 2003, the key leaders of DIYInsurance are Chief Executive of Providend Ltd Christopher Tan, MBA, CFP® and Head of DIYInsurance, Eddy Cheong, CFP® whom each have almost 2 decades of experience in the wealth management industry. All DIYInsurance advisers are licensed with the MAS.

Summary

When you plan your insurance needs through DIYInsurance, what you get is quality, transparent and conflict free advice at a much lower cost from a trusted place. Best of all, you can do all this at the comfort of your desk, without feeling the pressure that you need to purchase something. In addition, you still get all the help needed when you need to claim against your policies. That is why DIYInsurance is not “Do It Yourself Insurance” but “Do It Your-Way Insurance”. Try Selfcheck today!