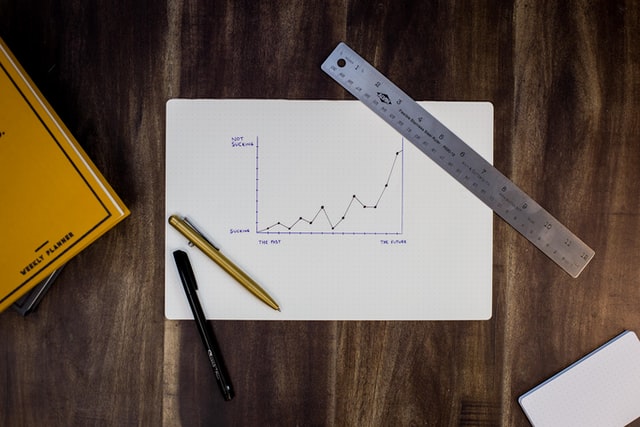

Your sense of stability will be at its peak at the age of 40. During this phase, you will get more control on your finances and your family plans. You may prioritize your child’s education and sustain the needs of 3 people in your household. On the flip-side, being financially stable in your 20s is a rare sight!

It is terrifying to navigate through the adult world while being confused with will happen next. Sometimes, you think you have plenty of money to spare. The next minute, you feel that you need to call your mom or dad for help. This stage of instability can last up to your 30s.

Relax. You are not alone. For a friendly warning and healthy awareness, here are the telltale signs that you are not doing financially well.

999. WHAT’S YOUR EMERGENCY?

It comes as no surprise that you will borrow a small amount of money while you are applying for a job. Sometimes, you may ask for a little help too. However, if you have your parents on speed dial as your financial helpline, you are in a sticky situation.

Your parents may not be able to support your financial needs all they time as they are going through another phase of their lives – retirement. It is seemingly embarrassing to rely on your parents when you have no cash left as an adult. Hence, you need to do your best not to be an added weight to your parents.

YOU BETTER HAVE MY MONEY!

With red markings on your calendar, you saw that #PAYDAY is two days down the line. You keep on waiting for this day to come. You have not gotten your salary yet, but you have numerous plans on how to spend your money. Do you want to hangout with your friends at the pub? Do you want to purchase the designer bag online? You have no worries! You got plenty of money. At least, that was what you thought.

Seven days after your payday, you are already regretting most of the things that you have done. Why didn’t you spend your money wisely? You should have kept some of your money in your investment portfolio. Now, you are wondering how you will get through the week with only S$50 on your pocket.

PAY ME WHAT YOU OWE ME!

It is your creditor’s phone operator again. The operator is calling to remind you about your unpaid credit card bills. You think you are responsible just by carrying a credit card? You think you will only use it for emergencies? Think again!

As you get comfortable with swiping your expenses on your plastic card, you will be able to widen the scope of your shopping categories. After two to three months, you will notice that you will feel safe to swipe your card when purchasing new clothes and when eating out. Online shopping? It is easy with a credit card!

Your bill arrives and you feel horrific! You are wondering where you can borrow money to pay for all your bills.

WHAT SAVINGS?

You are in a financially unstable place if you do not have a savings account. A payroll account does not count! It is essential for working adults to have a separate savings account to create an emergency fund.

People typically see the value of a savings account after being caught in a financial mess with no emergency funds or no one else to run to. Taking loans or cash advances can incur more debt in the future.

THE FUTURE IS NOT NEAR

You are not thinking about your retirement. Retirement? Yes. You are too young for this. You have your lives ahead of you. But, time is in your hands. Use its power to create a wealthy retirement fund.

Image Credits: unsplash.com

You do not want to beg people for money 30 to 40 years down the road. Being financially stable is a lot of hard work, but you can achieve that by planning and spending wisely. Reach your financial goals in a slow and steady pace.