I’m going to give it to you right from the start:

The convenience of a rubbish chute.

Yes, I think that’s the main reason why recycling won’t work in Singapore.

I’m looking into this issue because I happened to read a commentary on CNA where the writer wrote about how he doesn’t need a free Bloobox to get started on recycling at home.

And it reminded me of my recent conversation with my mum regarding the free Bloobox collection.

If you haven’t heard of the term “Bloobox” yet, don’t feel left out. That’s because I didn’t too…

What’s the Bloobox initiative?

My mum recently received a flyer regarding the collection of a free Bloobox for recycling.

She showed it to me, which sparked my interest in that initiative.

I then saw it on the news on the same day, where it was reported that locals were collecting them from vending machines.

Image Credits: straitstimes.com.sg

But that was that, I didn’t look into it further.

Not until today, after I came across the commentary written. Yup, the one I mentioned earlier.

So I searched “Bloobox” and this was what came up: gowhere.gov.sg/bloobox

Apparently, this initiative is part of the Recycle Right campaign that started on 19 March 2023.

Oh boy, I was totally clueless.

Anyway, if you hold an NRIC or long-term FIN tagged to a residential address, you can collect the Bloobox on behalf of your household from any Bloobox-dispensing vending machine until 30 April.

To search for the nearest vending machine from where your place, simply head to gowhere.gov.sg/bloobox and key in your postal code.

Anyway, this Bloobox functions as a recycling box to encourage households to set up a recycling corner and start recycling at home.

My honest thoughts about the campaign

I don’t think it will work.

Period.

And the main reason is because of the convenience of the rubbish chute we have.

It’s going to take more than a Bloobox to get our lazy bums and hands to start recycling if we can just throw our trash down the chute every day.

Image Credits: tnp.straitstimes.com

I mean, why would any busy Singaporean adopt the recycling habit all of a sudden just because of a free Bloobox?

It’s much easier to just gather food waste and recyclables in one big plastic bag and throw them away, isn’t it?

Don’t get me wrong, recycling is cool but having tried recycling while living abroad, it’s not an easy habit to pick up (unless official rules start kicking in). And if the rubbish chute is there, nothing gets solved.

Drawing from my recycling experience abroad

I’ve had the “privilege” of living abroad and being among locals means I had to adopt their living patterns and law, right?

But coming from a country where we do not need to recycle (by law), the whole recycling thing was a hell of a lesson for me.

But hey, everyone’s got to start somewhere, and with practice, I got better.

Anyway, the main point of bringing this up is because where I lived, there was NO rubbish chute.

So then your question might be:

“So, how to throw trash ah?”

Well, that’s where the whole recycling thing comes into the picture.

For explanation’s sake, there are 3 broad categories:

- Food waste

- General trash

- Recyclables

I won’t get into much detail on food waste and general trash but to give you a rough idea, I had to pay to get rid of them. Yes, that was how it worked.

As for recyclables, the place where I lived (each region has slightly different rules on recycling) did not specify the type of plastic bags to use so I bought big white plastic bags from Daiso to contain my recyclables before throwing them out in bulk.

Here comes the best part…

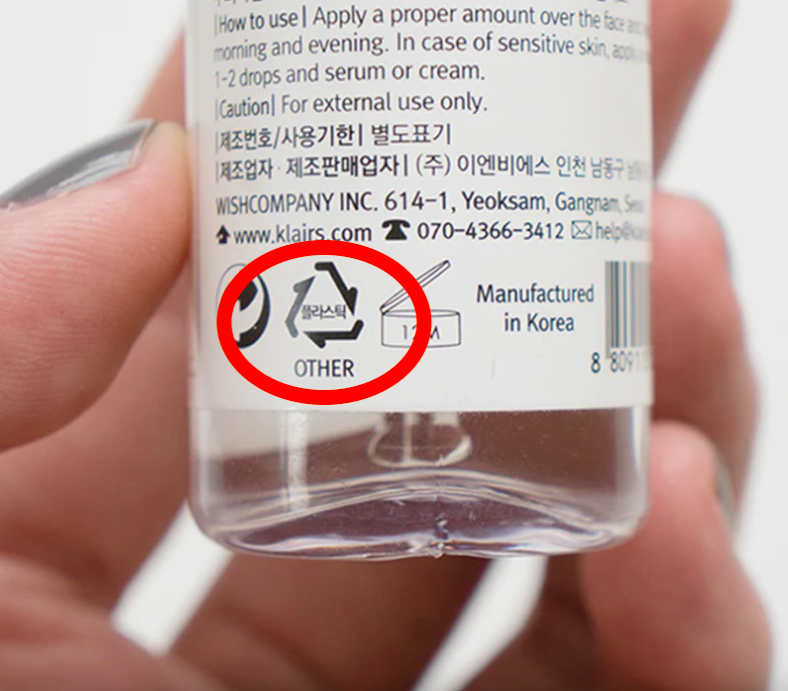

I like how 99% of the products in Korea have labels on them so you know exactly how to sort them.

It looks like this:

Image Credits: sokoglam.com

After a while, you somehow get the hang of things but as a recycling newbie adopting this whole recycling routine, the labeling was a lifesaver.

In Singapore, we don’t have that. At least, that’s what I’ve realized.

But we do have a “recycling search engine” to help you determine what can be recycled and not: cgs.gov.sg/recycleright/check-my-item

But a tad troublesome, hor?

I think Singapore has a long way to go when it comes to educating the public on recycling.

It takes just one culprit who doesn’t know the rules of recycling to contaminate the entire blue recycling bin.

I’m saying this because just last week, I spotted a man throwing his cai fan styrofoam box into the blue bin near my neighborhood.

So, there you go. Gone.

Poor blue bin and its clean recyclables inside.

In closing, I think it’s going to be a long fight with our current recycling efforts. We cannot afford to take our own sweet time because the Semakau Landfill is expected to be full by 2035. If Singapore can step up its recycling game and be much more aggressive with its campaigns, we can certainly slow down the speed of landfills being filled and contribute to a much greener world. So what say you? Are you still planning to use your newly collected Bloobox as a storage box? Or are you putting it to good recycling use?