Update: As part of support measures in light of the COVID-19 situation, the due date for filing of personal income tax returns has been extended to 31 May 2020.

Tax season 2020 is here! If you’ve yet to file your taxes because, “still got time”, you’re not alone. But why risk it, especially when the consequences of accidentally missing the 18 Apr 2020 deadline are so not worth it?

Here’s a quick way to make sure you’ve maximised your reliefs and file your taxes – and be done for this year’s tax season.

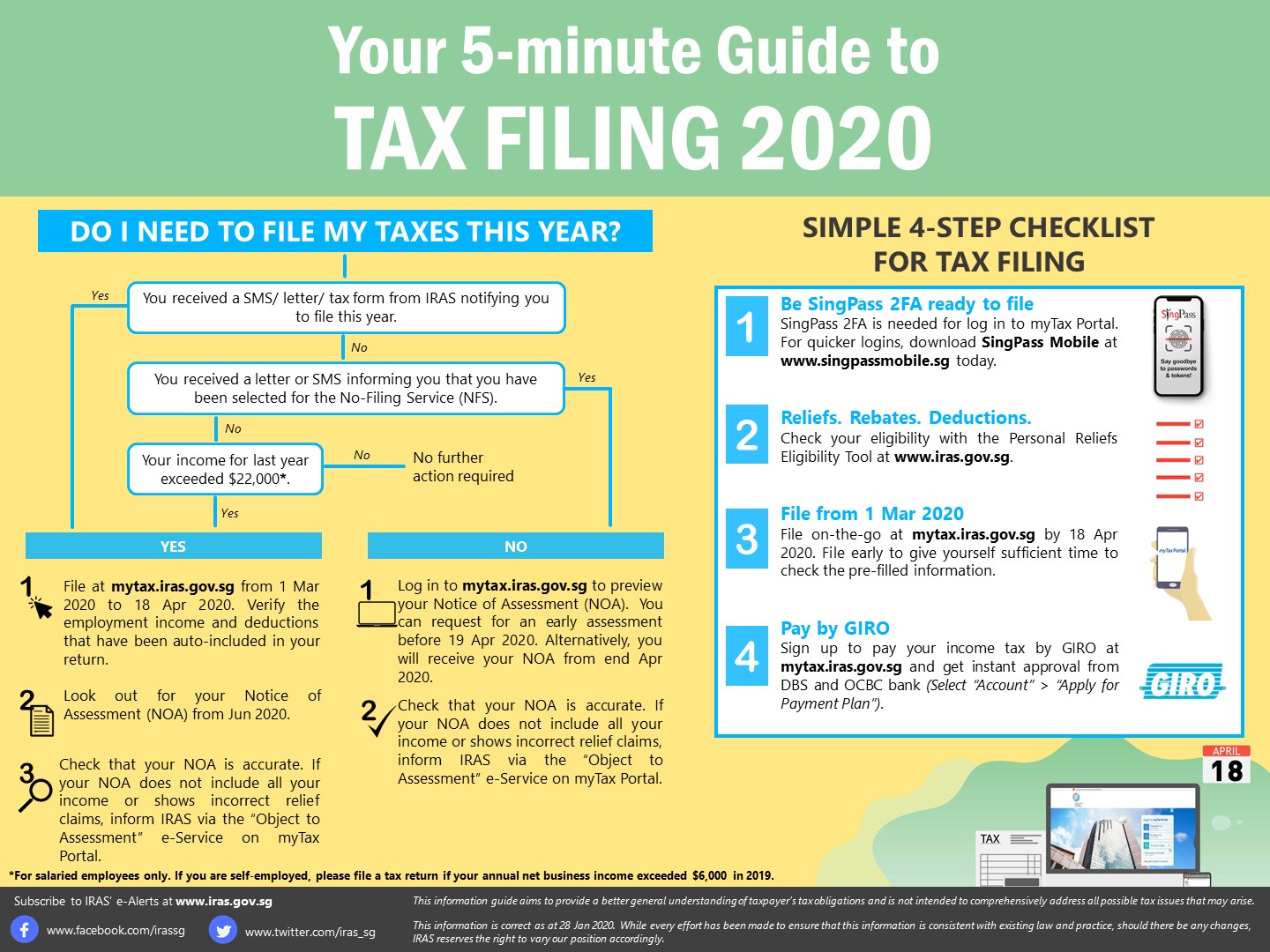

1. Find out if you’re required to file your taxes this year

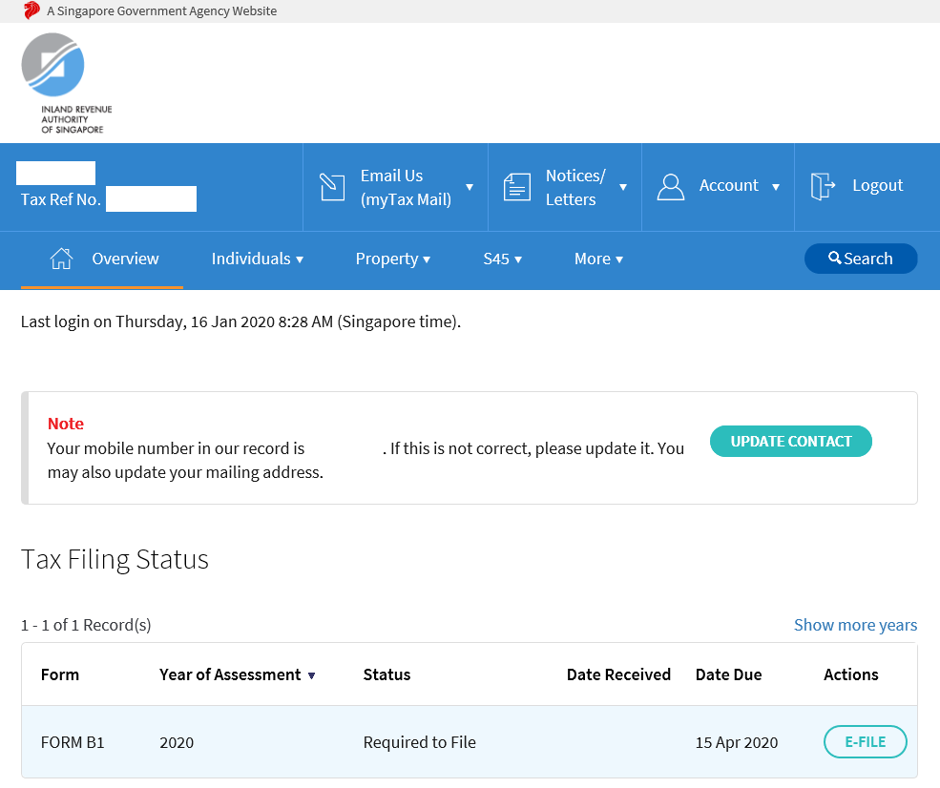

2. File your taxes or preview your Notice of Assessment (tax bill) by logging in to https://mytax.iras.gov.sg using your SingPass

If you need to reset your SingPass, visit www.singpass.gov.sg/singpass/onlineresetpassword/userdetail.

3. Edit your tax return and claim the tax reliefs available to you

Your income information may have already been pre-filled in your tax return if your employer is under the Auto-Inclusion Scheme. This means that your employer submits your income information to IRAS on your behalf so you need not calculate your past year’s income all over. However, if you received additional income in 2019 or spot an error in your tax return, hit “Yes, I have other income to declare or changes to the reliefs” to ensure that these are correctly reflected.

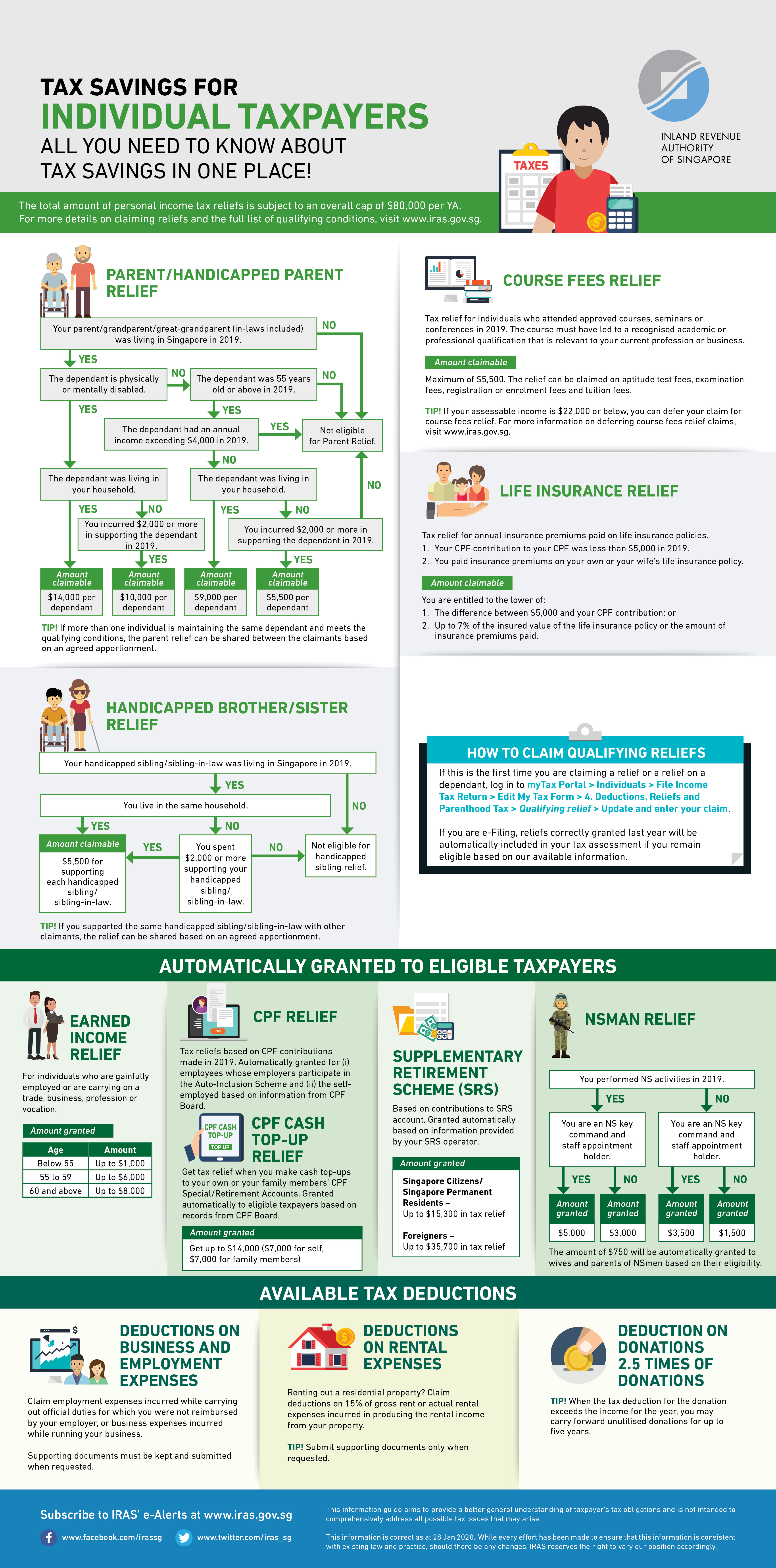

Tax reliefs and deductions are targeted at certain groups of people to encourage social and economic objectives, such as filial piety and the advancement of skills. If you are eligible for any of the tax reliefs below, be sure to make your claims for them in your tax return to lower your tax payable.

Ensure that you meet the qualifying conditions for the tax reliefs though. They won’t be of much use otherwise – wrongful or ineligible claims won’t get you any tax reliefs. Find out more about the qualifying conditions and claim amounts at https://www.iras.gov.sg/irashome/Individuals/Locals/Working-Out-Your-Taxes/Deductions-for-Individuals–Reliefs–Expenses–Donations-/.

4. Cross tax filing off your to-do list and look out for your tax bill

When you’re ready, hit Submit before logging out. An acknowledgement message will be displayed upon successful submission of your tax return, and with that, you’re all done with your tax matters! You’ll know how much your final tax payable comes up to when your tax bill arrives – by mail or digitally. Make payment for the tax bill, or sign up for GIRO to automate your tax payments across 12-month instalments.

And if you’re wondering where all that tax money go to, check out this video.