Your home is often the biggest purchase you ever made in your life, however that also means landing yourself the biggest debt you ever had.

Properties in Singapore are expensive – be it HDB flats, excecuive condos, or bungalows. It’s not uncommon to have a million dollar price tag onto it. And often, taking up a mortgage loan would also means being in debt for 25, 30 or even 40 years.

Therefore, you want to be careful in choosing the most cost effective lender with the best mortgage terms.

Lenders usually offer many different types of mortgage packages such as interest-only mortgages, off-set mortgages and more. Understanding the difference between a fixed or floating rate loan and which is better is a major financial decision for home buyers.

Fixed Interest Rate

As the name suggests, the interest rate tags to your mortgage is fixed for a specific period and could span 1, 3 or 5 years before reverting to a floating rate once the term is up. For buyers who are risk adverse and want to reduce uncertainties, fixed interest loan is the way to go ask you don’t subject yourself to the fluctuation in interest rates. The cost to it is you have to pay a premium on top of the existing rate (so that lender can hedge the risk of lending you at fixed term) and when interest rate falls, you still pay the same rate when other borrowers on floating terms pay a lower rate.

Floating Interest Rate

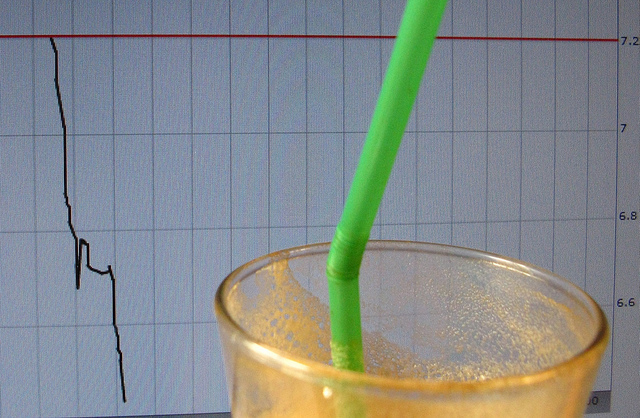

On the other hand, floating interest is revised every month or every 3 months.Your repayment amount would therefore change every month. The rate fluctuates according to the Singapore Interbank Offered Rate (SIBOR), Swap Offer Rate (SOR) or the Internal Board Rate (IBR). SIBOR and SOR are more transparent than the IBR which may change according to the company’s discretion, so make your choices wisely. A floating interest rate is more suitable for astute buyers who are able to accurately assess and predict interest rate movement.

Which one to choose?

It’s never easy to decide which rate to choose as it is akin to selecting the correct stock in a market filled with uncertainties. Interest rate movement is volatile and may go up or down without you being prepared for it.

First, ask yourself if you have the financial means to afford a risk in an interest rate hike. If you are someone who just barely scraped through the monthly repayment, you should not be gambling with the interest rate, albeit a lower initial cost. What you need is certainty, so that you would be able to accurately plan and budget your monthly expenses. You don’t want to go around borrowing money to meet other necessary expenses. A peace of mind has a value in itself.

Conversely, if have lots of spare and liquid cash (now and in the future), you may consider a variable SIBOR if you want to take advantage of the low interest rate environment. If you want some degree of certainty, you can consider taking a longer tenor SIBOR rate of up to 12 months, even though it cost a little more than a 1 or 3 month SIBOR.

It is also important to note its correlation with the US’s fed rate and with interest rate hike looming as early as April 2015, it may be wise to time the commencement of your loan.

If you want to reduce your exposure to the US market, you can also consider DBS’s fixed deposit home rate (FHR) which is calculated from the average of DBS 12-month and 24-month interest rate. The FHR is more stable and is not subjected to constant repricing on the daily market movement but that is not to say that it is completely independent of externalities. It is still considered a board rate which DBS has the discretion to adjust the rate to meet their objectives.

There are also other factors to take note of in deciding the right home loan package. One should also consider if there is any prepayment penalty should you decide to pay off your loan early or refinance it in the future. The duration of the loan should also be taken into consideration when deciding whether to take a fixed or floating rate loan. If you take a longer tenor loan, what you need most is stability.

If you are financial savvy, you may want to keep yourself informed of the supply and demand for funds in the interbank market and how it influences interest rate movement.

Lastly, don’t forget to make Janet Yellen your friend.