These days, rising inflation which causes a higher cost of living means more households are looking for cheaper grocery prices to ensure that they can still buy the same quantity of goods with a similar-sized budget. Therefore, it has become even more important to learn how to shop smart when we are on our grocery runs. Let me share with you 7 ways to become a smart grocery shopper.

1. Fill your grocery basket with discounted items displayed at the front

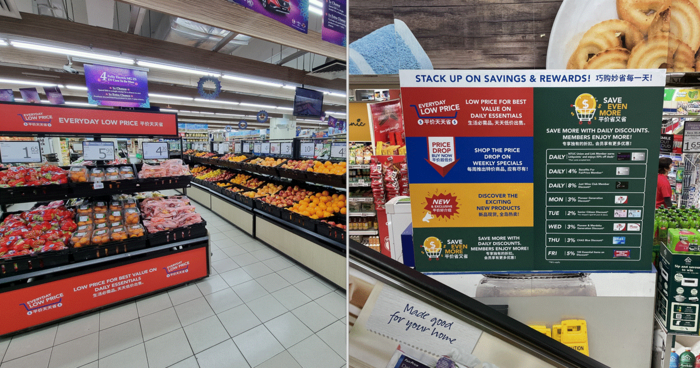

To ensure shoppers never miss out on more savings, do you know that items on promotion are almost always displayed prominently at the store entrance instead of being tucked away at the back? Alternatively, head straight for items marked with the Price Drop Buy Now icon where great bargains are released on a weekly basis every Thursday. Grocery shoppers are thus able to commence their shopping journeys by filling out their grocery baskets with heavily discounted items first.

I adhere to this rule strictly to ensure that I am off to a good start as I gradually navigate my way through the store while I keep an eagle eye on more hidden gems.

2. Buy only essentials that are competitively priced

Here is a quick and easy way to ensure that we are buying essentials that are the lowest priced in the market without having to do the comparison ourselves. At FairPrice, simply look out for the Everyday Low Price icon where 500 daily essential items are competitively priced in the market at any time.

To provide greater savings, FairPrice will freeze the prices of 50 items, out of a pool of over 500 popular daily essential items, every month. The list of 50 items will be announced every last Thursday of the month through its print, online and social media advertisements so remember to keep a lookout!

3. Take advantage of limited-time promotions

Supermarkets tend to run limited-time promotions, especially if the fresh produce are in season during that period. At FairPrice, simply look out for the Price Drop Buy Now icon to snag weekly specials or items that are on limited-time offers.

For myself, I take advantage of these periodic discounts to buy in bulk and stock up on items such as non-perishables which have longer shelf life. Such opportunistic purchases are a smart way to save massively on my grocery bill!

4. Shop strategically on the “right” weekday

When visiting the supermarket, who you shop with may make a difference to your grocery bill! Let me explain how FairPrice provides discounts to various shoppers on all weekdays with Save Even More.

On Mondays, Pioneer Generation cardholders enjoy a further 3% discount on their groceries in recognition of their contribution to nation-building. On Tuesdays, Senior Citizen (≥ 60 years old) enjoys 2% discount. If members of the Pioneer Generation are not free on Mondays, they get a second chance in the week to enjoy 3% discount on Wednesdays at FairPrice, which is also extended to Merdeka Generation cardholders. On Thursdays, it will be CHAS Blue cardholders who get to knock 3% off their grocery bills.

Therefore, I sometimes get my parents to come along during my weekly shopping trips to FairPrice! Not only do I get to enjoy additional discount, I also get to bond with them and learn nifty tips on how to pick the best quality produce! Perfect for killing 2 birds with 1 stone.

5. Join the supermarket’s loyalty programme

It pays to be loyal to a supermarket chain. Simply find one supermarket near your neighbourhood and stick religiously to it to accumulate loyalty points. For example, at FairPrice, NTUC Union and Link members earn Linkpoints and enjoy 50% deals daily! After amassing a substantial amount of Linkpoints, shoppers can use it to offset the bill of their next grocery bill.

Wine lovers should not miss out on substantial savings as a Just Wine Club member. Simply pay a membership fee of $20 for 1 year or $35 for 2 years to enjoy an additional 8% off on regular and promotional wines!

6. Pay with Mobile app to get free discount voucher

Do you know that first-time users of the FairPrice App get up to $5 off when they pay with the app in-stores? Don’t sniff at this little incentive to get you started on this payment mode! Eventually, you will come to appreciate the convenience of skipping long queues and having all your Linkpoints tracked seamlessly on the FairPrice mobile app. If you are still not a Link member, simply download the FairPrice app to be one. Be notified of promotions instantly pushed to your mobile phone so you don’t miss out on great deals.

7. Pay with a cashback credit card

Finally, always pay with a cashback credit card if you have one! That is an additional saving that you might not benefit from if you are paying with cash instead. For myself, I pay with the NTUC Link Credit Card by Trust when shopping at FairPrice that allows NTUC Union members to save up to 21% savings. For non-NTUC union members, you can get up to 15% savings if you sign up for the Trust Link Credit Card.

Here are my 7 tips on how to become a smart grocery shopper! At times like this, every cent saved is indeed every cent earned. Do share this article along so that more households can benefit from shopping smarter and their wallets will definitely be thankful for it.